- The global chocolate industry is currently undergoing dramatic structural shifts

- Unstirred chocolate indulgence – premiumisation, healthiness and ethics take it all

- Sweet treats investing is not like a box of chocolate: you get what you pay for!

Some like it hot, others dark & bitter, white & crunchy, or plain & milky. But one thing is for sure: Nine out of ten people like chocolate. The tenth person always lies!

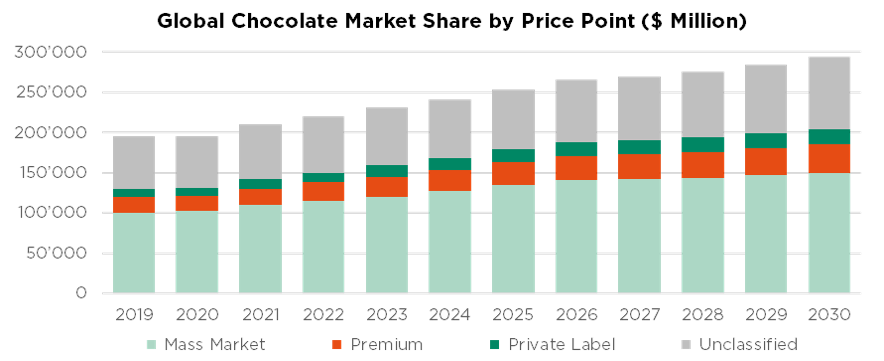

Did you know that global chocolate consumption reached 29 million tons in 2024, for an average 1,3 kilogram per capita? And that this ranking is proudly led by… Swiss citizens, who gorge on almost 9 kilograms annually, well ahead of US consumers for instance (3.7 kilograms)? While the latter should not really come as a surprise, the current global market worth USD 130 bn is nonetheless still expected to grow +4-5% p.a. through 2030, driven by Asia and South America. Somewhat unnoticed though, is the fact that this seemingly flourishing industry is undergoing dramatic changes, facing structural headwinds both on the supply and demand sides, suggesting fewer winners are now taking a bigger slice of this growing chocolate cake.

Chocolate industry challenges have proven plentiful indeed. Firstly, surging cocoa bean prices resulting from multiple years of poor harvests (due to climate change and diseases), low inventory levels, as well as ongoing supply chain issues in Western Africa have squeezed all confectioners’ margins, though to varying degrees, leading to product reformulations. Secondly, global tastes have changed with both increasingly health-conscious consumers and anti-obesity GLP-1 drug patients adjusting their diets and cutting back on snacks spending, leading to subdued demand for (some) chocolate products. Finally, compounding the above, prevalent economic uncertainty (US tariffs/inflation) and rising regulatory complexity (traceability, ethical sourcing and sustainability) have also pushed many companies to the brink of bankruptcy.

But don’t forget how much the world loves this sweet treat!

Mindful indulgence actually continues to gain traction, and high-quality premium chocolate makers are set to benefit as mass-market rivals struggle from a lack of both pricing power and product customisation. Today, consumers are willing to pay more for chocolates that feel special, offering innovative flavours and multi-sensory experiences along with emotional indulgence, better aligned with their ethical values, and satisfying both healthier and functional requirements. As such, the premium segment, which accounts for ca. 10% of global chocolate market volumes and 25% of its value, is growing at a faster rate (+5-7% p.a. through 2030) and yielding superior returns thanks to its better cocoa price-cost spread.

Moreover, in contrast to the broader snacking industry, we believe that premium chocolate is better positioned to withstand structural pressure from consumers’ dietary shifts and GLP-1 drugs adoption, assuming less frequent but more selective purchases, hence paving the way for further market share gains.

Taking a closer look at global chocolate equity sector returns, trends have proved mixed recently with the aforementioned overhang from higher cocoa prices, structural consumer shifts, and subdued demand concerns all taking their toll on valuation multiples.

While understandable for most commodity-like mass-producers such as Barry Callebaut, we believe this de-rating now offers attractive investment opportunities in the premium chocolate segment, with high-quality compounders such as Lindt & Sprungli set to continue to gain market share – sustaining their superior organic growth and capital returns. In this context, make sure you pick your stocks in this sector like you pick your own chocolate, indulgently but selectively.

