By Quirien Lemey, Co-Lead PM of the DECALIA’s sustainable strategy

January was a strong month across the world but particularly the Nasdaq soared, having its best January since 2001, closing the month up 10.68%. At the time of writing, it’s up nearly 16% YTD and registering its 7th >2% gain on the year. Only a few months ago “tech” and “software” were dirty words at investment tables worldwide, not to be spoken of and definitely not to invest in.

So, what’s going on and are we at the forefront of another tech bull market or is this another bear market rally that will just fade again?

- The release of ChatGPT, an AI chatbot developed by OpenAI, created a buzz in the stock markets, and dozens of companies announced new products using the tech.

- Cloud operators are facing slowdowns, but flexibility is the reason why these cloud businesses have grown so fast and so big in the first place.

- Growth is also slowing for software companies, but many software companies have more than compensated by increasing margins.

- With valuations back at more normal levels, estimates that have been cut and expectations dimmed , we argue tech has got its investable status back.

What’s going on?

First, undoubtedly, the broad-based rally last month has been driven by renewed optimism about the global economic outlook. With signs that inflation has peaked in the U.S. and abroad, there are hopes that this week the Federal Reserve will slow its pace of interest-rate increases yet again (or at least not accelerate). China’s lifting of Covid-19 restrictions pleasantly surprised markets as well (see our macro comments “After the Great Reset”). Second, we rarely have seen negative sentiment on tech so bad as in the last couple of months. To the point that investors were no longer interested in hearing anything about tech (this is a big green flag), which was reflected in the bad performance seen in December of many tech stocks. Third, not just big tech but dozens of software companies have reacted with hiring slowdowns and restructuring efforts. The number of “rule of 40 companies” (revenue growth + operating margin, a popular metric for software investors) have increased this year compared to last year (more on that below).

The combo of a more resilient top line environment, swift FCF protection measures and the Fed seemingly also playing ball is making underinvested growth investors chase the FOMO trade. Consequently, we have also seen a fair amount of short covering. Finally, parts of tech were helped by a new buzzword “generative AI” …

Are we at the start of an AI (Artificial Intelligence) revolution?

The release of ChatGPT, a chatbot developed by OpenAI and launched in November 2022, unleashed an AI mania on stock markets, with companies like Nvidia up over 50%, or even BigBearAI +700% ytd. Dozens of companies have either announced competing solutions or new products using ChatGPT’s tech.

We would start by saying Artificial Intelligence has been around for many years, and the number of companies claiming to use AI in their products today are countless. However, ChatGPT is the first mass market consumer product that allows individuals worldwide to see and experience the power and possibilities of AI for themselves and this has created a renewed buzz around AI.

But, yes, we do believe AI is the next revolution, but it started years ago and adoption may accelerate due to the launch of ChatGPT. That said, the adoption will probably be more gradual than what is implied by the current frenzy on stock markets. Mass adoption will likely be dependent on specific product releases with a clear target audience (e.g. Dramatron by Google, an interactive co-authorship script writing tool which leverages large language models).

But the possibilities are endless, and we believe AI can increase productivity of existing workers significantly, and this cross sector, from designers to code writers to lawyers.

Investing in this trend is less obvious. Microsoft partly owns OpenAI and will integrate chatGPT in their products. After more than a decade losing out on search, Microsoft will wage a new war against Alphabet in an effort to gain high margin search business.

But we wouldn’t count out Alphabet, which owns massive datasets and have been investing in AI for a longer time than OpenAI. There’s a saying that AI is only as good as the data it was trained on. Moreover, Google search has become a life necessity for many of us and we think the vast majority of searches will still be done on Google. More problematic for Google is that including more and more AI to compete with ChatGPT might be margin dilutive as those type of searches can be several times more expensive than a traditional search (as you use more compute power).

We have refrained from investing in unprofitable companies like BigBear.ai and C3.ai. However, we have been invested in Nvidia for a long time for one reason and one reason only, Artificial Intelligence. Training and using these AI models is best done through GPUs and we believe Nvidia is probably the company with the most immediate and clear benefit of the current and future investments in AI. How much precisely and how fast is impossible to know but we do believe this is a multi-year tailwind. Marvell Tech is another company we think stands to benefit from increased datacenter spend.

