For years, betting on Japanese assets felt a bit like supporting Cagliari Calcio: admirable loyalty, questionable timing, and a long history of heartbreak. Perennially overshadowed by bigger, flashier rivals, both Cagliari and the Japan financial markets became symbols of battles few expected to win. The so-called “widow maker” trade (i.e. shorting Japanese bonds in anticipation of a long-awaited rates normalization) ruined countless macro theses, just as Cagliari’s stubborn survival instincts have repeatedly frustrated predictions of its demise.

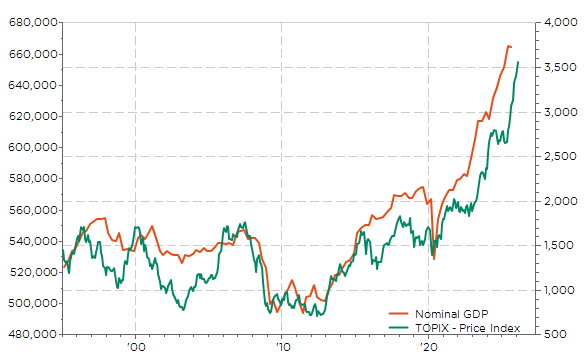

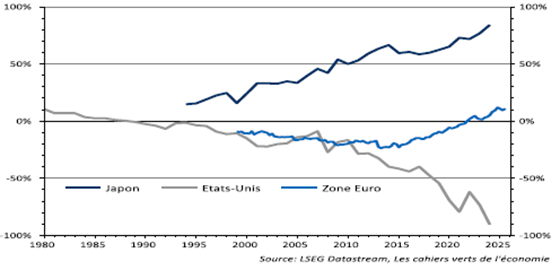

Yet football, like financial markets, has a habit of rewarding resilience in unexpected ways. After decades spent in the shadows of deflation, ultra-low yields, and policy exceptionalism, the Japanese markets are quietly stepping back into the spotlight. Not as a dominant giant, but as a disciplined underdog whose structural transformation is forcing global investors to reassess long-held assumptions. Much like a David learning not just to survive but to compete, Japan’s evolving inflation regime, shifting policy stance, and improving nominal growth backdrop are now reshaping the investment case for JGBs… as they already did for Japanese equities over the last few years (see graph below). Even considering the JPY weakness, the TOPIX has largely outperformed the S&P500 since the end of 2024 as it is up 32% in USD terms vs. 16% for the US large cap index over the same period…

Japan’s nominal GDP (JPY trn) and TOPIX: when the return of inflation is a blessing

Markets that were once dismissed as offering poor returns at best and sometimes “uninvestable” are now demanding a second look. Especially in a context of tectonic rebalancing, where the overwhelming exceptionalism of the US and its financial assets are becoming less extraordinary. And while the giants of global fixed income still command attention, the Japanese bond market, which represents still a non-negligible 9% of the Bloomberg Global Aggregate Bond Index, may be proving that persistence, timing, and a change in fundamentals can sometimes turn the most underestimated players into surprisingly compelling contenders.

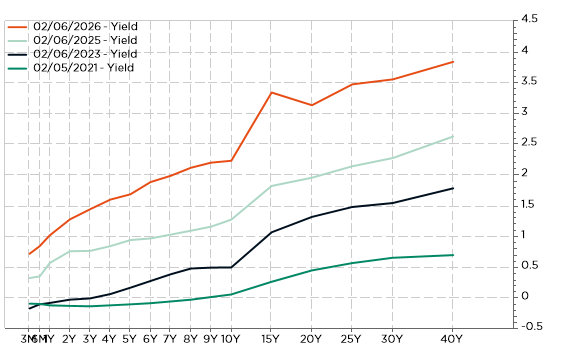

Since 2023, DM long-term interest rates have tended to plateau, while Japanese 10y rates have continued to rise with an impressive and thus rarely seen bear steepening of the whole JGBs curve.

