Gold just broke above $3’600 this morning, a new record high. In the same time, worries over government debt sustainability, geo-political instability, central bank’s independence and inflation are broadening out. For sure, the US holds the upper hand, not only because it’s the largest market accumulating all these flaws but also because the policies of the new US administration are scoring these spectacular own goals. So, non-US investors, especially foreign institutions, are wisely diversifying out US government debt and/or the US dollar. However, the situation isn’t much better elsewhere if you think about Japan, France or the UK, which are all also experiencing a toxic mix of political instability, perilous fiscal trajectory, inflation issues, or some fiscal dominance in different degrees depending on the countries I am referring to. In this challenging context, it is therefore not surprising that the “barbarous relic” is emerging as the big winner.

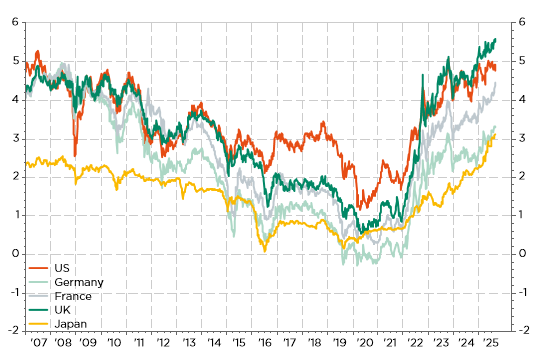

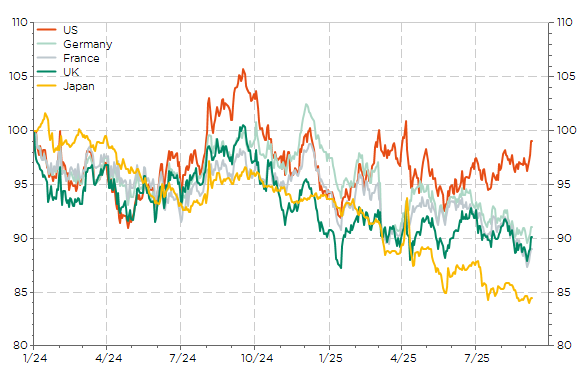

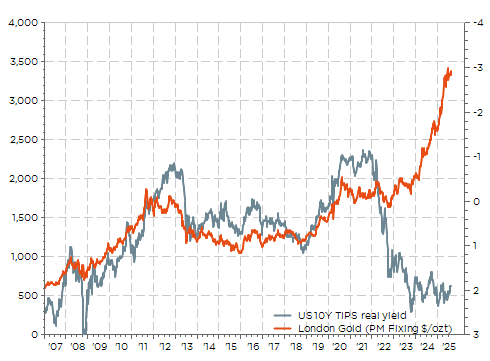

The fortunes of gold and long-term government bonds have diverged significantly over the last quarters as several long-dated DM sovereign bond yields hit levels not seen in decades, while gold price ascent has accelerated since 2024. Looking at the two previous decades playbook, you would have expected a negative correlation between long term rates and gold prices.

Selected 30y government bond’s yields

For sure, US Treasuries haven’t sold off nearly as sharply as European or Japanese bonds this year, largely because US economy is now slowing, Fed will soon resume easing, US coupons are higher (less price sensitivity to rates changes) and… the greenback is also boring a large part of the downward adjustment (USD lost about -10% YTD against most other DM currencies).

Selected 10+ Years government bond’s total return since 2024

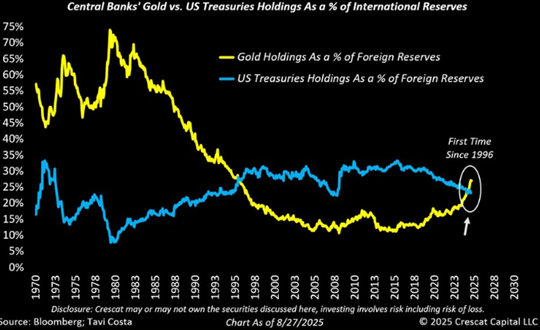

Thanks to accelerating gold demand from central banks -especially, if not only, from EM- and soaring prices, gold has recently surpassed the euro to become the 2nd global reserve asset after the US dollar and, for the first time since 1996, gold represents a bigger share of central banks‘ reserves than US Treasuries. Central banks now hold 36’000 tons of gold, according to a ECB study (Gold demand: the role of the official sector and geopolitics). Among the largest holders, according to the world gold council data, you will find the US (8’100 tons), Germany (3’350), France & Italy with about 2’450 each, China (2’300) or Switzerland (1’040 tons according to SNB data).

