•Sustainable exploitation of the maritime environment is key to fight climate change

•Addressing the plastic waste issue will require significant (public and private) funds

•Recycling should be expanded – making for diverse investment opportunities

Those lucky to be enjoying a beach vacation this summer certainly want to swim in pristine waters. But it is not only seaside tourists to whom healthy waters are important. The Blue Economy, a term coined by the UN back in 2012, encompasses all activities related to oceans, seas and coastal areas, thus including also fishing and aquaculture, maritime transport, port activities, offshore energy production… The key objective being that these economic activities become sustainable and socially equitable. Which in turn requires a serious – both public and private – investment effort.

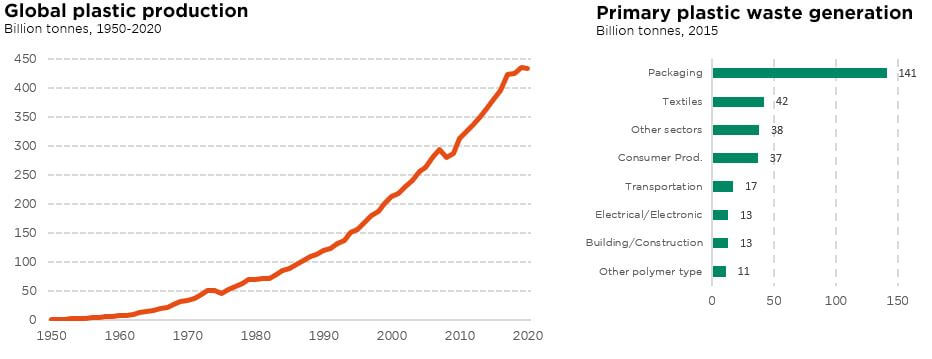

Although the plastic crisis has, by now, been widely acknowledged, some figures still warrant reminding. In the space of seven decades, annual plastic production has been multiplied by a factor of over 250. From 1.5 million metric tonnes in 1950, it grew to over 400 million metric tonnes in 2020, for a cumulative output exceeding 8 billion metric tonnes. Packaging alone accounts for over a third of plastic production. And while very convenient and inexpensive to use, plastic generates a lot of waste, that mostly (70%) ends up in landfills, dumpsites or – even worse – litter in the nature. Once in the environment, plastic remains there for more than 500 years, slowly decomposing into micro components that move quite easily through water and air, with damaging consequences for both humans and animals.

By increasing adoption of single-use plastics, for safety reasons and because of the growth in take-away food, the Covid pandemic unfortunately exacerbated the plastic problem. But many countries have now taken measures, in the form of regulation or financial incentives, to discourage single-use plastics. And a historical breakthrough was achieved earlier this year, on 2 March, when 175 UN member states unanimously resolved to develop by 2024 a global and legally binding framework to “end plastic pollution”.

The 2019-2023 SEA circular project, active in six South-East Asia countries (Asia being, according to recent research, the region from which 81% of plastic enters the oceans), is also worthy of note. It involves cooperation between public, private and academic entities, with the aim – as the name of the project suggests – to address the full plastic lifecycle.

The final stage of this lifecycle is of course sorting and re-use. Disappointingly, the current plastic recycling ratio stands below 10% – and not all types of plastic can even be recycled. Innovation is, however, rampant and the list of products made from plastic waste is growing. Adidas has, for instance, worked with the Parley for the Oceans environmental organisation to develop a running shoe made of upcycled ocean plastic. In the same vein, one can also buy Norton Point sunglasses or G-Star RAW clothing. Discarded fishing nets are, meanwhile, used by Bureo to make skateboards and by Net-works to make carpet tiles. And a company like Unifi recycles plastic into graduation gowns, that 2.2 million students have already proudly worn.

Transitioning towards a bluer economy is a challenge. One that will need policymakers, financial institutions, companies and investors to join forces, and consumers to change their mindset. But one that is vital in winning the ongoing battle against climate change – as well as ensuring a future for the more than 3 billion people who live of the oceans.

