Happy New Year and best wishes for a healthy and prosperous 2026! The first full week of trading on markets was already eventful… Should we have expected something else? Ironically, we are generally dealing with the same questions and concerns at the beginning of this year as we were last year. As a result, my base case scenario hasn’t changed much neither. As usual at the beginning of the year, I have also polished my seasoned crystal ball in order to make 10 predictions that could shape financial markets and portfolio returns over the next twelve months. Some may be considered as general macro views or asset allocation themes, a few could be provocative, many of them won’t happen, while others may seem crazy but I still consider worth to keep them in mind because the purpose of these forecasts isn’t pinpoint accuracy (just getting the direction right is already a challenge). But reviewing what might happen compels us to prepare for different scenarios – at least mentally. And often, mental preparation is half the battle…

Furthermore, surprises tend often to matter more than getting the central macro scenario right, especially when there is a strong consensus around it, because the biggest risks -or opportunities- are always what no one sees it coming and thus no one is prepared for it. In this context, the consensus remains surprisingly optimistic for 2026. Most strategists anticipate further gains in the equity markets this year, which would prolong an already exceptional bull market. Downturns are considered likely, sometimes brutal… but a priori temporary. “Buying the dips” remains a popular strategy, and so far, a profitable one. However, the risks are very real. AI and overall tech account for a significant portion of hopes and valuations: if the promise is slow to translate into tangible profits, the disappointment could be severe. Inflation, which remains above central bank targets, also limits their room for maneuver. Finally, and this is perhaps the subtlest point, the consensus itself has become a risk: pessimists are few and far between, and even the most skeptical struggle to identify an immediate trigger for a major reversal. As a result, it may be tempting to anticipate a pause… or not? For the time being, we remain on the consensus bullish side as we basically expect more of the same in 2026 than last year. See you at the end of the year for the results of the predictions here below.

- Global growth to accelerate in H1 before slowing in H2

For once, forget about the US consumer. In 2026, US growth — as well as economic activity in Europe, China and Japan — will rely more heavily on other components of GDP. Back to Economics 101: Y = C + I + G + (X − M), where Y is GDP, C consumption, I investment, G government spending, and (X − M) net exports. So, I expect a broad-based acceleration in investment, fiscal spending and net exports across most economies. Even if US consumer spending remains sluggish due to a weaker labor market, overall GDP growth could still accelerate. Note however that even consumer spending may surprise on the upside at some point, by mid-year, as US middle-income households will receive some cheques in Q2, through the OBBBA…

Still in the US, net exports are unlikely to become a positive contributor – unlike in Europe or China – but they may act as a smaller drag than in the past, as tariffs shrink the trade deficit. The euro area remains the most vulnerable: not all major economies can improve net exports simultaneously. In this context, China’s pro-export strategy represents a significant competitive threat to European – and especially German – growth.

- US equities and the “Magnificent Seven” will no longer lead the market

Equities should deliver another positive year, but leadership will broaden further beyond US mega-cap tech. AI-related productivity gains may finally spread to other sectors, while investors begin questioning the ultimate returns of the AI capex arms race. A more mundane explanation is simply mean reversion after more than a decade of US mega-cap dominance.

If this leadership reversal unfolds gradually, it could last for several years. Consider banks: a chronic underperformer over the past decade, the sector has now outperformed for three consecutive years, particularly in Europe and Japan. Valuations remain reasonable, positioning is still light, and the macro backdrop is supportive. US banks should also benefit from deregulation tailwinds. I therefore bet on a fourth year of bank outperformance.

- US 10y rates move above 4.5% before easing later

With growth accelerating, inflation proving sticky in H1, persistent fiscal concerns, Trump’s interference with the Fed, and non-US yields looking attractive on a hedged basis, US long-term rates should first rise above 4.5% before declining somewhat in H2. Two implications follow. First, the US yield curve is likely to steepen early in the year. Second, the Fed may delay its next rate cut until H2 unless it cuts prematurely under political pressure, which would steepen the curve even further.

- The Swiss franc depreciates modestly.

I do not expect a sharp sell-off in the Swiss franc, but rather a gradual weakening, driven by three factors:

- a risk-on global environment,

- multiple BoJ rate hikes in 2026 forcing investors to seek alternative funding currencies as short-JPY positions become more expensive, and

- a narrowing Swiss trade surplus, largely driven by declining pharma and chemical exports to the US following tariff increases.

As long as depreciation remains orderly, no one in Switzerland will complain. On the contrary, the SNB and exporters would likely welcome it.

- Valuations stretch further: run it hot

In our base case, equities merely track earnings growth (10–15%). However, under an even more Goldilocks-like scenario – accelerating growth, easing inflation, accommodative central banks, rising fiscal spending, and looser financial conditions from US bank deregulation – equity multiples could expand modestly and credit spreads compress further. There is particularly ample room for non-US assets and the broader US market (ex-mega-cap tech) to rerate as the rally continues to broaden.

- Gold shines again, Bitcoin struggles.

