A Fed’s rate cut in September rate is still far from guaranteed, in my views, especially after last week’s releases of US CPI and PPI reports, which showed that supercore inflation remains stubbornly high, running at 4% yoy and 3.8% a.r. over last 3M, while companies are passing some tariff costs on to consumers. In the meantime, the fed-funds futures market currently prices circa 85% odds on a 25bps cut. For sure, labor market is slowing but it remains overall quite healthy with most indicators at levels similar or better than before the pandemics, while tariffs are complicating every decision the Fed might make from here. Cut rates too aggressively and risk fueling inflation; or hold rates steady at current levels and risk further erosion in job growth and thus higher unemployment. As a result, I wouldn’t like to be in Jay Powell’s shoes currently. Moving to China, for a change, the diagnostic is easier but the monetary remedy isn’t working, while there could be some unwelcomed consequences for the rest of the world.

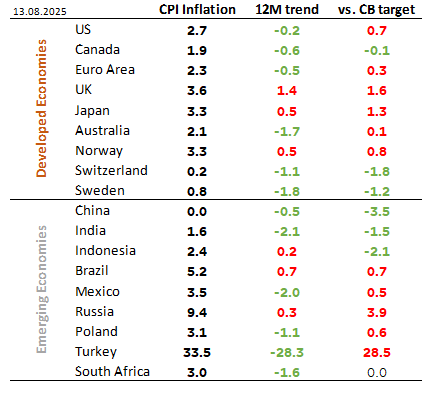

Let’s start with a global views of inflation dynamics in the world. The table and scatter plot here below illustrate the headline inflation trend on the x-axis vs. the deviation from central bank’s target in the major economies (green points for DM and orange diamonds for EM). Headline inflation has declined almost everywhere over the last 12M, helped obviously by lower energy prices, except in Japan, UK, Norway & Brazil. Note also that the decline in the US is not the most striking. Furthermore, headline & especially core inflation remain slightly above central bank’s target in most major economies, but still clearly “too” high for full comfort in Japan & UK, and to a lesser extent in Norway and in the US. At the opposite, Switzerland, Sweden and especially China are flirting with deflation.

Headline inflation level, trend and deviation from central bank’s target

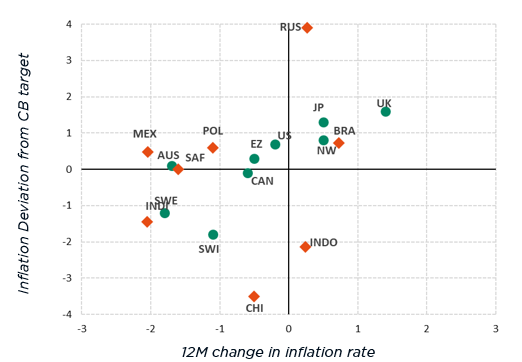

What makes the case of Chinese’s deflation very interesting is that it is the second largest economy in the world and still represent a major world’s exporter. And on a more sarcastic note, the Chinese government must not be pleased to see its economy increasingly turning… Japanese.

When Chinese economy turns Japanese: China vs. JGB’s 10y yield at the crossroads…

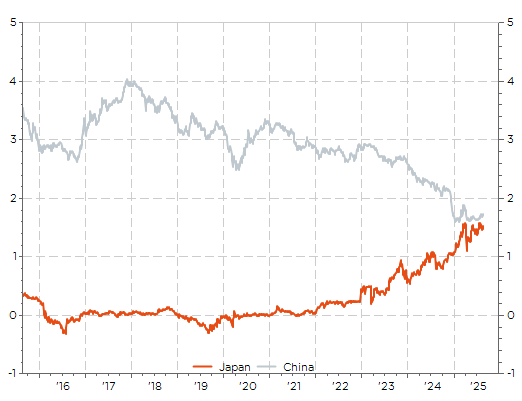

At least, the PBOC has well flagged the issue: the current deflationary spiral isn’t really due to a lack of (domestic) demand, but rather by an excess of supply/production. In this context, it has rightly decided that monetary easing is of little use in the face of overcapacity. China is indeed suffering from “involution”, a term used by locals to describe the intense price competition spurred by excess production, as illustrated by the ongoing decline in the producer prices index, which has registered yoy declines for 34 consecutive months (-3.6% in July).

