By Quirien Lemey, CFA, Co-Lead PM for DECALIA SOCIETY strategy

Key points

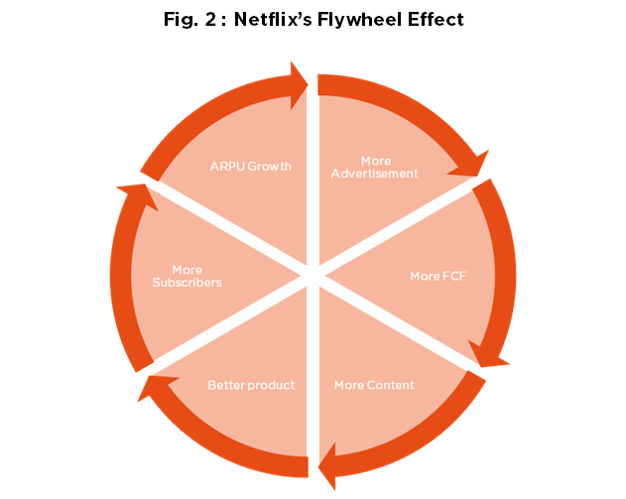

- Flywheel Momentum : The business model of platforms epitomises the flywheel effect, whereby each step of development feeds on the previous ones

- Moat Formation : The end of zero interest rates makes the building of new platforms much more difficult, resulting in the “moats” of this digital age

- Service Expansion : As the customer base of a platform grows over time, adjacent services can be added at a low incremental cost

- Tariff Resilience : Many platforms are relatively more shielded from the ongoing tariff war

The Flywheel effect

In these times of great macroeconomic and geopolitical volatility, focussing on company fundamentals serves not just as a welcome respite, but also, and more importantly, as the path to solid long-term portfolio returns. In particular, we would like to address here the attractivity of the flywheel effect, a concept that was allegedly first sketched – on a napkin – by Amazon’s Jeff Bezos during a meeting with Jim Collins, back in 2001.

This excerpt from Jim Collins’ Good to Great book provides a vibrant description of the process: “Each turn of the flywheel builds upon work done earlier, compounding your investment of effort. A thousand times faster, then ten thousand, then a hundred thousand. The huge heavy disk flies forward, with almost unstoppable momentum”. In more operational/financial terms, the Amazon 2001 letter to shareholders read as follows: “if we do our jobs right, today’s customers will buy more tomorrow, we’ll add more customers in the process, and it will all add up to more cashflow and more long-term value for our shareholders”.

For that, in essence, is the flywheel effect. The first turns (initial investment) require great effort but, once the movement has set in (the customer base becomes larger), incremental turns (additional services) compound the speed (returns) with little additional exertion (cost). Software and internet platforms, be they consumer-facing or business-to-business, epitomise the flywheel effect – which is why they today account for over 50% of our Sustainable Society fund holdings. In Warren Buffett language, we could say that their flywheel characteristic is what makes platforms the “moats” of this new age of digitalisation, cloudification and big data.

To delve further into the concept, nothing better than a couple of detailed examples.

Portfolio Company Example : Amazon

Let us begin with the aforementioned Amazon. As the customer experience improves (top right hand segment of the adjacent diagram), traffic in the Amazon marketplace increases, which attracts more sellers, thus a larger selection of products, further reinforcing the customer experience.

The incremental revenues have also enabled greater investments in Amazon’s logistics network. This led to deliveries within just a couple of days, then one-day delivery and now even same-day delivery in some of the most densely populated markets. Again, enhancing the customer experience.

Note that the logistics network not only serves as a massive barrier to entry (it is hard for a competitor to replicate billions of capex deployed over the years), but the improved customer experience that it entails also plays a part in driving subscriptions to Amazon’s prime membership programme – increasing high margin recurring revenues, etc. (For sake of simplicity, this specific aspect of the flywheel effect is not depicted in the Amazon diagram).

Importantly, increased traffic has also made it possible for Amazon to garner advertising revenue (an area in which the company went from scratch to becoming the third largest global online actor in less than 10 years), with limited incremental investment but at high incremental margins. This has helped lower the cost structure, thus also contributing to a better customer experience.

Round and round that wheel thus spins, constantly reinforcing cash flows – which ultimately form the value of any company.

Portfolio Company Example : Netflix

Now to the Netflix flywheel effect. The diagram looks somewhat different, but the process is the same: various components feed off one another to propel the business forward. Content, of course, lies at the heart of Netflix’s business model. As this content improves, in quantity and quality (bottom-left segment of the adjacent diagram), average revenue per user (ARPU) grows and the number of subscribers broadens. This results in greater cash flow generation and advertising, which in turn reinforces Netflix’s leverage over peers and content creators… further improving the content. Here again, a wheel is in motion, gaining speed upon each turn.

Platforms advantages

Returning to more general considerations regarding software and internet platforms, and why we see them as an extremely powerful long-term business model, an important first point to be made pertains to the end of the zero interest rate era. Financing the building of a new platform has become decidedly more difficult since central banks begun to tighten their policies. This means that today’s well-established platforms, built during the times of “free money”, boast high barriers to entry.

