DECALIA SIM SpA provides portfolio management advisory services to private and institutional clients. In addition, thanks to its asset management team, it manages and distributes high-added-value investment funds.

DECALIA SIM offers a modern asset management that truly lives up to investors’ new expectations. Through its distinctive approach, DECALIA focuses on a clear objective: securing a first-rate performance, based above all on consistent results and stringent risk control. DECALIA benefits from the solid experience of its team of professionals and on some strong fundamental principles that guide its decisions.

DECALIA SIM SpA is regulated by Consob and by the Bank of Italy.

Wealth Management

Wealth management

DECALIA targets a private clientele looking for personalised wealth management that generates consistent performance.

Based on the advanced techniques and rigorous processes of institutional asset management, our investment approach is clearly focused on risk control.

A human-sized management boutique, DECALIA naturally pays particular attention to the quality of service.

Asset Management

Asset Management

DECALIA has developed a range of strategies focused on several investment themes offering strong long-term prospects.

DECALIA has launched its own range of UCITS investment funds (DECALIA Sicav), registered in Switzerland and other European countries. For some specific strategies, we have also established partnerships with external asset managers.

Team

DECALIA team

DECALIA’s asset management team is made up of seasoned investment professionals, whose areas of expertise are very complementary.

NEWS

Recent news

Humanoid robots: the next labour revolution

From being just a curiosity twelve months ago, humanoid robots went to taking centre stage at CES 2026. Indeed, this year’s edition of the Las Vegas “most powerful tech event” saw nearly two dozen humanoid robots on display. Robotics is entering a new phase of commercial acceleration, driven by AI breakthroughs, falling hardware costs and […]

Winning the yield race

Champion the european specialised private credit market Nicolò Miscioscia, Partner and Head of Private Markets, Co-Manager DECALIA Private Credit Strategies For this DECALIA Private Markets Focus issue we have drawn inspiration from the winter Olympics currently unfolding in Italy. Investors can learn from athletes chasing for gold medals : study the discipline, refine skills, develop […]

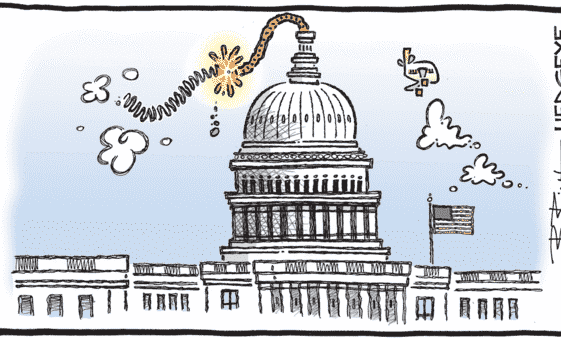

Still a supportive macro backdrop

The US Supreme Court ruled last Friday that the President cannot use “emergency” authority to impose tariffs at will (i.e. the use of the International Emergency Economic Powers Act (IEEPA) to impose broad based tariffs is unconstitutional). While that’s a great victory for the “rule of law” and thus somewhat reassuring politically speaking, it brings […]