It’s currently difficult to have strong “macro” convictions with the ongoing US data blackout. In the meantime, US earnings have been pretty stellar so far, turbo charged once again by those of the mega cap tech stocks, tensions between US and China have eased -at least temporarily- thanks to a new trade truce, while the Fed cut its target rates as expected last week. Against this backdrop, global equities continued their upward trend last month, unlike the Cagliari Calcio, which remained stuck at 9 points in the lower half of the rankings (but fingers crossed for tonight game against Lazio).

For sure, given the current stretched valuations, the markets are now sanctioning heavily any small disappointments, either in companies results or in the favorable macro backdrop. The hawkish comments from Powell during the press conference, which cast a chill, illustrates indeed the current markets’ overdependence to easing financial conditions, one of the three pillars of the Goldilocks scenario, along with low inflation and positive growth, for which we currently have little or no information…

As the US government shutdown will likely not end before mid-November -at the earliest-, investors as well as the Fed, we will continue to fly blind until next month. Then, if everything goes fine, we will eventually get the November US job report (scheduled on December 5th) and the CPI just in time for the Fed’s meeting later on the same day (December 10th). Unfortunately, nothing is certain because there could be some delays or missing pieces as it takes time to conduct a survey and aggregate the data results.

So, investors will continue trying to guess estimate what will be the Fed’s next move(s), but as Jerome Powell said himself “if you drive in a fog, you slow down”. In this context, financial markets may finally experience some stabilization and calm after hectic months of activity, with the key silver lining conclusions for investors that crashes rarely happen when you drive slow and carefully.

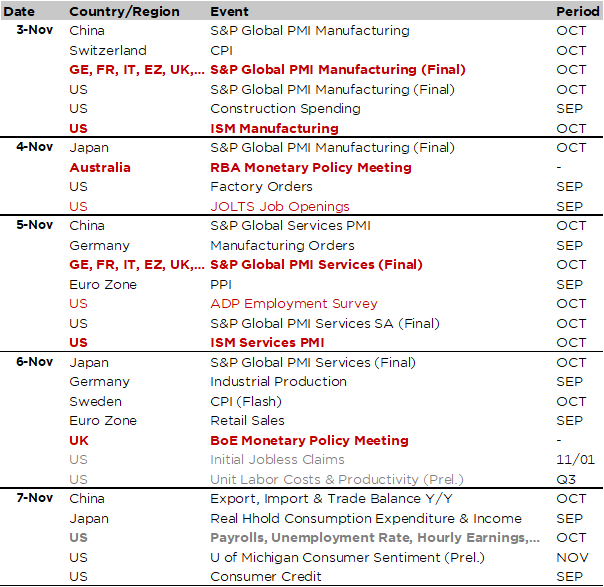

Economic Calendar

Brave investors, who survived Halloween, will continue to find their way through a dimly lit US economy due to the ongoing government shutdown. As a result, they will neither be spooked nor pleasantly surprised by the October job report, which is/was due this Friday. Against this backdrop, the few insights about the labor market, as well as price pressures, will primarily come from surveys such as the October ISM indices (Monday for manufacturing and Wednesday for services), the JOLTS report (Tuesday) or the ADP survey (Wednesday). The consensus expects a slight improvement in both ISM indices and some contained but positive net jobs creation in the private sector despite a small decrease in job openings. Finally, we will also get the preliminary reading of the US consumer sentiment from the University of Michigan on Friday.

Otherwise, central bank meetings and monetary policy decisions will continue to be in focus this week with the RBA on Tuesday and the BoE on Thursday, both expected to stand pat with rates at 3.6% and 4.0% respectively. However, there are some non-negligible odds (circa 30%) to see actually the Bank of England to cut its target rates to 3.75% as the disinflationary process seems to have gained some traction recently, while the fiscal risk is now expected to deflate with the budget decision at the end of the month. As a result, the BoE may decide to front run these developments. The Sweden Riksbank and the Norges Bank will also meet this week. Elsewhere, notable economic indicators due include Swiss October CPI (Monday), Germany industrial orders and production (Wednesday and Thursday) and trade balance figures for China (Friday).

Finally, Q3 earning results will continue to hit your screen as we are now halfway as far the US market is concerned. Among the major ones to publish this week, US tech firms will remain in the spotlight with Palantir, AMD and Qualcomm. We will also get the announcements of McDonalds, Uber, Pfizer, Amgen or Spotify. In Europe, key ones include AstraZeneca, Novo Nordisk and Rheinmetall.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.