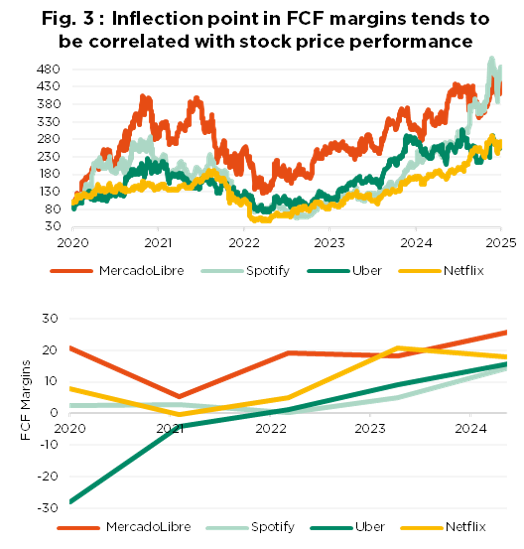

Then there is the all-important CAC metric, which stands for “customer acquisition cost”. The key point to make here is that CAC is not linear over time. As a platform grows in size, the incremental CAC shrinks. Word of mouth is also an important factor in this regard, as well as being the “first” entrant in a category (think Uber, Spotify, etc.). Capex spending thus becomes much more effective and free cash flow margins turn positive. From an investor perspective, not surprisingly, this inflection point in free cash flow margins tends to be correlated with stock price performance.

Similarly, once a platform is up-and-running, with a large customer base, adjacent services can be added at a limited incremental cost – i.e. a very high profit margin. We have already mentioned Amazon’s very successful entry into advertising. The same can for instance be said of gaming companies’ addition of a live service component to their popular franchises. In the old days, owners of triple A franchises typically sold games at a large, one-time fee. Today, many of these games have a live service component, which typically requires a monthly subscription or a season pass, and often offers additional in-game purchases (that can be provided at a low incremental cost for the company).

As content is updated regularly, this can generate much longer lasting (recurring) revenues, in some cases for over a decade. Having amassed a large fanbase, sometimes in the hundreds of millions, obviously facilitates this move. We see such companies, like Take Two with their GTA (Grand Theft Auto) franchise, as also falling within the « platform » category.

The fourth advantage of platforms is their ability to scale market share. A software company such as SAP that has built a broad customer base will naturally attract new developers to its ecosystem, which in turn will bring more customers. And once a broad customer base is established, the company can easily add new modules, either acquired or self-developed, and immediately start selling them into that large customer base. A cybersecurity company such as CrowdStrike has a product that relies on algorithms. The more data is fed into this algorithm, the better the product becomes theoretically. Since CrowdStrike was the first mover in next-generation endpoint detection, it boasts the largest customer base, and thus the biggest amount of data, which should result in the best product and… more customers.

What about tariffs?

What about tariffs might readers argue, are platforms companies not vulnerable to the ongoing trade war? While a case-by-case analysis is obviously warranted, the broader point to be made is that software and internet platforms generally have a low exposure to the tariff risk (Amazon being the notable exception). Policies announced by the Trump administration are – logically – focussed on the trade of goods, not services. The EU could of course decide, as a retaliatory measure, to begin taxing US services deployed in Europe, but we consider that to be a low-probability scenario. The largest impact would occur if tariffs cause an economic recession, which would also hurt platform companies. Although we would argue that the impact, in many cases, would still be lesser than for companies active in many other sectors.

Perspectives

The future thus looks bright, in our view, for platform companies. Flywheel effects tend to develop over a long period of time, meaning sustainably strong – aka structural – free cash flow generation. While business-to-consumer platforms may seem expensive on 2025 price/earnings (P/E) ratios, the picture is thus very different when looking at free cash flow yield. Uber, for instance, is trading at a P/E of 27x at the time of writing, but displays a free cash flow yield of over 5%, more attractive than that of the overall market. We certainly intend to continue to keep a significant part of our Sustainable Society fund invested in such companies, to harness this cashflow as well as potential future AI opportunities. For indeed, the data-rich business model of platforms also makes them ideally positioned to ride the AI adoption curve…

Alexander Roose

Head of Equities

Senior Portfolio Manager

and

Quirien Lemey, CFA

Senior Portfolio Manager

About DECALIA Sustainable SOCIETY :

- a multi-thematic global equity fund, investing in innovative sectors and disruptive companies shaping our SOCIETY in the future

- invests in the 7 themes (Security, O2 & Ecology, Cloud & Digitalisation, Industrial 5.0, Elder & Well being, Tech Med, Young Generation) regrouped by the acronym SOCIETY

- managed by an experienced team: Alexander Roose (ex-CIO of the Fundamental Equity of Degroof Petercam AM) & Quirien Lemey (ex-Lead PM of a Multi-thematic fund at Degroof Petercam AM

About DECALIA SA

Established in 2014, DECALIA SA is a Swiss investment management company. With more than 72 employees and assets under management that stand at CHF 5.6 billion, DECALIA has expanded rapidly, in particular thanks to its active-management experience built up over the last 30 years by its founders. The strategies developed by DECALIA focus on four investment themes deemed promising in the long term: the disintermediation of the banking sector, the search for yield, long-term trends and market inefficiencies. DECALIA is regulated by FINMA through a collective assets manager’s license. In addition to its Geneva headquarter, the group has offices in Zurich, Milan & distributors of the DECALIA Sicav.

Copyright © 2025 by DECALIA SA. All rights reserved. This report may not be displayed, reproduced, distributed, transmitted, or used to create derivative works in any form, in whole or in portion, by any means, without written permission from DECALIA SA.

This material is intended for informational purposes only and should not be construed as an offer or solicitation for the purchase or sale of any financial instrument, or as a contractual document. The information provided herein is not intended to constitute legal, tax, or accounting advice and may not be suitable for all investors. The market valuations, terms, and calculations contained herein are estimates only and are subject to change without notice. The information provided is believed to be reliable; however DECALIA SA does not guarantee its completeness or accuracy. Past performance is not an indication of future results.