The million-dollar question: Did Tech get its mojo back or will the rally fade?

First, making general comments about tech is typically done by strategists and generalists but most of the time makes little sense as tech is a very diverse market with different drivers and valuations for software, semiconductors and other subsectors. But often when they speak of tech, they refer to big tech, FANG or FAAMG. And the argument goes that the reign of big tech is over due to law of large numbers and regulatory crackdown. Again, speaking about big tech makes very little sense as every company has its own drivers and these are completely different businesses! Facebook got hammered by Tiktok and their massive capex bet on VR/AR, Amazon overbuilt logistics during Covid, etc. But yes, regulation is a headwind as the free reign of these giant companies is over but that itself is not a reason for these companies not to perform from here.

We’ve been in the business long enough to know that the law of large numbers was an argument used against Apple when it was a 300bn market cap… We are positive on some of them and negative on others, based on fundamentals, and that is reflected in our ownership.

If there is one common driver and business unit, then it is the cloud business of AWS (Amazon), Azure (Microsoft) and GCP (Alphabet). And just like any other business they have seen a slowdown as customers are optimizing their cloud spend.

People forget that flexibility is the reason why these cloud businesses have grown so fast and so big. As Amazon CEO Jassy mentioned on the earnings call: “when it turns out you have a lot more demand than you anticipated, you can seamlessly scale up. But if it turns out that you don’t need as much demand as you had, you can give it back to us and stop paying for it”.

This optimizing might take a few quarters and obviously growth is slowing down, but there no doubt in our minds that these businesses are nowhere near maturity (e.g., Jassy estimated that 90-95% of global IT spend is still ‘on prem’) and money can be made on the back of these over-pessimistic views (e.g., Amazon’s EV/Ebitda ratio today is lower than during the 2008-2009 recession). Moreover, strategists are still keen on privileging value stocks and putting Tech into the growth bucket, which is not only backward looking, but also a rigid view of things and prone to errors.

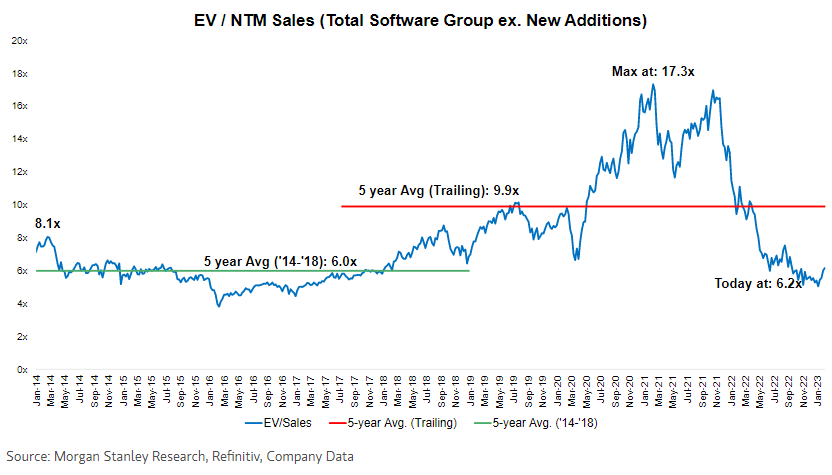

Second, software is the largest component of the technology sector and was one of the worst performers last year. Truth be told, we were caught off guard when software saw a massive derating and in hindsight it is very clear a valuation reset was long overdue, especially with the higher rate dynamic. However, valuations have become very reasonable in our opinion. As can be seen below we are now trading at pre-Covid average valuations, so not considering the frothy valuations of the last 3 years. Moreover, we would argue that these are better companies than pre-Covid, with on average more recurrent revenues and higher margins.

Moreover, as mentioned above, almost every software company has reacted with a slowdown in hiring and restructuring efforts. The number of “Rule of 40 companies” have increased this year compared to last year (e.g., Morgan Stanley estimated the Rule of 40 scores for the large cap cohort have increased to 46% at the median vs 43% last year). The rule of 40 is used because it balances growth and profitability. The best software companies are the ones who grow fast but can do it in a profitable way.