Written by Damien Weyermann, CFA, Lead Portfolio Manager & Senior Equity Analyst

“All clear” but with limited upside

- The Goldilocks scenario has been further reinforced by the Fed’s recent rate cut…

- … reducing near-term tail risks and propelling valuations ever closer to extreme levels

- Beware of overconfidence though, as it is leading to a growing asymmetry in risk assets

It may sound counterintuitive, but despite the many uncertainties and structural fragilities still facing the global economy, the Goldilocks scenario has been further reinforced by the Fed’s recent rate cut. Equity markets have continued to post new records worldwide during recent weeks – one all-time high chasing another – underpinned by resilient economic activity, robust earnings growth, lower energy prices, moderating global inflation and, of course, dovish Fed expectations that have just been fulfilled.

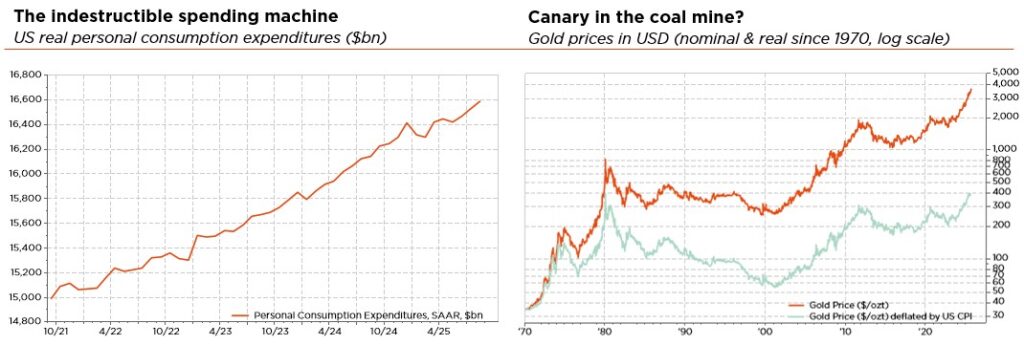

In this highly supportive environment, risk premia and volatility have compressed further toward the lower end of historical ranges. Meanwhile, long-term global rates have stabilised somewhat, although concerns remain – more or less visible depending on the economy – about the sustainability of current fiscal and debt trajectories. Against this backdrop, credit continues to outperform duration, with spreads at historically tight levels that leave little margin for error. The US dollar remains weak, weighed down by a softening labour market, lower Fed rates and the Trump administration’s economic policies, while gold has surged to fresh records. Does this gold rally constitute the proverbial canary in the coal mine? Or simply a “normal” response to elevated geopolitical risks and latent threats (recession, a resurgence of inflation, rate shocks, or currency debasement in a context of fiscal dominance)? Either way, it starkly illustrates the paradox between Main Street and Wall Street.

With the Fed having cut its target rate by 25bps to 4.25%-4.00% at its latest meeting, we have increased the probability of our supportive base case, which otherwise remains unchanged: steady but positive growth, sticky yet manageable inflation, and gradual policy normalisation in an increasingly fragmented world. Framed by the Fed Chairman as a “risk-management cut,” the move has reduced near-term tail risks – particularly those linked to an imminent or sharp US slowdown – thereby strengthening the case for a soft-landing “all clear” scenario that has propelled valuations close to extreme levels. At the same time, investor sentiment is not overly euphoric, market breadth is improving, and earnings growth continues to surprise on the upside, all while inflation and rates moderate. We recognise that today’s apparent overconfidence in a seemingly endless Goldilocks environment, combined with lofty valuations (even signs of froth in meme stocks and some IPOs), limits near-term upside potential. With little cushion left to absorb earnings disappointments, negative inflation surprises, unexpected rate shocks or currency debasement, risks are building the next “wall of worry” that markets will have to climb.

In the current environment, we remain in wait-and-see mode so long as the soft-landing scenario holds. Accordingly, no changes have been made at the portfolio level. We are maintaining a broadly neutral stance on both equities and fixed income. This balanced positioning and well-diversified allocation reflect our cautious approach to the wide range of potential outcomes. It should allow portfolios to capture modest but positive returns across most asset classes in the near term, smoothing the inevitable bumps of sectoral rotations, while retaining enough flexibility to adapt as conditions evolve.

Opportunistically, we may implement tactical hedges – as we are doing currently. Diversification remains a cornerstone of our strategy: within equities (by region, sector, style and market cap), within fixed income (across geographies, maturities, sectors and credit risks – beware however of fragile issuers and weaker sectors in these challenging times) and also through gold exposure, which we continue to prefer to government bond duration in the absence of a severe recession. Gold, in our view, provides a broad safe-haven buffer across a range of risk-off scenarios.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

External sources include: LSEG Datastream, Bloomberg, FactSet, Euromonitor.