With the end of the year just around the corner if you consider Christmas decorations as a leading indicator, it’s already time to think about the macro scene and markets outlook for 2024. As you all know “it is difficult to make predictions, especially about the future”. So, I would love to receive a new correct set of forecasts and strong convictions from Santa Claus this year but I didn’t find this item in the catalogue. As a result, you will find some key questions, grouped by themes over the next few weeks, that will shape financial markets trends next year and to which we will eventually get already some additional hints during the next 48 days left before year-end, depending on both my inspiration and how things evolve and develop.

First thing first: let’s start with economic growth this week. More of the same next year? Is this cycle really different? I mean, will DM economies really avoid a (severe) recession caused by the sharp and impressive tightening of their monetary policy over the last 18 months? We have experienced a sizeable upside surprise on global, and especially on US, growth this year on the back of the lasting distortions related to the unique events of the pandemic, economic policies medicine administered and post-pandemic healing. At this stage, I expect overall economic growth to remain quite resilient next year thanks to solid consumption trend (real disposable income sustained by low unemployment rate and falling headline inflation), as well as an improvement on the manufacturing sector (end of destocking, ongoing reshoring process and a slight improvement eventually of EM growth). The positive growth surprise may come from non-US economies next year as:

- European consumers will also benefit from a significant increase in real disposable income next year (assuming there isn’t a spike in energy prices this winter) as there has been a lag compared to the US, also due to the invasion of Ukraine by Russia, when considering the wages and inflation trajectories. Furthermore, the households savings cushion accumulated during the pandemic has likely melted faster in the US than in Europe.

- Japan has also kept a loose monetary policy so far and may thus continue benefit from a reflation scenario with both wages and consumption/investment picking up, while debt overweight is somewhat lightened in real terms.

- Inventories destocking has been a more important drag for non-US manufacturers

- EM economies may already start cutting rates next year or at least they have the possibilities to do it given the current level of real rates.

As far as China is concerned, I fear it’s more a downside than an upside risk we may face next year… Growth is indeed softening again according to the latest economic releases despite all the easing measures, especially in the property sector, which remains a major headwind also for the overall household & business confidence. Without a re-opening boost likely to occur next year, a bearish “Japanese deflation scenario” case could be made with a non-negligible risk of negative feedback loop dragging down further expectations and thus spending. The god news? I suspect Chinese government is well aware of that and it may thus step in at any time with some strong (bazooka) medicine to avoid a dramatic downturn.

Most of my thoughts here above also depend on the inflation, economic policies framework, as well as geopolitics developments I foresee for next year, or any other unknown unknows that may appear during next year journey on markets. Fortunately, the ranking of Cagliari Calcio won’t be a key market driver next year either (even if I obviously hope my favorite team will avoid relegation). As a result, I will spend more time in the next few weeks on these topics but, basically, I don’t expect sizeable surprizes on both inflation and monetary policies. For the rest, it remains anybody’s guess. So, I would be grateful if you could inform me a few days before these things happen or just send me your current thoughts and gut feelings and we may try to list them and think about how they may impact the macro and market outlook for 2024.