Foreign (i.e. Non-US) central banks hold more gold than Treasuries

With the price of gold currently above $3’600, central banks‘ gold holdings are now worth more than $4.5tn vs. $3.5tn of US Treasuries in foreign central banks (i.e. excluding the Fed, note that the Fed alone holds about $4.2tn of Treasuries). Gold holdings as foreign reserves value (in USD) has therefore benefitted from both the price effect since the post-pandemic inflation spike, but also a significant increase in demand since the invasion of Ukraine by Russia at the end of February 2022. They have increased their holdings by more than 1’000 tons in each of the last three years, a record pace and double the average annual purchases in the preceding decade…

Gold price & US real interest rates: correlation broken as risks shifted after the invasion of Ukraine (Feb 2022)

It’s certainly not a coincidence if the last time gold accounted for a greater share of global reserves than UST was at the end of the 90’s. At that time, many European countries sold some of their gold reserves ahead of the advent of the euro currency: gold fell as low as $250 in August 1999, down 40% from the mid-90’s, not really a gold-friendly period with falling or stable and low inflation, geopolitical stability overall (peace’s dividends’ time), solid growth in DM, a strong USD, and even an occurrence we haven’t seen often in our life-time – a budget surplus in the US. It’s also not a coincidence if bonds-equities correlation turned negative from the end of the 90’s…

Fast forward to today and we are basically experiencing the opposite environment, while gold is now shining and thus outperforming sovereign government bonds, which are struggling. In other words, gold is highly favored by investors, as well as by EM monetary and fx reserves institutions, as a broad and non-systemic “safe haven” in different scenarios, at least a “better one” than government bonds in the current context. It doesn’t mean that gold price could not turn down (measured in your base currency) at some point, but it’s really hard to see what will really derail his ascent in $ terms in the near term. A severe US recession and renewed deflation risks may eventually help at first glance, but fiscal sustainability and/or currencies depreciation in a more challenging than ever geopolitical context could then strike back with a vengeance.

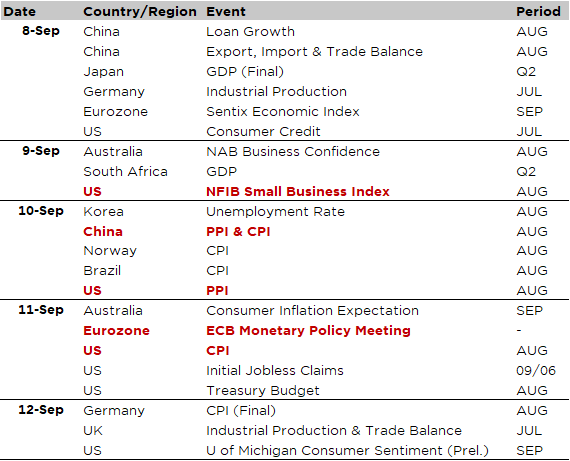

Economic Calendar

US inflation figures for August will be the focus of investors‘ attention this week, with the PPI due to be released on Wednesday and the CPI on Thursday… 11 September. While we all remember what we were doing and where we were on that date 24 years ago, let’s hope that the same will not be true for investors this Thursday (especially for those in Geneva who will not be in front of their Bloomberg terminals). After the latest disappointing employment figures, there is now very little chance that the Fed will disappoint the market at its next meeting. For that to happen, the expected inflation figures would have to turn out to be completely… catastrophic, with a surge in producer and consumer prices. The probability of this is therefore as low as any other catastrophe. On this subject, the consensus expects a monthly increase of +0.3% for both headline and core PPI, compared with +0.9% last month (both of which were well above expectations). The same applies to the CPI, with +0.3% MoM expected for both headline and core indices (same as the prior month), which would imply annual inflation of +2.9% (vs. 2.7% in July) and +3.1% excluding energy and food (unchanged from July).

On the same day (Thursday 11 September), there will be a meeting of the ECB, but this will most likely be a non-event with the deposit rate remaining at its current level (2%) as ECB has likely reached the terminal deposit rate in this cycle. However, it will be interesting to keep an eye on the ECB’s projections for growth in the coming quarters (probably revised marginally upwards) and inflation (stable or even slightly down). We should also pay close attention to Ms. Lagarde’s press conference, particularly when questions will certainly arise about France’s fiscal situation and the tools available to the ECB, especially the procedures and prerequisites for using them to extinguish any potential sovereign debt crisis impeding the transmission of the adequate monetary policy medicine.

Staying in France, PM Bayrou will not win the confidence of the National Assembly tonight. Following his resignation, President Macron will address the nation shortly after this evening. He will have then three options: cabinet reshuffle, new general election or resignation. The former option is the most likely, whereas the two others will bring another layer of instability and a delay in the budget debate. Note that Fitch is also expected to update its sovereign rating on Friday. Speaking of politics, Japan’s PM Ishiba announced this weekend that he will step down, after the poor summer election results. An early leadership election will now take place in a few weeks, with the direction of monetary policy at stake when dust will settle.

Finally, we will also get the inflation prints for China (Wednesday) with the release of both the PPI and CPI figures for August. Focus will be on the former as a key watching point for the progress in „anti-involution“ efforts (see our weekly note of August 18th, “Let’s speak about deflation!”): the consensus expects a -2.9% YoY print, up from -3.6% in July, while consumer price inflation is foreseen in negative territory with a -0.2% YoY (vs. 0% in July).

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.