It begins with a “C”, it is struggling and it is at the bottom of the performances ranking… Have you got it? I am referring to China of course! While billions of people in China and around the world are celebrating the beginning of a new Lunar year, there is still little to celebrate about Chinese economic & financial prospects in the near term as animal spirits have been crushed. The coming Year of Dragon may bring some short-term relief but it is unlikely to mark an end to the ongoing structural challenges and decline in China’s growth potential.

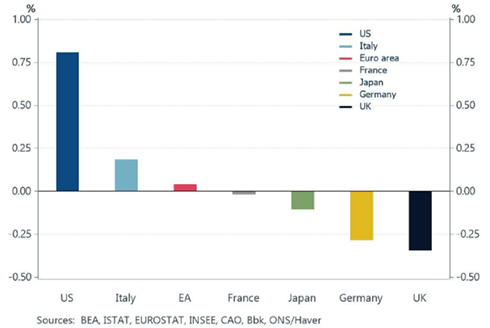

Speaking about struggling economies, China is not alone as both Germany and the UK experienced a technical recession in the second half of last year (2 consecutive quarters of negative growth). While you know my structural distorted disinclination about Britannia’s economy (a submerging economy), it is perhaps no coincidence that two world manufacturing and exports champions are currently facing some major structural headwinds. At the opposite, the outperformance of the US economy in H2-2023 brings another stone to the American Exceptionalism.

Q4-2023 Real GDP growth (Q/Q % chge) in selected DM: Come fly with me (US) vs. the Land of Mordor (Germany and UK)

Let’s return to our little Chinese sneezing Dragon…This year will be the first for China, since 2019, that won’t be impacted or distorted by the covid and its subsequent related lockdowns. Furthermore, household savings rate remains elevated (excess savings mean dry powder for spending) and the Year of the Dragon should also bring some temporary relief from a demographic standpoint (Dragon babies are widely believed to enjoy good fortune and marriages look to have ticked up in 2023, the first annual rise in a decade).

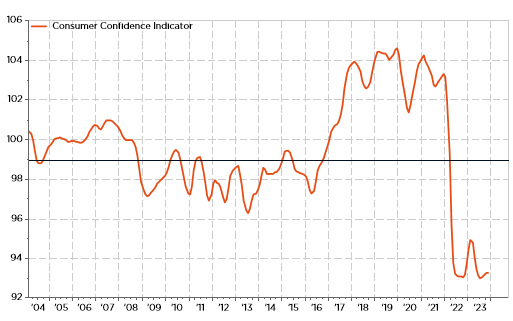

However, there are still plenty of reasons for caution. The economy has yet to get out of the negative feedback loop of weak sentiment, anemic private investment and slowing growth overall. Doing so depends heavily on the success of fiscal support (Beijing’s reluctance to go big with fiscal stimulus has frustrated investors, but policymakers are concerned and constrained by growing debt levels and an aging population) and some… political changes (moving from multiyear crackdowns on the private sectors to credible incentives to revive animal spirits) given that the monetary easing is largely ineffective in the face of weak credit demand due to a loss of confidence in a brighter future. In other words, PBOC is pushing on a string: you can lead a horse to water but you can’t make it drink.

China Consumer Confidence: You can lead a horse to water but you can’t make it drink

Moreover, there are still also downside risks for construction (a deeper adjustment and/or a more massive intervention from the government are needed in residential investment) and exports (greater trade protectionism and near shoring trend). Last but not the least, China flirts now with deflation, while it is stuck in the middle-income trap. In this context, the similarities with Japan lost decades become even more striking and concerning as China is getting older before it got rich (contrary to its Asian rival). To be sure, Chinese growth won’t falter this year (likely around 4-5%) and we may even observe some marginal improvement over the coming months on the back of these not-so-effective monetary stimulus.

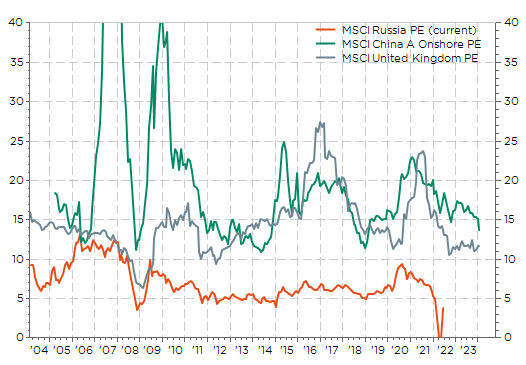

Meanwhile, investor sentiment toward China has logically soured for all these reasons: Pessimismo, what else? Not to mention that many foreign investors, especially in the US, have even decided that China is uninvestable due to latent and growing geopolitical risks. As result, Chinese equity market is becoming one of the cheapest markets in the world, trading at around 10x next year earnings. Is it cheap enough? Perhaps not, suffice to remember the valuation of the Russian equity market in the years before the invasion of Ukraine and some of its best constituents, which were always trading at a deep discount versus developed markets. At this point, just looking at valuation, you may even prefer another currently struggling economy… such as the UK.