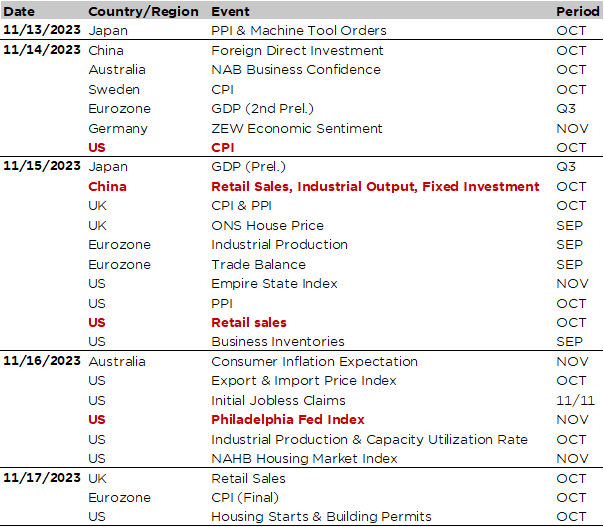

Economic Calendar

Despite there is still some way to go before year-end (48 days to be precise), this week could already set the tone for markets’ final sprint to close 2023. So, we may perhaps experience a kind of “make it or break it” week on the back of some crucial data releases, namely the US CPI and US retail sales reports on Tuesday and Wednesday respectively, as well as China economic activity indicators (industrial production, retail sales and business investment) in between them during the night, which will thus all be key highlights of this week. In addition, a potential US government shutdown on Friday remains also in the air although the odds have decreased materially since a Speaker of the House of Representatives (Mike Johnson) has finally been appointed. Note also that Moody’s will conclude its review of Italy’s rating on Friday: it’s on negative outlook and one notch away from high yield territory (Baa3) but, here too, the odds of a negative surprise seems low as the 3 other main rating agencies have affirmed their Italy IG rating in recent weeks. Last but not the least, there are still a few companies that will report their earnings, while the Q3 season is now winding down (more than 90% of the S&P500 members already reported). The notable ones include essentially techno and consumer related ones such as Walmart, Tencent, Home Depot, Cisco, Alibaba, Applied Materials, JD.com or TJX.

US inflation and growth dynamics will be in focus this week. The consensus expects inflation to have been relatively muted last month with headline and core CPI seen up +0.1% and +0.3% respectively over the month, leading to a slight decline of annual headline inflation to 3.3% from 3.7%, while core one should remain stable at 4.1%. There will also be the PPI report on Wednesday and then still one more CPI release the day before the next Fed meeting on December 13. As far as US growth trend for this quarter is concerned, retail sales on Wednesday and industrial production on Thursday will be closely scrutinized. The consensus foresees some moderation after the strong consumer demand observed the previous quarter (consumption was up +4.0% a.r.) as higher borrowing costs, a somewhat softening labor market, a more challenging path for financial markets recently (i.e. not so great wealth effect) and the resumption of student loans payments may weight on shopping activities. As a result, October retail sales are expected to decline by -0.3% (after +0.7% in September) and decelerate to +0.2% from +0.6% the prior month when excluding auto & gas. Another read-across on the consumer mood will come from the earnings reports of key US retailers including Home Depot, Walmart, TJX and Target.

Industrial production is also foreseen to reverse prior month gain (-0.3% expected after +0.3% in September). Furthermore, the release of the regional manufacturing indices (Empire State and Philadelphia Fed) for November will give us the first clues about the US ISM manufacturing index that will be released on December 1st. We will also get further insights about the US housing market with the release of the NAHB index for November (a stable reading of 40 is expected) and the housing starts and building permits for October on Friday. Note that this Friday is also the deadline for Congress to avert a government shutdown…

Turning to China, the releases on Wednesday of industrial production, retail sales and fixed investment data for October will be closely watched following last week’s disappointing PMIs, weak exports growth and CPI miss (due to mainly to a sharp fall of pork prices to be fair) on one hand, and ongoing government support through various necessary but not-sufficient measures so far on the other hand. Note also that we will get Japan Q3 GDP preliminary reading on Tuesday: a small -0.1% QoQ contraction is expected after a strong +1.2% gain in the previous quarter. Moving to Europe, the German ZEW survey will be released tomorrow, while other notable reports include trade data and industrial production for the Eurozone on Wednesday, as well as UK CPI & PPI for October on the same day.

Aside from economic data and earnings reports, there will be several European central bankers’ speeches and interviews this week, including ECB President Lagarde on Friday (with a keynote speech at Frankfurt for the European Banking Congress: „Navigating in a World at Risk of Fragmentation“). Finally, a bilateral meeting between US President Biden and Chinese President Xi is also expected to happen on Wednesday during the APEC meeting in San Francisco.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.