Written by Andrea Biscia, Equity Analyst, ESG Analyst

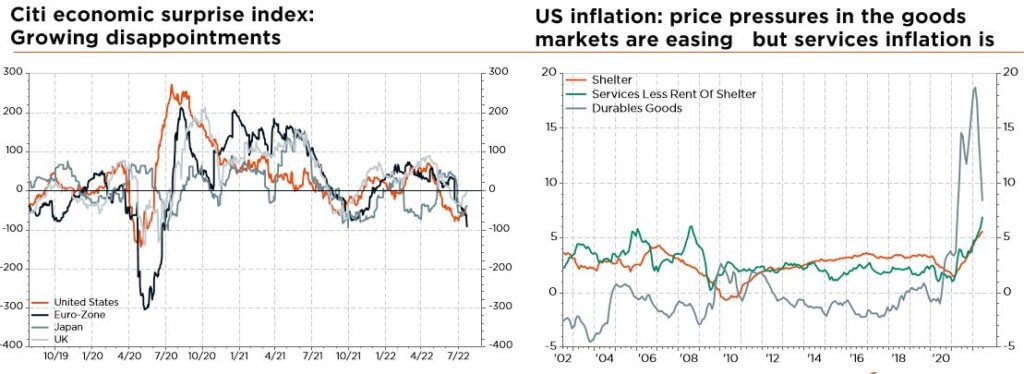

The investor pendulum of worries has begun to swing

It’s getting hot out there! And this explosive cocktail of inflationary pressures, hawkish central banks, deteriorating economic momentum, slowing earnings, political instability and geopolitical tensions is doing little to help cool investors’ minds. Indeed, global equities remain under pressure as inflation rates keep moving up, forcing aggressive monetary tightening, while a recession is now just around the corner (technically, the US economy is already in recession). Just as they are having to deal with the shift from the past decade’s deflationary market backdrop to a new inflationary one, with the surge in real rates taking its toll on long duration asset valuations, investors are now also confronted with the prospect of a recessionary environment, likely to drag down corporate earnings.

Though seemingly adding to one another, new concerns are in fact emerging and gradually replacing those prior. In particular, “bad” news regarding the economic outlook have mostly become “good” news for financial markets, driving a welcome pullback in oil prices alongside declining rates – as investors increasingly expect the major central banks to ease off the gas pedal sooner rather than later. As a result, the pendulum of worries has begun to swing back from extreme inflation fears and hawkish central bank rhetoric to a more “balanced” stance.

These most recent markets trends (i.e. consolidating equities and easing bond yields) may admittedly suggest that the worst is behind, with the war in Ukraine taking a backseat, upcoming corporate downgrades a surprise to no one, bearish investor positioning overall and valuation multiples looking increasingly attractive following the sharp year-to-date de-rating. That said, in the absence of a clear-cut equity market capitulation, mounting Russian gas supply concerns together with the recent political turmoil in Europe (Italy) have only served to further cloud the picture, keeping us on the side-lines for now.

Overall, until we reach greater clarity on the occurrence, timing, duration and severity of the next economic recession, we expect global equity markets to remain bumpy, with factor rotation still driving performance dispersion among regions, sectors, and ultimately stocks. The same goes for bond markets, with rates oscillating between a higher inflation risk premium and mounting recession concerns.

Given the current crammed macro and political agenda, in addition to the ongoing Q2 earnings season, still suggesting many potential surprises ahead, especially in Europe, we retain our near-term prudent – but balanced – approach at the portfolio level. As such, we keep our asset allocation unchanged for now, with a slight underweight of both equities and bonds. Within equities, consistent with a higher risk premium and still limited earnings visibility, we remain sellers of any meaningful “bear market rallies” should they occur. Meanwhile, though maintaining a balanced multi-style all-terrain approach to portfolio construction, we now advocate a slightly more defensive high-quality equity allocation/selection. In fixed income, we have already flagged the more attractive yield investors can now get at the short end of the curve globally, with short-term bonds providing almost the same yield as longer maturities – offering a way to mitigate overall portfolio volatility.

Elsewhere, we stick to our gold overweight, but we are wary of downside risks related an unwarranted spike in real rates should nominal growth collapse. Finally, we now believe that US dollar strength is coming to an end (downgraded to slight underweight last month) as other major central banks, such as the SNB, the BoC or most recently the ECB, are gradually catching up on the Fed’s rate hike agenda, in order to tame record high inflation. In this context, the CHF remains our favourite currency.

Written by Fabrizio Quirighetti, CIO & Head of Multi-Asset