An impressive and rarely seen bear steepening: JGB’s yield curve at different points in time over the last 5 years

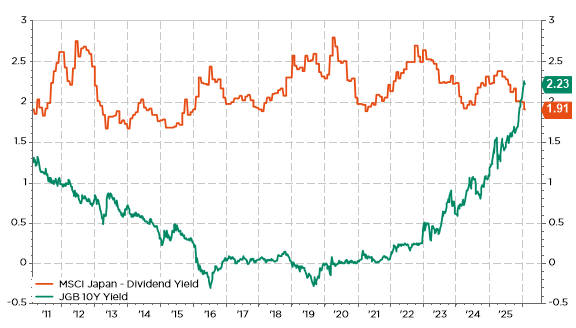

As a result, the Japanese 10y yields (2.3%) now exceeds largely that of the China 10y (1.8%), whereas the 30y JGBs yields as much, i.e. 3.5%, as the German 30y Bund. I do believe that most of the JGBs steepening potential is now behind us as the curve is now relatively attractive for Japanese institutional investors. In fact, not only JGBs are regaining some relative value, shining and thus interest within the Global Bond Market landscape, but they are now also offering… an alternative to domestic investors as the JGB 10y yields are again competing the Japanese equities dividend’s yield. Who would have believed or thought that this would happen again one day?

Japanese bond & equity yield: Mrs. TINA Watanabe is dead

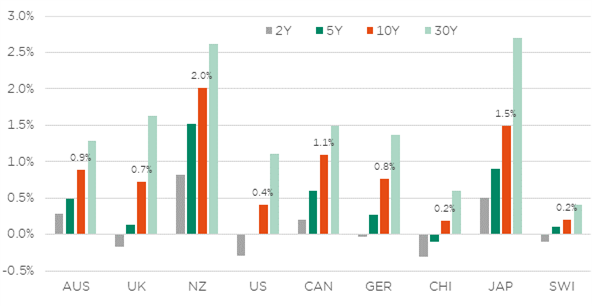

As the risk of rising rates gradually decreases in Japan, carry strategies on Japanese debt hedged for currency risk may be worthwhile, also for foreign investors but especially for Swiss investors who are starving for yielding sovereign bonds in CHF.

2-, 5-, 10-, and 30-year selected government bond yields (with 3-month CHF currency hedging)

For sure, Japanese government has a lot of debt and current inflation rate in Japan (3.0%) remains above current 10y JGB’s yield. So, the Japan long rates may continue creeping up. However, when looking to other alternatives, JGBs also offer some attractive, or more appealing, features compared to other sovereign bonds market (“quand je me regarde je me désole, quand je me compare je me console”)

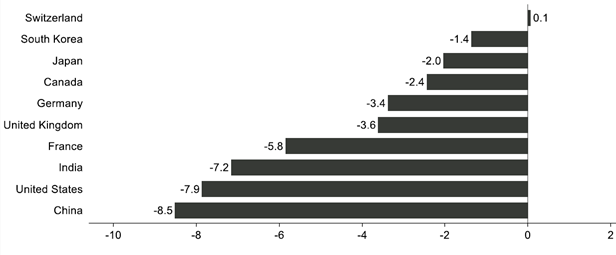

- Very low foreign debt as it benefits from high domestic savings (actually Japan remains the biggest net external creditor, see graph below), which act as a structural stabilizer and may now lead JGBs to outperforming sovereign bonds in global risk-off scenario, especially if you add the likely strengthening of the JPY in this context. This also explains why Japan has been able to sustain such a high debt-to-GDP ratio that would be unsustainable elsewhere. In other markets: China is the corporate debt champion with an explosion in corporate credit since 2008 on top of the strong quasi-public component via local governments and some compatibility’s tricks to hide exploding budget deficit, whereas the United Sates compound high public debt, corporate and household debt, which has thus been financed mainly by external savings so far…. but perhaps not forever, especially with its current President and his politics.

Net external position, as % of GDP: Japan has been financing foreigners’ debt, while US is a net “huge” debtor to the RoW

- Low and contained fiscal deficit since the end of Covid, thanks also to the very low average coupons after almost 3 decades of deflation and subsequent zero-interest rate policy, which are now being literally wiped out by the resurgence of nominal growth, closed to 4% last year. Consider that the average coupon of JGBs is about 1.1% with an average maturity of 9.4 years. As a result, the central government debt to GDP has declined from 214% as of end of 2021 to less than 200% as of end of last year (according to the IMF).