The next leg higher in gold will likely be driven by private investors, especially in the US. According to a recent Goldman Sachs study, gold-backed ETFs represent just 0.2% of US household financial assets. While 10–15% of retail investors reportedly hold gold in some form, this share is still likely below that of crypto. As distrust in fiat currencies and US Treasuries grows, household allocations to gold should increase further. This may be reinforced by a downturn (or at least reduced volatility) in cryptocurrencies. Precious metals may increasingly attract speculative capital once drawn to crypto. Moreover, meaningful progress in quantum computing would pose a non-immediate but serious long-term threat to the cryptographic foundations of Bitcoin and Ethereum, potentially triggering a sharp reassessment of the entire asset class. As crypto investors start panicking on these concerns, the rush to the exit may cause a sharp sell-off.

- Japan posts the highest inflation rate in the G7 by year-end

US and UK inflation should decline further in H2, converging toward 2%. By contrast, Japanese inflation may remain close to 3%, assuming spring Shunto wage negotiations deliver increases of 5% or more, fiscal policy continues to stimulate growth, the BoJ hikes only 2–3 times, and the yen fails to appreciate meaningfully. In this reflationary environment, Japanese equities – particularly banks and value stocks – should continue to outperform.

- Oil and energy prices to remain low

Trump’s policies could drive a significant increase in global oil supply: an end to the war in Ukraine, easing Middle East tensions, higher Iranian and Venezuelan output, and rising US shale production – not to mention the longer-term effects of global warming. If confirmed, this would further entrench the Goldilocks scenario and provide strong support to both equities and bonds.

- Republicans lose control of Congress despite strong growth

Even amid solid economic performance, voters may decide to punish Trump due to rising inequality, higher living costs driven by tariffs, labor market fragility linked to immigration policy, erratic foreign policy, and ongoing interference with the Fed, the judiciary, and the business world.

In short, Americans may vote to restore calm. Make America quiet and friendly again. Under these conditions, a third impeachment would become a realistic possibility.

- Italy will participate in the next FIFA World Cup – creatively

Italy will not qualify on the pitch, losing its playoff matches as usual. However, following Iran’s boycott, Italy will be reinstated at the last minute. And if that happens, let us dare to dream: at least one Cagliari Calcio player will make the Squadra Azzurra.

Best of luck on the markets for the year ahead. As always, we remain at your side to help you navigate this complex environment with composure, humility, and a light sense of humor—essential qualities for any long-term investor.

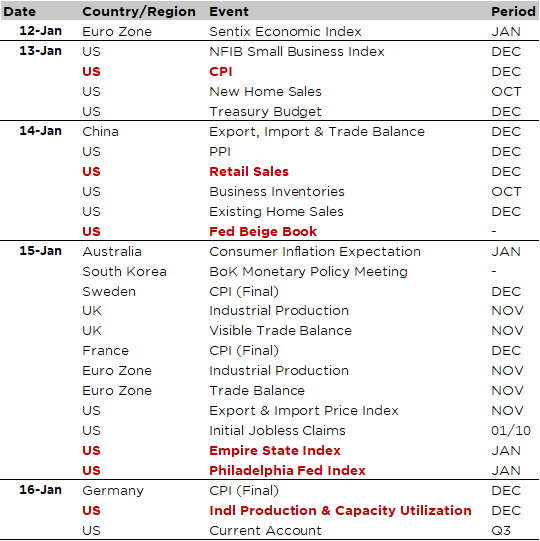

Economic Calendar

The first full week of trading on markets was already eventful… Should we have expected something else? For this week, the focus will be on the US CPI report for December due on Tuesday, the last one ahead of the next Fed decision on January 28. The consensus expects both the headline and core inflation to increase by +0.3% MoM, which will leave their YoY changes almost unchanged around 2.7%. There will be other important US economic activity indicators the following days such as the November retail sales on Wednesday (consensus expects +0.4% MoM), the regional manufacturing indices for January on Thursday (where an improvement is foreseen) and December industrial production (+0.2% forecasted) on Friday. Finally, the Fed’s Beige Book (Wednesday) will also help paint a picture of economic activity in the country.

Elsewhere, as far as economic data are concerned, it will be a light agenda. The few notable economic data releases include the trade balance in China (Wednesday), Korea monetary policy meeting (Thursday) and the final reading of German CPI for December (Friday). Finally, apart from economic data, the US Q4 earnings season will kick off on Tuesday with US banks: JPM on Tuesday, followed then by BofA, Citi and WFC on Wednesday, and then GS, BlackRock and MS on Thursday. The consensus forecasts S&P500 earnings growth rising about 10% YoY in Q4 slowing down from 14% YoY in Q3, which is thus a relatively low bar (i.e. it’s fair to expect a large earnings’ beat overall).

Last but not least, it will be worth keeping an eye on geopolitics where events are plentiful and moving fast currently with Venezuela, Iran and Greenland on top of the mind. And to add to the noise and volatility, a subpoena has just been issued to the Fed’s Chairman this morning, while we may also get a ruling on the IEEPA tariffs from the Supreme Court (possibly Wednesday).

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.