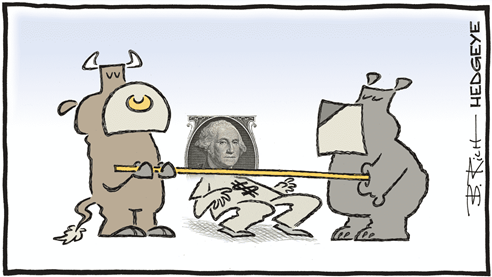

Still a supportive macro backdrop

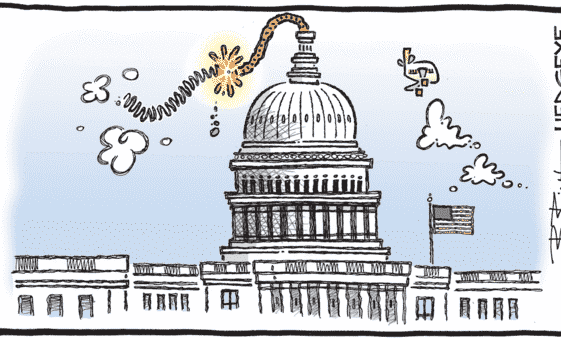

The US Supreme Court ruled last Friday that the President cannot use “emergency” authority to impose tariffs at will (i.e. the use of the International Emergency Economic Powers Act (IEEPA) to impose broad based tariffs is unconstitutional). While that’s a great victory for the “rule of law” and thus somewhat reassuring politically speaking, it brings […]