As the Cagliari Calcio is still muddling through in the middle of the Italian Serie A standings after its defeat 0-2 against Bologna yesterday, it’s hard to detect any signs of exultation in me as a fan this morning. Considering politics, geopolitics, the state of the world in general, or just the weather conditions for the next few days, is not really helping neither… So, it seems that the only way left to cheer my mood, and therefore yours by ripple-effect, is to look at the financial markets’ trends and performances year-to-date, which have surprised favorably most of us. At least so far, fingers crossed! In this weird context of ongoing disconnect between booming financial markets and bleak socio-politico-economic backdrop, there is a growing debate surrounding legitimate concerns about irrational exuberance filtering into the recent price actions of some assets such as IT stocks (especially those closely related to AI) or gold. Every boom carries indeed the seeds of its own bubble. While I don’t think we are there yet, here are a few survival tips on how to detect financial bubbles and the lessons that could be learned in the current context.

Detecting a financial bubble before it bursts is very difficult. Even the best and most educated often fail, especially on getting out with a good timing. Did you know for example that Sir Isaac Newton lost a fortune in the South Sea Bubble of 1720? Newton initially invested early and made a substantial profit when he sold his shares. However, as the bubble kept inflating and everyone around him seemed to be getting even richer, he got greedy and reinvested near the peak. A clear FOMO (fear of missing out) and mimetic (mis)behavior. When the bubble burst later, he lost a large portion of his fortune, reportedly around £20’000 (or several million pounds today). “I can calculate the motions of heavenly bodies, but not the madness of people” is a famous quote attributed to him afterward as one of the greatest mathematical minds in history was outsmarted by market psychology.

However, there are recurring signals (economic, financial, and psychological) that, when taken together, can already help identify bubble behavior. The best reference on this topic (and the subsequent financial crises that follow) is undeniably the book of Charles P. Kindleberger and Robert Z. Aliber “Manias, Panics and Crashes”, written in 1978 but now in its 8th edition to include new crises and developments like cryptocurrency and the housing bubble in China. So, here are the key and universal conclusions of this book we may basically think about to assess if we are experiencing a bubble and eventually where we are in this process.

The authors’ work relies heavily on Hyman Minsky’s model of financial instability (his theory suggests that during good times, financial institutions and individuals take on more risk, leading to increased debt and a greater vulnerability to shocks), describing a typical crisis pattern:

- Displacement (trigger): a technological, political, or economic change attracts attention (e.g., discovery of gold, innovation, deregulation, etc.). New opportunities are perceived, attracting capital.

- Boom (expansion): credit expands, asset prices rise, optimism prevails. Investors become optimistic.

- Euphoria: prices soar, investors speculate recklessly. Greed replaces rational analysis.

- Crisis: a minor event can shatter confidence, and forced sales begin. Rapid/panic selling of assets, credit crunch.

- Panic: the rush for liquidity, falling prices, and a string of bankruptcies. Investors want to liquidate their positions at any cost.

- Revulsion: confidence slowly returns, and the economy stabilizes.

In this context, credit is the central mechanism as its expansion fuels the speculation, and its sudden withdrawal precipitates the crash. In other words, credit is procyclical, amplifying both the ups and downs. In my views, we are clearly in a boom as far as IT stocks or gold are concerned, but I don’t see or perceive yet any signs of euphoria currently. For sure, there are some red flags and signs of froth such as the last exponential upward leg on gold, which was likely due to inflows on ETFs from retail investors, but again it’s hard to speak about a generalized and contagious euphoria. I haven’t yet observed a collective narrative saying “you’d be crazy not to take advantage of this” as investors, especially institutional ones remain overall cautious and contained in their overall stance. Furthermore, the fact that there are continuous concerns and debates about a bubble is also a healthy development.

