Today’s my editorial title is a reference to the Public Enemy 1990’s hit song (911 is a joke), which still resonates 35 years later… So get up, get, get, get down. 899 is a joke in yo town.

As the One Big Beautiful Bill Act is currently debated and will likely be amended in the Senate, investors are focusing on the section 899 of this Act. It basically concerns and legislates income source from the US flowing from a US entity to foreign entities and individuals in countries that have enacted any “unfair foreign tax” on US persons or businesses…. Here are our quick take-aways regarding its implications on economic growth, equities, rates and forex.

Economic growth: the key point about section 899 is that it is a tax on capital income… While it could increase marginally the cost of capital (after tax) and thus disincentive somewhat willingness to invest in the US, the effect on economic growth would be negligible -excluding an extreme scenario where this tax increase will be set at really deterring levels for foreign direct investment (FDI) from most/all foreign investors.

Equities: the direct impact should logically be more pronounced for US subsidiaries of foreign companies than for US companies themselves. Large US multinationals should also be able to fare better than smaller companies (avoiding / reducing the tax by redirecting cash flows), while high dividend sectors such as Energy, Utilities or REITs should be more impacted than tech companies or “growthier” stocks for example. As there are still many unknowns (level of this tax, the implementation date and even more importantly how to define objectively “unfair foreign tax” for clarity’s sake), nothing has really been priced in so far.

Rates: Likely a minimal direct impact on Treasuries holdings by foreigners at the end, but, once again, not in the good direction and adding some oil on the fire… as it increases the foreigners perception that the current US administration is making US Treasuries more punitive to hold, either through concerns about currency devaluation, financial repression (with a Fed eventually slashing rates later to help to fund the US growing deficits), or now some additional taxes -even if minimal- on top of that. As a result, this section 899 adds and compounds with related tariffs uncertainties on US future growth and inflation trajectories, structurally higher budget deficits and current USD weakness to lead to a higher term premium.

FX: Section 899 adds again downward pressures to the greenback as it doesn’t incentivize foreigners’ willingness (either individual investors or companies) to hold US dollars.

To sum up, the Trump administration continues to throw new things in the air that just continue denting foreigners’ confidence in greenback and the safe haven status of US Treasuries. In order to fund a gargantuan budget deficit, the Trump administration is not short of wacky ideas (such as DOGE, trade tariffs or this Section 899), which may seem sensible on the paper, but will likely prove another costly joke from the US considering a more holistic view. Let’s crack one to conclude: what is the difference between theory and practice? In theory, there is none. Not sure Trump and his administration get this one.

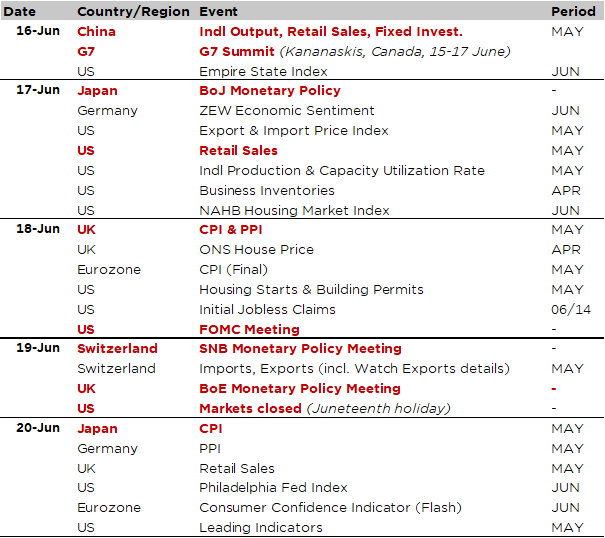

Economic calendar

While events in the Middle East will likely continue to take center stage over the next few days, with investors focused on the potential for further escalation between Israel and Iran, central banks and monetary policies will also be on the front line this week with decisions due, in chronological order, from

- The BoJ on Monday night (consensus: target rate unchanged at 0.5%) with the central bank to continue pointing to the foggy outlook and especially the high level of uncertainty on growth, inflation but also JPY trend from US tariff policy.

- The Fed on Wednesday evening (consensus: hold with key rate unchanged at 4.25%-4.50%) with investors focusing also on the SEP (Summary of Economic Projections) and the famous “dot plot” and how recent tariff developments and the Big Beautiful Bill discussions are affecting the central bank’s outlook. Barring a major economic or financial shock, or an unexpected spike in unemployment rate, the Fed is widely expected to resume easing in September with another 25bps cut before year-end.

- The SNB Thursday morning (consensus: a cut from -0.25% to 0% is expected… but some – including GS – do not rule out a deeper -50bps cut, which would send rates back into negative territory)

- The BoE late Thursday morning (consensus: target rate unchanged at 4.25%, but a cut remains possible given the sometimes highly variable and thus unpredictable votes of certain members). Anyway, the BoE may open the door to a rate cut at their next meeting in August

Otherwise, we will also get_

- An update on May activity indicators in both the US (Tuesday) with the releases of retail sales and industrial production figures (consensus expecting flattish-slightly positive gains) and China, which just released data on industrial production, retail sales and fixed investment this morning. Basically, retail sales surprised positively (likely helped by some favorable calendar holidays effects), while industrial production and fixed investments came slightly below consensus expectations. Moreover, both new and existing home prices decreased more than expected in May.

- As well as May inflation in the UK (Wednesday), which could influence the BoE’s final decision – or their stance- the following day (UK annual core inflation is expected to slow down from 3.8% to 3.6% in May), and Japan (Friday), which could then eventually force the BoJ to tighten its monetary policy sooner rather than later if it were to accelerate further (headline and core inflation are expected at 3.5% and 3.2% respectively).

In short, financial markets, including rates and exchange rates, are likely to see some movement, especially if there are any negative surprises in terms of economic growth (Tuesday’s US figures + regional manufacturing indices), a much higher than expected Japanese CPI (which would put the BoJ in a bind) or a Fed that appears too “hawkish” for investors’ liking… or Trump’s one. Alternatively, the reverse is also true: a de-escalation in Middle-East tensions, some positive economic data, softer inflation readings and somewhat dovish central banks stance should play in favor of equities.

Finally, note that US markets will be closed on Thursday due to the Juneteenth holiday.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.