Forget about the August 1st trade deadline… but beware of the incoming flood of economic data.

It seems indeed that Trump’s tariff saga is finally coming to an end as another key trade “deal” was struck yesterday between the US and the EU. This agreement (how could you reasonably conclude a complete and detailed trade deal in less than one hour in between two rounds of golf?) is quite similar to the recent US-Japan accord with a 15% tariff on EU exports to the US (including autos, but excluding pharma and maintaining the existing 50% tariffs on steel and aluminum). In exchange for this more “favorable” treatment (the initial tariff, which would have kicked off on Friday, was set at 30%), the European Union has pledged to import $750bn of energy, invest $600bn into the US economy and purchase “vast quantities” of military equipment. Furthermore, the EU has also committed to opening its markets to US goods at 0% tariffs… to thanks Trump kindness?

In the meantime, the US-China negotiations are currently underway in Stockholm. Apparently, there could be another 90-day extension (deadline was set on August 12th during Geneva negotiations in May), reducing therefore urgency surrounding this week’s trade calendar.

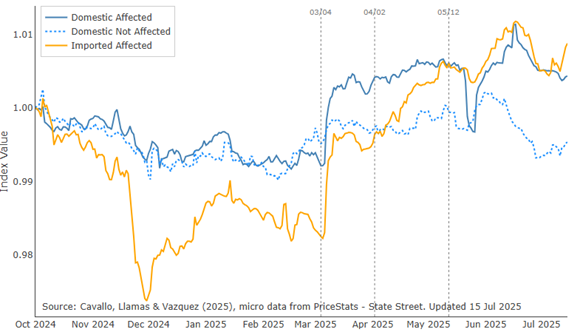

So, the stock market will certainly continue to celebrate this less bad than expected outcomes today, especially as there is a growing self-confidence from Trump as well as from investors, that this tariff saga -on top of all the rest such as immigration policy or the OBBBA- will not damage the US/global economy, reignite some unwelcomed upward pressures on prices or derail the monetary policy trajectory. Unfortunately, I fear that it’s only a matter of time before some of these tariffs’ negative impacts start to show up in the data as existing inventories are depleted, while consumers and companies adjust or find “sustainable” turnarounds. According to the daily retail price index from major US retailers (data compiled by HBS Pricing Lab), prices of imported goods have already risen by more than 3% since the beginning of the year, while prices of domestic goods in tariff affected categories are up circa 1% since March…

US daily retail prices of imported & domestic goods in affected & unaffected categories

Source: https://www.pricinglab.org/tariff-tracker/

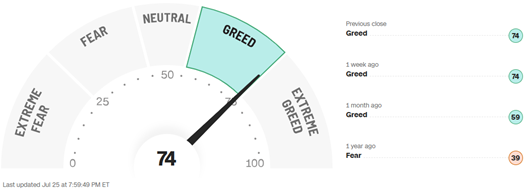

In this context, and thanks to one of the busiest weeks in memory for economic news, all the elements may already be in place for a big (but perhaps not so magnificent) fireworks display on Friday, August 1, for the Swiss National Day. Considering the current complacency, the lofty valuations, as well as the market’s narrow breadth, a whole series of potential sparks, in the form of surprising enough economic data releases, could indeed easily ignite the powder keg – leading eventually to a healthy short-term correction.

CNN Fear & Greed Index: is it still safe to remain bullish?

Source: https://edition.cnn.com/markets/fear-and-greed

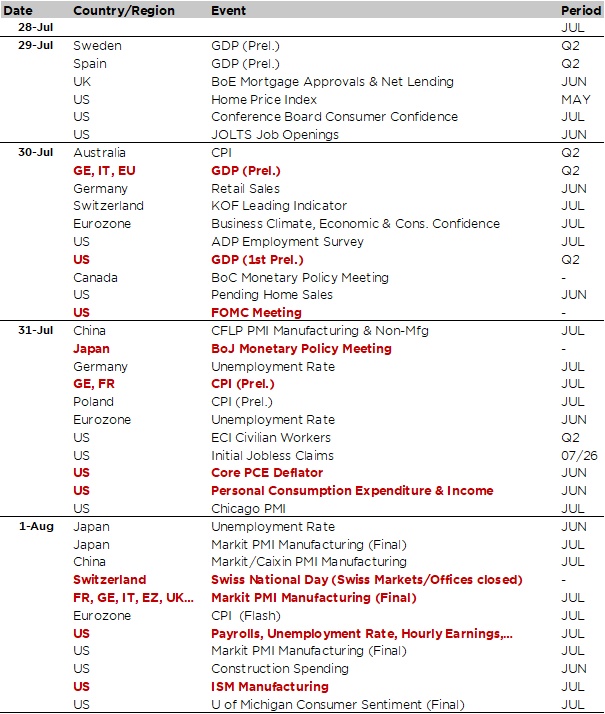

Here is the packed macro agenda for the coming days. Beware of the indigestion!