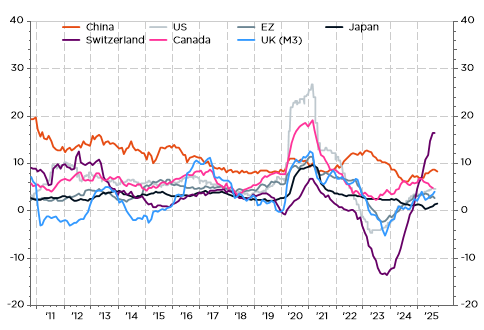

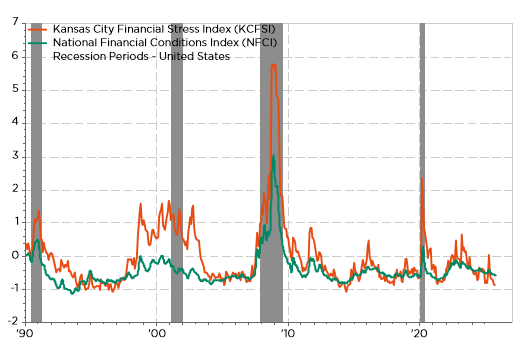

Moving to valuations, they are certainly stretched but the disconnect between prices and fundamentals doesn’t seem so irrational -if there is really one-. In other words, a correction remains entirely possible but certainly not a crash -from the current levels-. Turning to credit and leverage are probably more an issue for some private markets players and some (small) banks but it should be contained and manageable and thus not pose a systemic risk at this stage neither. Finally, a probable and valid explanation behind these bubble price patterns or feelings may be the renewed increase in money supply and the current dovishness of the Fed.

M2 growth: ample liquidity si still flowing into the global financial system

US financial conditions: to easy to be true?

In other words, the US monetary policy may prove too accommodative, therefore fueling some speculative movements on the financial markets. While US and global rates remain obviously much higher than the previous decade, they are perhaps still too low considering the cumulative and underlying systemic risks of currency debasement, inflation and sovereign debt crisis. As interest rates act as the gravitational force on asset prices, an increase in yields (perhaps also through higher credit spreads due to a recession), may be the much-(or rather less)-awaited event to bring their valuations to Earth.

Economic Calendar

Macro data releases will return to the forefront this week, which promises to be eventful, with the China Q3 GDP and the September activity data (retail sales, industrial production & investment), which were due this morning -more on them here below-, the October flash global PMI indices on Friday and the delayed and thus much-awaited September US CPI reading on the same day. The consensus expects a +0.4% month-over-month for the headline and +0.3% for core, which will bring both annual US inflation rates above 3%. Other notable macro data releases include the UK CPI (Wednesday) to see if UK inflation can stabilize (headline and core annual inflation foreseen at 4.0% and 3.7% respectively) after months of trending up on the back of sticky inflation in services (close to 5%), as well as Japan CPI (Friday), which is key for assessing BoJ monetary policy tightening pace. The consensus forecasts an increase of annual Japan inflation rate to 2.9% in September from 2.7% the prior month.

These come amid a host of evolving global developments, including renewed tensions in the US-China relationship & discussions between Trump and Putin about the Ukraine, the US government shutdown, the durability of the Israel-Hamas peace deal, French budget challenging discussions, China’s Plenum -where the 15th 5-Year Plan will be discussed, or Japan’s Prime Minister election (a coalition deal between LDP and the Innovation Party has just been agreed this morning and should thus set the stage for Sanae Takaichi to become Japan’s first female PM), …

Not forgetting the earnings season obviously with several major US companies set to report their Q3 results, potentially driving movements across and/or within equity markets. Among the big tech names, Tesla, Netflix, IBM, Texas Instrument and Intel will unveil their latest quarterly earnings: will they be “good enough” to sustain the enthusiasm surrounding the AI boom or will their guidance somewhat disappoint (and risk reversing some of the recent market optimism)? P&G, GE and Coca-Cola will also feature among the other main highlights in the US; as well as RTX, Lockheed Martin and Northrop Grumman within the defense sector, or SAP and Sanofi in Europe.

Economic data on China Q3 GDP and September activity indicators released this morning didn’t move the needle: China’s economy is still muddling through and holding up amid persistent domestic challenges and external headwinds. Its current growth still relies essentially on exports, which are offsetting an ongoing slowdown in consumption. As a result, China growth remains at risk of slowing further… unless the authorities take much more proactive steps to support consumer demand.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.