Who would have thought it? After four matchdays, Cagliari Calcio is sitting in seventh place in Serie A following its 2-1 victory over Lecce at the weekend. It may not last, but it proves that smaller, less popular teams can spring surprises and outperform the big clubs that dominate the headlines. The same is true in the markets, with the strong comeback of small and mid-cap stocks in the United States since the end of July (Russell 2000 +11.0% vs. S&P500 + 5.3% in total return), the impressive comeback – completely ignored by commentators – of European banks over the last few years (total return of +65% this year and well in excess of 150% since January 2023), or other unnoticed trends that may lead to investment opportunities or risks.

In this context, focusing on the fixed income market, there are also some interesting developments outside the US rates, European bonds (German fiscal plan, France debt sustainability, UK Gilts volatility among the most predominant news headlines), the ongoing outperformance of credit over sovereign or the strong performance of EM debt this year on the back of a weaker greenback and easing US monetary policy. As many international investors are diversifying out of US Treasuries for obvious “risk management” reasons related to Trump politics or various concerns about monetary policy (Fed’s independence), fiscal trajectory or untamed inflation, which may all lead to a much weaker dollar and/or a spike in long rates, here are three sovereign government bond’s market or yield curves I deem worth having a look and an exposure: Australia, New Zealand and Japan.

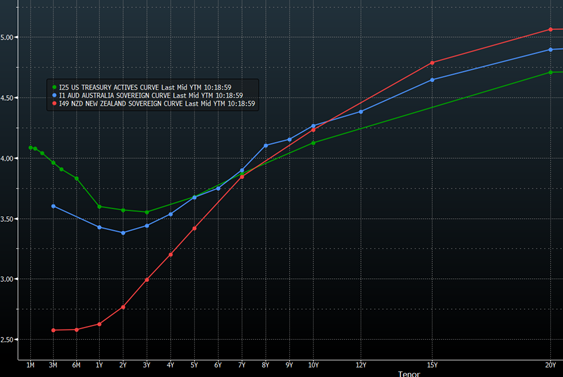

For Australia and New Zealand, the interesting features -compared to US Treasuries- are the following:

- Slightly higher 10y rates

- Steeper yield curves

- Inflation rates trending down more clearly to the central bank target (1%-3% for New Zealand and 2%-3% for Australia)

- Economic growth slowing (New Zealand experienced very weak growth since 2023 with even a GDP contraction last quarter)

- And so less complicated easing cycles for both the RBNZ and the RBA, which by the way should remain truly independent central banks…

- A better credit quality with solid AAA ratings (low public debt to GDP ratio)

- Lower cost of fx hedging for Euro or CHF based investors (i.e. a positive carry for USD investors)

For these reasons, an overweight of these DM sovereign bond markets -at the expense of the US Treasuries- makes sense in my view nowadays.

US Treasuries, Australia & New Zealand sovereign bonds yields curves

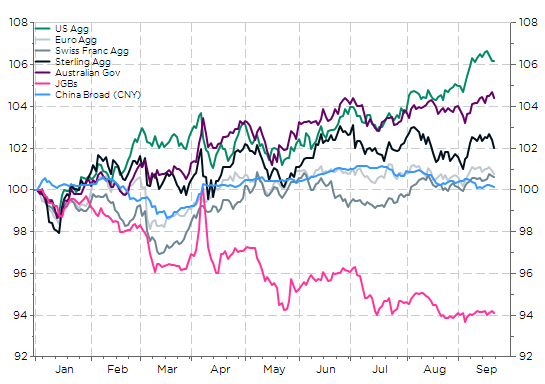

Investing in JGBs (Japan Government Bonds) is likely a more controversial story, especially as it has been a bad idea so far this year with JGBs underperforming meaningfully -in local currencies- within the global sovereign bonds market. However, past performance is not indicative of future results as you all know… particularly in the bond’s universe where higher yields or rates should translate in better returns going forward (excluding default obviously).

Selected sovereign bond indices (YTD returns, in local currency)

Except JPY-based investors, foreign official institutions or passive investment vehicles, there are not many private foreign investors “active” managers really exposed to JGBs as JPY rates have been close to zero for almost 3 decades, while Japan has still the highest government debt to GDP ratio worldwide. However, things are changing…

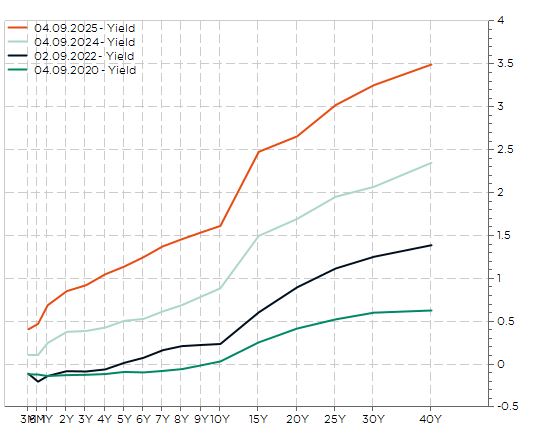

First, Japan 10y rates have increased and are now around 1.6%, a level not seen since 2008. Furthermore, the increase has been even more spectacular for longer maturities, resulting in the steepest yield curve among the developed markets. In other worlds, JGBs offer the best roll-down value among sovereigns.