So yes, growth is slowing down, also for software companies, but on average software companies have more than compensated by increasing margins. A software feature that is common but hardly seen in other markets are the high gross margin (70-90%) and the possibility to scale operating margins very quickly and to very high levels (although the latter is still fairly untested in the subscription software world as most of them are still in growth mode). This potential is also the reason why we have seen activists stepping in, with Salesforce the prime example (Dan Loeb’s hedge fund Third Point, Elliott Management and Value Act among others have taken a stake in the company).

So not only do we argue that there is valuation support today, we believe the negative sentiment has reached the status of ridiculousness in some cases.

For instance, just looking at consensus Bloomberg numbers; a defensive company like Nestlé has a ’24 FCF/EV yield of 3.4% versus Datadog 2.6% but Nestlé is growing FCF by 33% over the ’21-’24 period whereas for Datadog this is 266%. At this pace, we don’t need to look more than 2 years out for this company to become cheaper than Nestlé on an FCF basis. And this for one of the best profitable growth stories in software. Yes, just like AWS and Azure, this is a consumption software business and thus slowing down, and there is high competition, but just last quarter this business was still growing over 60%, and quite profitable (over 20% FCF margins), even considering stock-based compensation. Palo alto Networks, a cybersecurity company, a large >20% grower, seen as one of the more defensive cybersecurity companies, with FCF margins > 30%, has a ’24 FCF/EV yield closer to 6%. And these are just a few examples, but the point is, in our opinion, just as when stock market overshot on the upside during Covid, we are now undershooting on the downside and opportunities can be found. Overweight profitable, secular growth software companies is one of our key convictions.

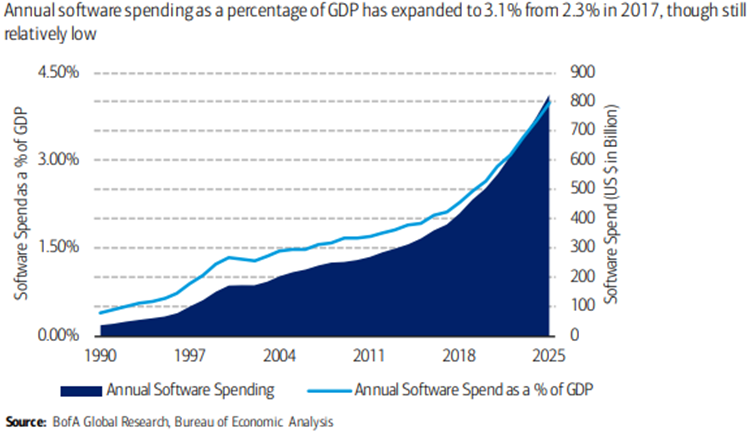

Equally there is lots of skepticism about the rate of ‘digestion’ of IT Spending across the industry. Let’s be very clear, software might have lost its mojo on the stock market for a while, but it never did in the real world (see picture below). Software is becoming increasingly important for ANY business worldwide and this will not change, to the contrary.

Also, do we get a second half recovery later this year and how fast? We all know it is notoriously hard to time the market and that’s no less the case within semiconductors.

Hence, we focus on companies that are driven by secular trends like the move towards silicon carbide and electric vehicles in auto, the structural need for more datacenter spend as data and things like Artificial Intelligence proliferate.

So, did “tech” get its mojo back? That will in large part depend on the performance of the largest constituents and more importantly, and unfortunately, of what will happen with the global economy and rates. But with valuations back at more normal levels, estimates that have been cut and expectations dimmed, we feel much more comfortable. We are not arguing for a big rally in tech stocks from here on, but we would be surprised if we go to lower lows (ex-major macro slowdown). We just argue tech has got its investable status back.

Cloud & Digitalisation is one of the seven main themes of the DECALIA sustainable strategy that will shape our future society.

Five sub-topics (such as hydrogen, solar, insulation, circular economy and silicon carbide) have been developed in publications in the DECALIA Ecology series.

Another theme will be developed in 2023 called DECALIA Wellness series.