- Initial estimates of US and European GDP will be released on Wednesday. The US GDP (+2.4% a.r. expected) could surprise on the upside due to tariff-related distortions (as imports collapsed in Q2 vs. the massive front loading in Q1) and resilient domestic demand -especially capex-.

- Still on Wednesday, we will hear about the latest thoughts of Jerome Powell during the press conference following the Fed meeting, where key rates will be kept unchanged. However, there could be some dissensions within the board of governors… something rare enough to raise some eyebrows (Christopher Waller and Michelle Bowman are expected to dissent in favor of a rate cut) and add another (unwelcome) growing internal pressure to lower rates. As a result, the incoming meeting isn’t just about monetary policy, it’s about Jerome Powell’s ability to hold the line against Trump, the dissident voices on his own board or the voices urging him to step aside. Note that the Bank of Canada will also decide on rates on Wednesday.

- The BoJ meeting will take place just after that, on Thursday early morning. It could lead to a remake of “I remember what you did last summer” as we can’t completely rule out a surprise rate hike or a hawkish tilt of the current policy framework, which would be totally unexpected according to the Bloomberg survey (65/65 economists surveyed foresee unchanged rates at 0.5%) as it happened exactly one year ago…

- We will also get the first inflation estimates for July in Germany and France, as well as the June US core PCE deflator (expectations are for a +0.3% MoM increase and 2.7% YoY) on Thursday

- On Friday, August 1st, the global manufacturing PMI and US ISM index will be released, but more importantly the US job report for July will be published at 2:30 pm. According to the consensus, the US employment figures should show a +109k monthly payrolls change with an unemployment rate ticking up +0.1% to 4.2%. Contrary to these expectations, the July job report could show a drop in the unemployment rate, not because of increased hiring but fewer job seekers (in part due to immigration policy). In this context of a decreasing jobless rate, it could provoke a negative reaction in the bond and stock markets as it could further complicate Fed policymaking as a low unemployment rate makes it harder to cut rates… Before that, other labor market indicators will be published such as the JOLTS and ADP reports on Tuesday and Wednesday, respectively.

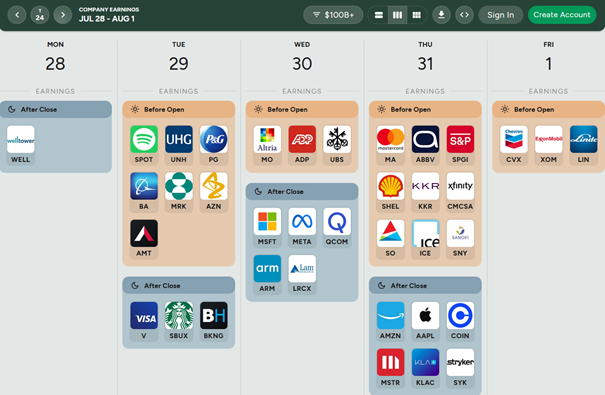

- Last but not the least, it will also be an intense week in terms of Q2 corporate earnings releases, with 159 S&P500 and 113 Stoxx 600 companies reporting in the coming days, including figures from Amazon, Microsoft, Meta, Apple, etc… in the US (representing 20% of the S&P500 market capitalization).

My main concern is that macro figures will continue to indicate that the US (and global) economy is not really slowing down, but rather accelerating (particularly in Europe), which would prevent the Fed from lowering rates this year. Renewed tension on long-term rates, a rebound in the dollar, a sharp but “limited” drop in equities, widening credit spreads, underperformance of emerging markets, and consolidation/pullback in gold.

Obviously, we may also see the opposite scenario (i.e. a renewed recession risks if macro data disappoint), but (1) I assign a lower probability to this outcome in the short term, and (2) it would likely be less disruptive, since bonds and gold would perform well in this case, while the US dollar would either remain on its downward trend or at least it wouldn’t rebound much…

The best case would be more of the same data, still pointing to a soft-landing scenario and thus allowing markets to continue climbing a wall of worries… until one of them becomes eventually a reality.

Economic Calendar

Non-exhaustive list of major earnings releases over the week (market cap > $100bn)

Source: https://earningshub.com/earnings-calendar/week-of/2025-07-28

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.