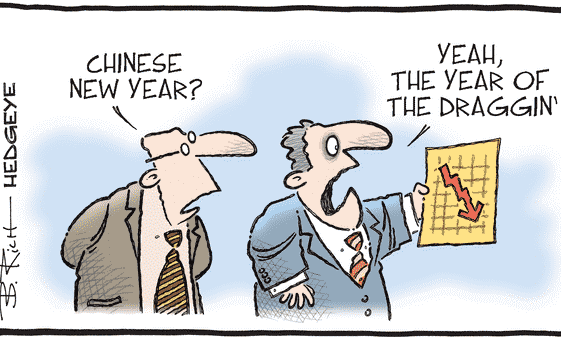

The Year of the Draggin

It begins with a “C”, it is struggling and it is at the bottom of the performances ranking… Have you got it? I am referring to China of course! While billions of people in China and around the world are celebrating the beginning of a new Lunar year, there is still little to celebrate about […]