Cyclically adjusted budget balance (% of GDP) expect for 2026 (obviously pre-Takaichi’s landslide victory in Japan Lower House)

Source: IMF, LSEG, Vontobel (Jan. 2026)

- Very favorable positioning as it is most certainly very light and clearly underweight, from the perspective of foreign, read non-Japanese, investors. Here are just two numbers: 10% of JGBs are held by non-resident vs. over 50% for France OATs!? So, non-residents cannot really reduce their exposure unless they go outright short, which would be a riskier bet at this level, for sure, than a few months ago. More generally, Japanese net bond issuance is still increasing while demand has been relatively weak so far. BoJ sales related to its Quantitative Tightening have only been barely offset by purchases from Japanese institutional investors, which have also reduced their portfolio average maturity, exacerbating therefore the steepening of the curve.

Admittedly, Japanese public debt still appears high at first glance. But its net debt is significantly lower, and the country has been running a current account surplus for many years, resulting in a strongly creditor external position (see chart above). More importantly, there is no risk of a balance of payments crisis such as the United Kingdom experienced in Autumn 2022, or the latent looming risks on the US, whereas the political situation in Japan seems today just as stable as that in … Italy since a Meloni, another woman, won the elections. What’s about the current political situation in the UK, France or the US? More divided and uncertain I highly suspect, likely requiring a higher risk premium on their sovereign debt.

To sum up, it now seems that the past rise in Japanese long-term rates and the steepening of the Japanese curve is likely coming to an end finally: institutional domestic and foreign investors’ demand should increasingly emerge at these carry levels. Moreover, current 10y rate levels are also approaching a fair estimate of the Japanese nominal equilibrium rate; somewhere around 2%-2.5%. So, we may be at a turning point. Same for Cagliari Calcio if it wins tonight against Roma (beware my dear friends Enrico, Fabian or Romano!): I will start to dream about a qualification for an European competition next season rather than praying for not being relegated to the Serie B.

Economic Calendar

A new week begins with… another major change in the geopolitical landscape, which is having also some ramifications in global financial markets. In Japan, the LDP-JIP coalition led by PM Takaichi has won a huge majority with 316 seats out of 465 at the Lower House election. That’s the largest election win in Japan since World War 2. While a large victory was expected, this „supermajority“ was rather seen as a tail-risk, which has therefore raised the prospects of even more aggressive fiscal policy. As a result, Japanese equities are soaring, JGBs yields are climbing and the JPY remains volatile but strengthening for once.

Turning back to the economic agenda, this week’s focus will be on the delayed US jobs report for January, which will finally be released on Wednesday, as well as the rescheduled January CPI report next Friday (initially scheduled on Wednesday). The consensus expects total payrolls (i.e. 159’625’000 as of December 2025) to increase by +70k (+50k in December) or by +0.044% to put in perspective, with an unemployment rate steady at 4.4% and the hourly earnings growing +0.3% MoM, like in December. In other words, almost no change compared to the prior month. As far as US inflation is concerned, economists see MoM growth of both headline and core inflation at +0.3%, which should lead to a small decline in YoY annual rate towards 2.5% for both gauges. Other notable US economic data will include the NFIB Small Business Optimism Index for January and the December retail sales on Tuesday.

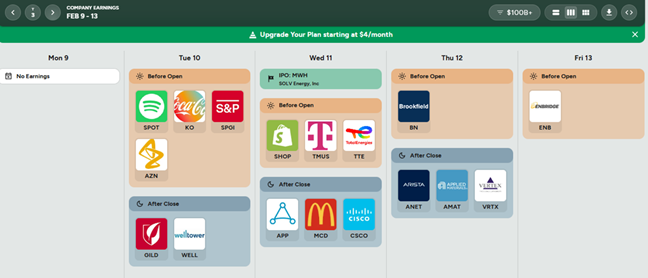

Inflation reports are also due in China (Wednesday) and several European countries, including Switzerland (Friday). Finally, we will also get the Q4 GDP in the UK on Thursday (consensus foresees +0.2% QoQ and +1.2% YoY). Wrapping up with the earnings season, next week’s lineup features tech names including Cisco, Applied Materials, Arista and Shopify as well as US consumer firms Coca-Cola and McDonald’s, but also S&P Global or Spotify. In Europe, we will get the results from several large caps including AstraZeneca, Hermes, Siemens, L’Oréal, Total and BP in the energy sector, as well as Unilever, AB InBev or Ferrari among consumer stocks.

Non-exhaustive list of major earnings releases over the week (market cap > $100bn)

Source: https://earningshub.com/earnings-calendar/week-of/2026-02-09

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.