China A Onshore equity valuation: Is it cheap enough?

Of course, China is home of some fantastic companies (well-managed, profitable, strong balance sheets and in leading-edge sectors), which may still be wise, if not worth in the near term, to have an exposure to. In addition, it will also make some sense to keep an exposure to Chinese equities from a purely pragmatic portfolio management standpoint as in these apparently desperate situations, you don’t need things to get really better sometimes. Just less bad may do the trick as it happened yesterday with the tied game of Cagliari Calcio against Udinese. Add to that a favorable confidence electroshock in the form of Cagliari players refusing the resignation of their coach Claudio Ranieri last week, and the destiny of those currently struggling may take suddenly a more favorable turn.

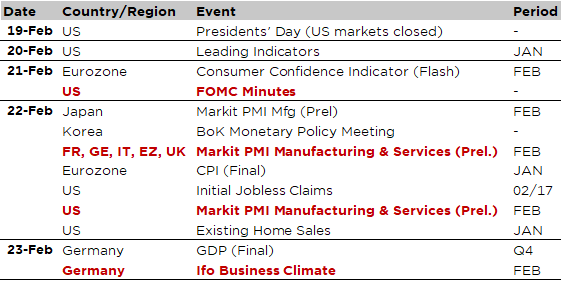

Economic Calendar

Be reassured as a rather quiet week await us in terms of economic data releases. Moreover, the US market will be closed today (President’s Day holiday). The FOMC minutes (Wednesday evening) will likely be the key highlight for investors who are still guesstimating the first Fed’s rate cut, while some doubts are even emerging about the long-awaited Fed’s pivot on the back of higher than expected January CPI and PPI reports released last week. Is the chance of a rise in the funds rate this year truly zero? Maybe not, suggest James Grant in his latest Interest Rate Observer. Other notable economic data releases include the global flash PMIs for February on Thursday and the German Ifo Business Climate on Friday. As a reminder, both manufacturing and services indicators remain above 50 in the US, while there have been tentative signs of bottoming out in Europe recently with Germany still the sick man (sorry, the tired man) of Europe.

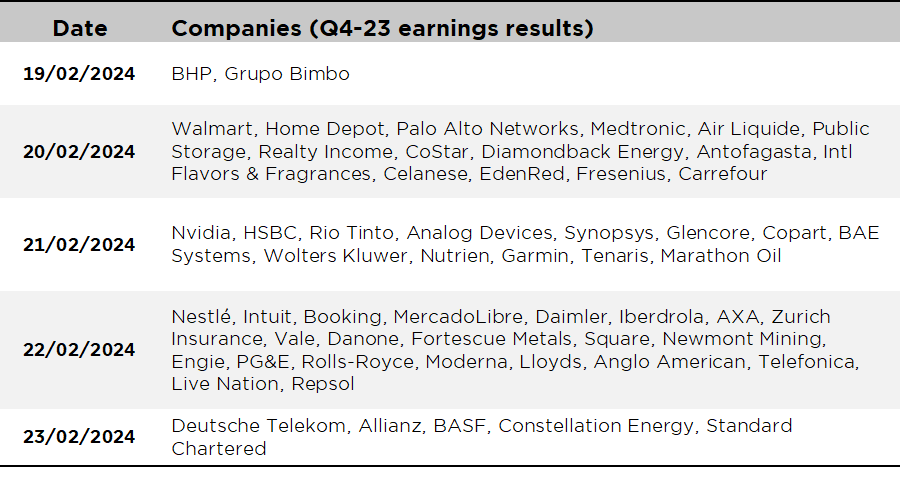

Turning to, and concluding with, the earnings season, there is little doubt that the highlight will be the release of Nvidia’s results on Wednesday and what it has to say (and sell) about AI. With a stock already up more than 40% YTD (best S&P500 stock performer), this shooting star won’t leave wishful investors indifferent. Before that, we will get some insights on the US consumer with the results from Walmart and Home Depot on Tuesday. Other notable earnings include Palo Alto Networks and Analog Devices in the technology sector; BHP, Rio Tinto, Glencore and Anglo American in Commodity-Materials, as well as Nestle, BASF, Allianz, Daimler or Iberdrola in Europe.

Non-exhaustive list of 2023-Q4 major earnings releases over the week

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.