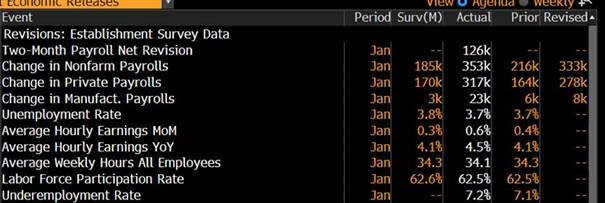

At first glance, there’s no doubt about it: the US jobs report for January, released on Friday, showed more than a resilient US labor market. Nonfarm payrolls increased 353K, largely beating expectations (185k). Furthermore, prior two months readings were revised by a total of +126k, bucking the recent trend of downward revisions. Last but not the least, average hourly earnings accelerated +0.6% MoM in January and +4.5% YoY, compared to +0.3% in December (actually revised up to +0.4%) and +4.1% respectively. But scratch somewhat under the surface and this report may not be as hot as it seems to get…

Indeed, the non-seasonally adjusted job growth last month was actually: -2’635’000. Yes, you read it well: 2 million & 635 thousand US jobs were lost in January according to the BLS statistics. In other words, the big positive surprise came from the seasonal adjustment as this impressive drop in “non-seasonally adjusted” payrolls was finally not as bad as the seasonal adjustment was expecting… To be fair, it looks like Groundhog Day as it was the 4th consecutive January in which employment growth came in about double what consensus was looking for. Keep also in mind that markets may be very sensitive to change in payrolls of plus or minus 100k compared to expectations, when total payrolls are close to 160mio. It means that rounding errors of 0.05% (which are furthermore often revised substantially up or down in the following months) may trigger sometimes big market reactions or have large influence on monetary policy decisions, when it actually hangs in a balance.

US jobs report: it’s getting hot in here apparently

Same grain of salt about the big upside surprise in average hourly earnings, up 0.6% last month (largest gain since early 2022)… which is linked in fact with the downside surprise in the average workweek, down 0.2 hour to 34.1 hours (lowest reading outside of recessions and the period immediately after recessions). In months with adverse weather, these 2 figures tend to move in opposite directions: workers may have to work less (hours reduced), which arithmetically boosts average hourly earnings. Q.E.D. In fact, the larger-than-usual number of people not at work due to bad weather (588k) in the household survey, used to infer the unemployment rate, suggests that adverse weather conditions did have an impact last month.

Bottom line: the unemployment rate from the household survey, unchanged at a low 3.7%, sent a simpler and fairer message of a steady and still solid US labor market, backing anyway Powell’s gut feeling that the first rate’s cut won’t come as soon as March.

Speaking about devil in the details, it relates also to sport and politics and therefore to two main events which will soon take place in the US: the Super Bowl next Sunday at Las Vegas and the Presidential Election in November. Here too, details may shape the ultimate winner as it was the case in the NFL Conference finals (AFC & NFC) the prior week-end where the Kansas City Chief beat the Baltimore Ravens, essentially on the back of a Raven’s fumble provoked by Chief just short of the goal, while the 49ers defeated the Detroit Lions 34-31 thanks to this improbable 51 yards completed pass, which turned the tide of the game. So, place your bets for Sunday, except for Taylor Swift fans, who will have no other choices than supporting the Chief’s team of her boyfriend (Travis Kelce). Moving and concluding with politics, I would like to draw your attention on this article from the Brooking Institution (hat tip to a faithful reader and a great investor). It explains what would happen in the event of the death or incapacitation of a candidate… A scenario for this year likely less improbable than the “Chauve-Souris” sketch of Jean-Marie Bigard! To make a long and somewhat intricated story short, the election could be decided by about 10’000 people who no one has ever heard of. Thus, even the fate of the world’s largest economy and one of its greatest democracies could hang by a thread.

Really beware of details!

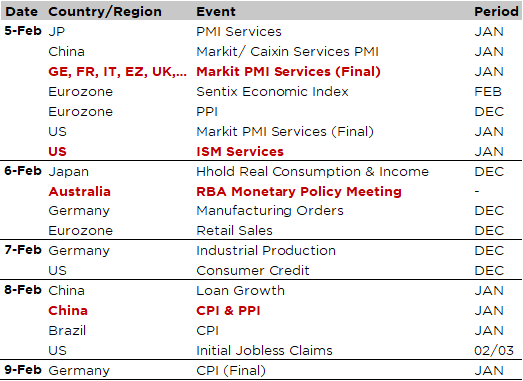

Economic Calendar

Let’s catch our breath as the week ahead is expected to be quiet in terms of data releases. The main highlights on the investors’ radar will be the January PMI services indices across the major economies as well as the US ISM (today), the RBA monetary policy meeting tomorrow, following the lower than expected Australian Q4-2023 CPI print released last week, and the Chinese CPI on Thursday (consensus expects a decline to -0.5% in January from -0.3%). In the meantime, we will get some insights about German manufacturing activity with the factory orders tomorrow and the December industrial production on Wednesday, in the context of the latest comment from Christian Lindner (German Finance Minister) who said that actually “Germany isn’t sick man, but tired man who needs coffee” of structural reforms. Last but not least, note that there will be the annual revisions for the US CPI due to the recalibration of the seasonal adjustment factors used by the BLS. It may be worth keeping an eye on it as last year revisions resulted in a faster pace of inflation than previously released for the last few months of 2022, causing some concerns to bond’s investors at that time.

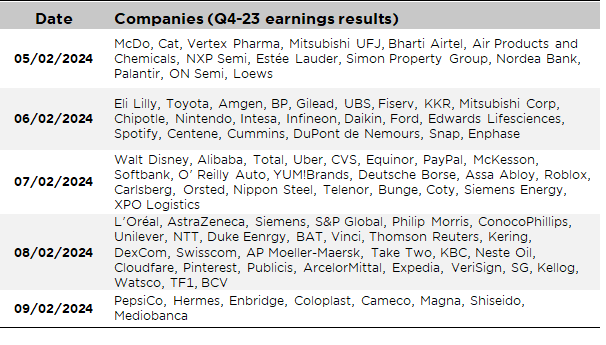

To conclude with the earnings season, notable corporate releases include Walt Disney, McDonald’s, Chipotle, Unilever and PepsiCo for gauging consumer health; a few healthcare players (Eli Lilly, AstraZeneca and Amgen) and energy companies (BP, Total or Equinor); as well as some Japanese iconic firms (Toyota, Nintendo and Softbank).

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.