And there you have it, Italy was served a cold pizza -with pineapple on it- by hungry Vikings from Norway last night: final score 1-4. Now, there’s a strange uncertainty hanging over the participation of the Azzurri to next World Cup… Will Italy be there? No one knows but this last defeat and the past experience of playoff games of Italy to the last few World Cup’s final stages raised some legitimate concerns that seem worse than being a fan of the Cagliari Calcio. At this point, it’s going to be a coin toss — and even then, it’s not certain that the coin will land on the right side. Uncertainties, fog, uneasiness and coin toss probabilities aren’t unique to Italian soccer… It’s also currently true in the near term for the US economy, the next Fed decision as well as the direction of US rates, the greenback or the US equities market and sectors’ leadership.

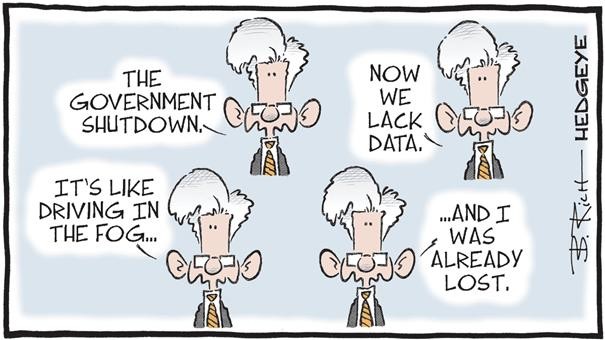

While we will be flooded by a deluge of delayed economic US economic data releases over the coming days and weeks, following the end of the US government shutdown, we won’t be more informed as it will likely add more noise than signals. First because, we are speaking of data related to the past (i.e. not really up-to-date), such as the September employment report that will be published this week. Then, the quality/completeness of most October data remain uncertain at this stage. In some cases, statisticians will have to either refrain from publishing their reports or estimate them based on incomplete information or imputation. As a result, these releases will be taken with a pinch of salt and the statistical fog will not lift completely for several weeks. Furthermore, this catch-up is also delaying the scheduled agenda with a non-negligible probability than when the Fed members will meet on December 10th, they won’t have in their hands the November jobs report and CPI reports, due theoretically on December 5th and 10th respectively.

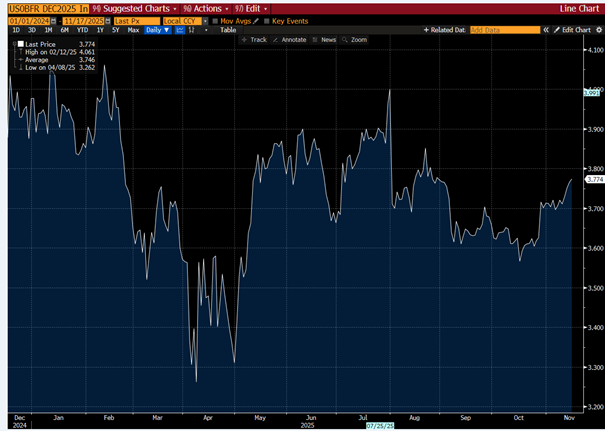

Against this unusual backdrop and the recent more hawkish than expected speeches or interviews of some Fed members, who said they will eventually prefer note to cut rates in December, either waiting for more clarity and/or fearing that inflation may remain an issue next year, the odds of a rate cut at the next December Fed’s meeting have decreased from almost a 100% done deal probability to 44% currently, resulting in an expected Fed Fund rate of 3.77% by end of December (vs. currently 3.875% = middle of 3.75%-4.00% range). In other words, it’s a coin toss!

US Fed Fund fut. (Dec 25): the markets are pricing a Fed Fund rate of 3.77% by year-end

Furthermore, if you look forward, entering into 2026, you may add another layer of uncertainties about how the overall “structural” stance of the Fed will eventually turn out. Or not… depending on who will be the next Fed Chairman when Powell term comes to an end in May 2026. Among the last 5 contenders at this point, you have 1 moderate/neutral person (Kevin Hassett) that could be seen as a form of continuity after Jay Powell, two potentially hawkish Fed Chairman (Kevin Warsh -the top hawk among the remaining contenders- and Michelle Bowman -a more moderate hawk-) and 2 rather dovish contenders (Rick Rieder -a growth-friendly with an easing posture- and Christopher Waller perceived as the most dovish one). While we can’t rule out neither Stephen Miran in the Fed Chairman driving seat, who appears clearly as the most extreme dovish pick.

So, it’s still hard to have strong convictions on near term (read until year-end) trajectories of US rates, US dollar and even the overall equity markets and sectors/styles when fog is surrounding US economic growth, inflation and monetary policy backdrop. Anyway, if there is one certainty that remains, it is that the US -but also Euro Area- fiscal deficit and sovereign debt won’t shrink soon, which makes us lean more towards real assets (equities / gold) than long duration government bonds. In this current environment, we thus remain in wait-and-see mode as long as our base case soft-landing scenario holds, maintaining a broadly neutral stance on equities, with a balanced positioning and well-diversified allocation, which reflects our cautious approach to the wide range of potential outcomes.