JGB’s yield curve at different points in time

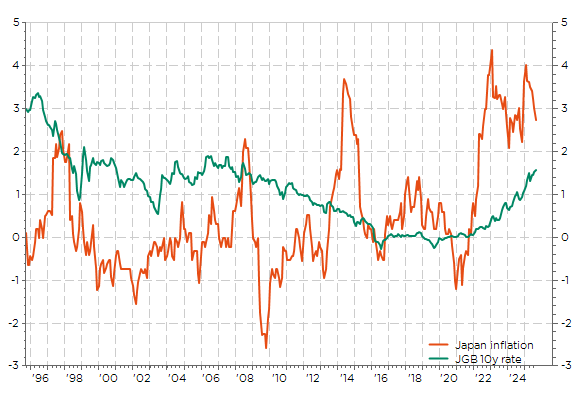

Then, because the much-awaited return of inflation, and inflation expectations, was the primary culprit behind the rise in Japanese long-term rates, the real debt burden of Japan is now becoming somewhat lighter thanks to

- A faster nominal GDP growth (above 3%) than fiscal deficit (< 3%) since covid ended

- A low average JGB coupon (just above 1%)

- No immediate wall of debt (average maturity of 9.5 years)

- A still highly accommodative monetary policy from the BoJ considering that inflation is still running well above 2% (and therefore above 10y rate for once)

Japan inflation & 10y rate: financial repression is finally in place

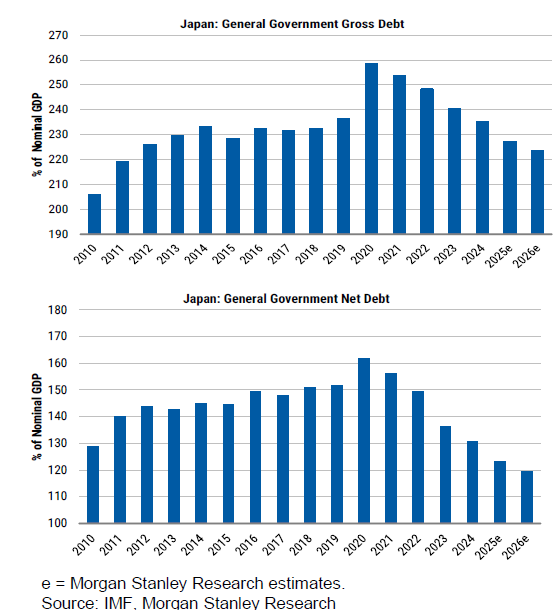

As a result, Japan government debt to GDP is now… declining. While in most developed economies, but especially in the US, UK, France or even Germany, government debt to GDP ratio keeps rising and is now much higher than it was before the Covid, there are some unexpected places, like Italy or Japan, where the public finance trends are currently more encouraging for fixed income investors.

Japan general government gross & net debt as % of GDP

It would therefore be wrong to ignore these bond markets, which often fly under the radar or are just dismissed, as they now offer the opportunity to diversify risk out of US rates without necessarily compromising medium-term performance. Similarly, smaller teams or opponents in sport should never be underestimated or ignored… Who knows? Cagliari Calcio could even beat Inter Milan next week-end or qualify for a European competition at the end of the season.

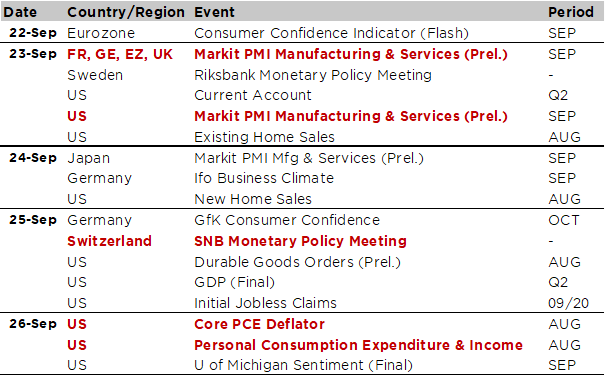

Economic Calendar

A quiet week should await us, like a transition in order to digest and process the info we got during the previous ones and thus get ready for the beginning of October. The global preliminary PMI indices for September (Tuesday) and the US PCE deflator (Friday) will be among the few key economic data releases to keep an eye one.

While the global flash PMIs should continue to point to a modest expansion of economic activity across the world, investors will focus on an eventual slowdown in the US -or not- and the ongoing improvement in the Euro Area and especially Germany -or not-, as well as the likely sentiment’s drop in France. Overall, most main economies seem fairly stable at the moment. Other sentiment gauges this week include the German Ifo survey on Wednesday as well as consumer confidence across major European economies.

In the US, the big piece will be the August PCE deflator print, along with the personal consumption, income and saving rate due on Friday. The consensus foresees +0.2% MoM growth in core PCE and +0.3% for the headline, which will leave basically the YoY growth unchanged at 2.9% and 2.7%. Personal income and consumption are also expected to grow at a similar pace than the previous month of +0.3% (+0.4%) and +0.5% (+0.5%), respectively. Staying in the US, other notable economic releases this week include durable goods orders (Thursday) and new home sales (Wednesday). Finally, as far monetary policy is concerned, we will hear many Fed members after their 25bps “risk management” rate cut, with an appearance from Jerome Powell himself scheduled for Tuesday. Sweden Riksbank and Swiss National Bank will also meet on Tuesday and Thursday respectively, both very likely staying pat at 2% and 0%.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.