Welcome to December! Celebrations are coming… According to the seasonality patterns, you have nothing to fear anymore for the next few weeks since the Santa Rally will now take care of bringing your portfolios accumulated YTD returns, included an additional last mile boost, directly under your Christmas Tree. For that, you just need to believe that Jay Powell and his Fed’s elves will behave well on December 10th by cutting rates as most investors have requested in their letter to father Christmas.

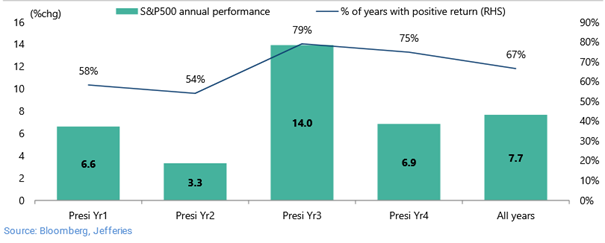

Speaking about seasonality, I came across these statistics here below about S&P500 annual performances by presidential years. Apparently, the 2nd year of a Presidential mandate seems the worst. So, it is perhaps an element to consider -for seasonality believers at least- that goes somewhat against the crowd as many Wall Street houses have just released their rosy 2026 forecasts, which often call for another round of double-digit gains for the S&P500 by seeing good times rolling next year… Let’s already celebrate and be grateful for this year.

S&P500 annual performance since 1929 by presidential years

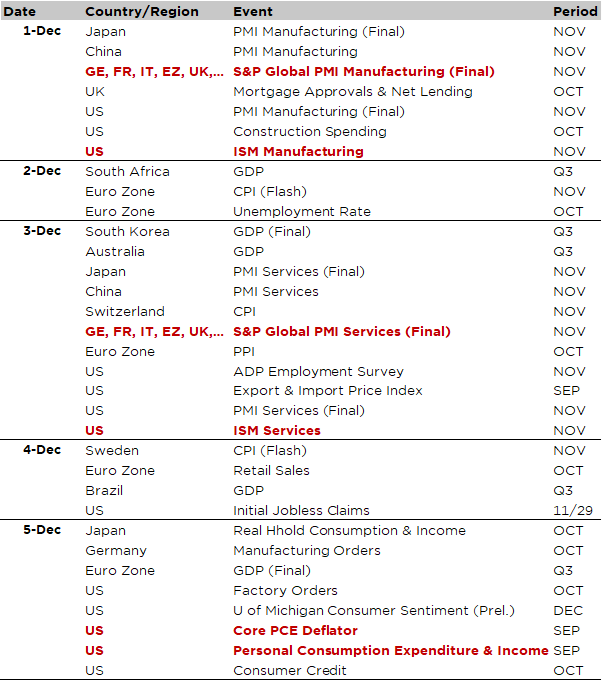

Economic calendar

Turning to the economic calendar, a busy week still awaits us despite the November job’s report won’t be released on Friday (it is postponed until December 16th, courtesy of the several weeks-long US government shutdown). We will get updated insights about economic activity through the releases of the global PMI for November as well as the US ISM indices (Monday for manufacturing and Wednesday for services), but also inflation via the delayed September US PCE deflator (Friday) and the Switzerland CPI for November and Euro Area flash CPI. Other noticeable economic data releases include the US ADP employment survey (Wednesday), the US jobless claims (Thursday) and the preliminary University of Michigan consumer sentiment for December on Friday.

While the Fed enters a blackout period ahead of 10-Dec FOMC decision, there will be -at the time of writing on Sunday evening- a speech by BoJ Governor Ueda on Monday. We may have therefore more clarity on whether the BoJ will hike in December or January, but I doubt… Anyway, I believe BoJ will move as soon as this month given (1) mounting pressures about JPY weakness and rising inflation and (2) the fact that BoJ likes to surprise when it acts (more bangs for their bucks)… so why waiting until January?

Finally, ending with the last few earnings to be released, tech and consumer companies will dominate the headlines this week with the results of Crowdstrike, Marvell, Salesforce or Snowflake within IT, as well as those of Inditex, Macy’s and Kroger for consumers, among others.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.