In short, today’s investors are moving forward as if in a London fog: we can vaguely see shapes, we can guess at silhouettes in the mist… but to know whether the Fed will cut rates or not, we are reduced to a coin toss worthy of a soccer match played by penguins. So, what should we do? Nothing could be simpler: stay calm, stay invested but diversified, and add eventually some tactical hedge if you have a bad feeling. At worst, if everything disappears in the fog, at least you can say that you had predicted the unpredictable.

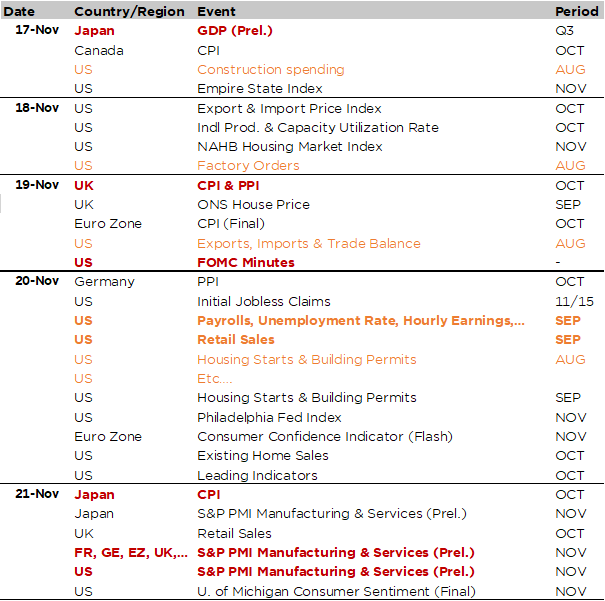

Economic Calendar

Don’t forget your swimsuit (and eventually your snorkeling accessories too) as we will be flooded by a deluge of delayed economic US economic data releases following the end of the US government shutdown. Note that the exact timing, as well as the quality/completeness, of this data releases remain uncertain at this stage. In some cases, statisticians will have to either refrain from publishing their reports or estimate them based on incomplete information or imputation. As a result, these releases will be taken with a pinch of salt and the statistical fog will not lift completely for several weeks. In this context, the September employment report will be the headline “delayed” economic data to be release this week (Thursday). The consensus expects payrolls to remain in positive territory (+50k), versus prior readings of +22k and +38k respectively, a steady unemployment steady at 4.3% and wages to growth +0.3% MoM.

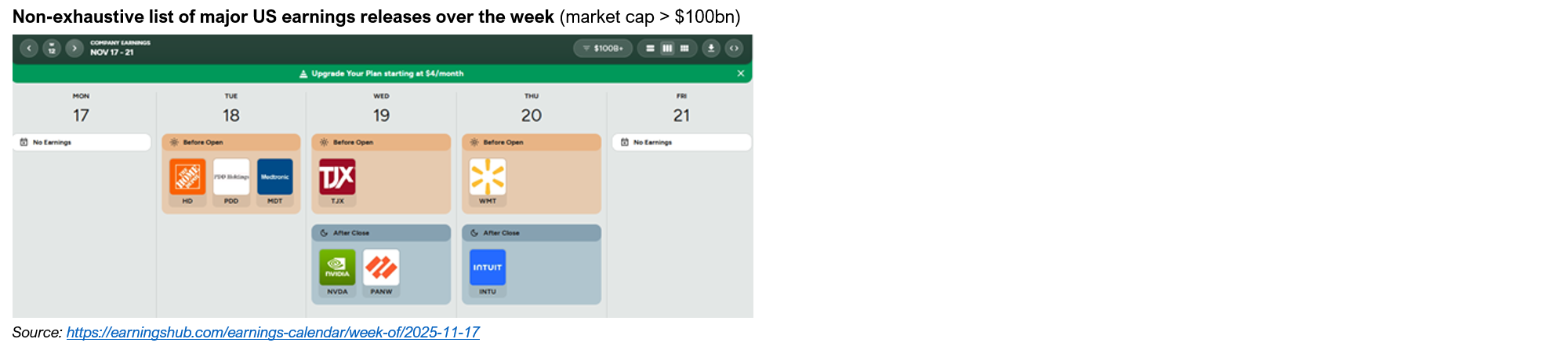

Otherwise, “scheduled” economic indicators due will include the flash November PMIs for the major economies on Friday, as well as inflation in Canada (Monday), the UK (Wednesday) and Japan (Friday). Other highlights include the Japan GDP (released this morning – it contracted less than expected in Q3, dragged down by net exports and inventories, whereas consumption and business investment experienced positive growth), but also the FOMC minutes (Wednesday evening) and… Nvidia’s results on Wednesday after markets close. Staying on earnings results, several US retailers, including Walmart, Home Depot and Target, will also report.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.