China PPI (Y/Y% chge): Fruits of “Involution”

How to sort it out? Either a significant shift in mindset is required for the government to embrace demand-boosting policies that would rebalance the economy (for the time being, there aren’t any imminent, offsetting demand boosts to point to), or government should shut capacity – as it did after 2015 – but this time is different as sectors concerned are more sensitive (real estate), higher value-added or strategically important (batteries, industrial production). In addition, shutting capacity will weigh on China economic growth and employment in the short term… while contributing to higher inflation in the rest of the world. One thing is certain: if China were to do so now, the timing would certainly not be appropriate for Uncle Sam, sheriff Trump and the Fed’s President.

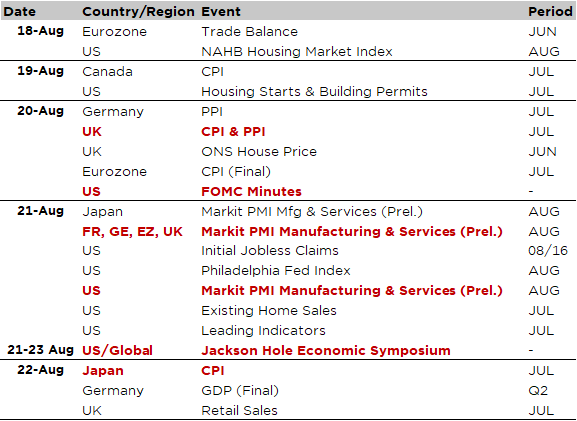

Economic Calendar

No major data releases this week that could derail the equity market, but, as with last week’s US PPI, it will still be important to keep an eye on them as they will shape investors’ expectations regarding growth trend (global preliminary PMIs across the world on Thursday), US monetary policy (minutes of last Fed meeting on Wednesday + Jackson Hole Economic Symposium at the end of the week) and that of the BoE with the UK CPI on Wednesday after the strong June print and the much better than expected UK GDP in Q2 released last week, as well as the BoC (Canada CPI on Tuesday) or the BoJ (Japan CPI on Friday), which remains well behind the curve, as Scott Bessent also pointed out last week.

Among the highlight, Powell will take the stage at the Fed’s annual Jackson Hole Economic Symposium on Friday. This year’s conference (“Labor Markets in Transition”) will focus on structural forces (demographics, productivity and immigration) that are reshaping the labor market. So, Powell won’t speak directly about the incoming September interest-rate decision, but his speech, titled “Economic Outlook and Framework Review”, is still wide enough to send important signals about how the Fed will assess the economy, account for tariffs, think about inflation and neutral rate going forward. Under constant attack from Trump, he may see Jackson Hole as his best chance to make the case for the central bank’s independence before his term as Fed’s chairman ends.

Thus, moves in rates and forex markets could potentially outpace those in equity over the next few days if these data releases push the balance in favor of a no Fed rate cut in September; impede the BoE to ease again before next year; or force the BoJ to accelerate rate hikes. Otherwise, a big positive for equity markets could come from some sort of stable and peaceful solution to the Ukraine war as after the Trump-Putin summit in Alaska last Friday, Trump spoke with European leaders and is also meeting President Zelensky today, that could lead to some progress on that front with then a meeting between Trump, Putin and Zelenski soon.

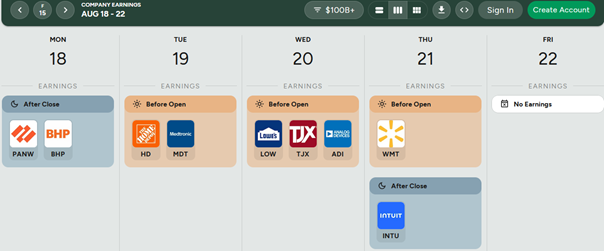

In terms of corporate earnings, we will also get an insight into the health of the US consumer via the publications of Home Depot, TJX and Walmart, which will provide an update on consumer spending add some depth to the July retail sales figures released last Friday, which showed resilience once again. On the tech front, we will have Palo Alto, Analog Devices and Baidu, but the Q2 earnings season is slowly coming to an end with the last big piece, namely Nvidia, releasing the following week (Wednesday 27th August).

Non-exhaustive list of major earnings releases over the week (market cap > $100bn)

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.