- Chronic undersupply of new builds has accelerated the ageing of the US housing stock

- Older homes lag in energy and health standards – requiring expensive upgrades

- A boon for building products distributors, a rapidly consolidating industry

The US housing market, despite the current administration’s recent efforts to revive it, is experiencing a period of stagnation caused by persistent macroeconomic trends, such as a rapidly ageing stock of homes and a chronic undersupply of new builds. The building products distribution segment, however, looks worthy of investor interest – following compound annual growth of 7% over the past 5 years, it now represents a USD 800 billion market across North America and Europe.

Interest rates are of course a key variable for housing. In the US, the steep increase in the 30-year fixed mortgage rate coming out of the pandemic, from ca. 3% in early 2022 to over 7% in late 2023, had a dampening effect on affordability and demand, as well as – somewhat paradoxically – on supply. This is because many owners found themselves locked into low-rate mortgages, thus unable to sell their house and relocate. With the US Federal Reserve having finally embarked on its rate-cutting cycle, not only should borrowing costs trend down, but home equity lines of credit could pick up meaningfully – providing financing for big ticket projects.

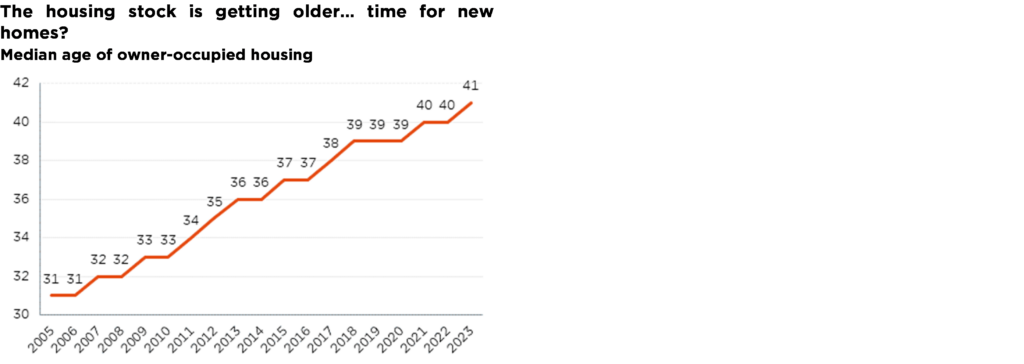

And indeed, such renovations are becoming increasingly necessary, with the median age of US owner-occupied houses now standing at 41 years. The slower pace of new building since the subprime crisis has been a key factor in accelerating this ageing: back in 2007, the median home age was 32. Older homes lag in energy efficiency, resilience and health standards, thus drive a disproportionate share of remodelling spending. They notably require costly upgrades to roofing, insulation and HVAC (heating, ventilation and air-conditioning).

Interestingly, for such projects, homeowners are exhibiting a greater inclination to turn to professionals. Put differently, “do it yourself” (DYI) is giving way to “do it for me”. This trend pertains in part to demographics: older owners tend to outsource physical work, while the younger generation lacks the space, tools and skills for DIY. The increasing complexity of renovations, with tech-driven and structural upgrades requiring certified experts, is also a factor. Lastly, as work from home patterns subside relative to the Covid period, time available for DIY is shrinking, making the speed and convenience provided by professionals ever more valuable.

The last pillar of the investment thesis for building product companies lies in the potential for consolidation. Since 2015, half of the top 10 players have merged or been acquired. Yet, the industry remains extremely fragmented, totalling over 7,000 firms. In the coming years, we expect M&A deals to continue, with large distributors progressively taking share from regional actors.

Home Depot figures among these prominent consolidators. A historical leader in home improvement retail, where it boasts a 16% share (nearly double that of its immediate rival, Lowe’s), it is rapidly growing exposure to professional customers – to whom it offers an attractive ecosystem, ranging from deep assortment and preferred pricing, to tool and equipment rental or trade credit. We have little doubt that its ability to generate cash and access to debt will serve to fund attractive M&A operations in the future, further strengthening its market share, supply chain, pricing power and stock valuation.

As a satellite play, we would highlight QXO, the building products distribution platform founded in 2024 by Brad Jacobs, a serial dealmaker with a unique track record. His ambition with QXO were made clear from the onset: build revenues of USD 50 billion, leveraging aggressive M&A. The equity raised to this effect, amongst the largest ever in the industrial space, started to be put to use in early 2025 already, with the acquisition of Beacon Roofing Supply.

All told, and despite a subdued housing cycle, structural support factors and consolidation dynamics suggest that building products distributors remain well positioned to deliver durable growth and attractive shareholder returns.

Gian-Luca Grassini, Portfolio Manager

May the goldilocks force remain with us

- Fast & Furious”: the year got off to a flying start, with plenty of moving parts

- Market trends have remained our friends overall despite the noise, fury and volatility

- Conditions still smell of Goldilocks but mind the tail risks – on both sides

2026 began much like 2025: with noise, fury, many moving parts… and, so far, positive market performances. Just one month into the year, a lot has already happened. On the geopolitical front, Venezuela, Iran and Greenland have of course been a focus, alongside President Trump’s speech at the WEF in Davos. In national politics, the Fed’s independence continues to be challenged, the US government may face a shutdown over ICE shootings, the Japanese parliament has been dissolved and France is seeing new budget developments. Economic news include several key US data releases, while financial markets have seen the kick-off of the Q4 earnings season, a spike in gold and silver prices, roaring equity indices (especially outside the US), massive sector/style rotations, new record lows for the USD, and long rate volatility in Japan. I suspect we all desperately need some serenity, but I fear it will not come soon.

That said, markets continue to benefit from a supportive backdrop – confirmed by the latest US economic data, as well as the first earnings releases. Global growth is resilient, disinflation continues and monetary conditions are gradually easing. Within equities, the AI theme remains omnipresent, of course, shaping key narratives that are now also broadening outside of the US or tech sector. Issues related to fiscal trajectories and overall (geo)politics are having a growing impact on the bond market (causing volatility), on commodities (pushing up the safety price of gold) and on currencies (making the USD a collateral victim of Trump policies).

What can be expected for the coming months? Overall, our macro outlook remains favourable for risky assets. We expect robust economic growth across all major regions, with perhaps even a slight strengthening amid fading tariff tailwinds, a positive fiscal impulse and easy financial conditions. Inflation is expected to fall back to central bank targets in the latter part of 2026, which will enable them to complete their normalisation of monetary policy. Finally, we also believe the AI boom is providing additional and broadening tailwinds, not only through capex or energy-infrastructure spending, but also increasing adoption going forward. In this context, we still assign a low probability to a “natural” recession scenario.

Among the downside risks that are bound to arise unexpectedly along the way are those related to interest rate pressures (persistent inflation, concerns about the sustainability of fiscal trajectories, currency debasement consequences) or, conversely, a sharp slowdown in economic activity and the labour market in particular. Markets could also crash for an “unknown unknown” reason – if not a major geopolitical event. In such an unusual context, portfolio resilience and managers’ ability to adapt will certainly be more important than usual, in order to navigate these unchartered waters as smoothly as possible.

As a result, we remain broadly neutral and in wait-and-see mode at the portfolio level, still constructively invested but cautiously diversified and balanced. This positioning reflects a prudent approach given the overall stretched valuations, high level of geopolitical uncertainty and wide range of potential tail-risk outcomes. It should help portfolios deliver better risk-adjusted returns by smoothing inevitable market bumps and sector rotations, while maintaining enough flexibility to adapt as conditions evolve.

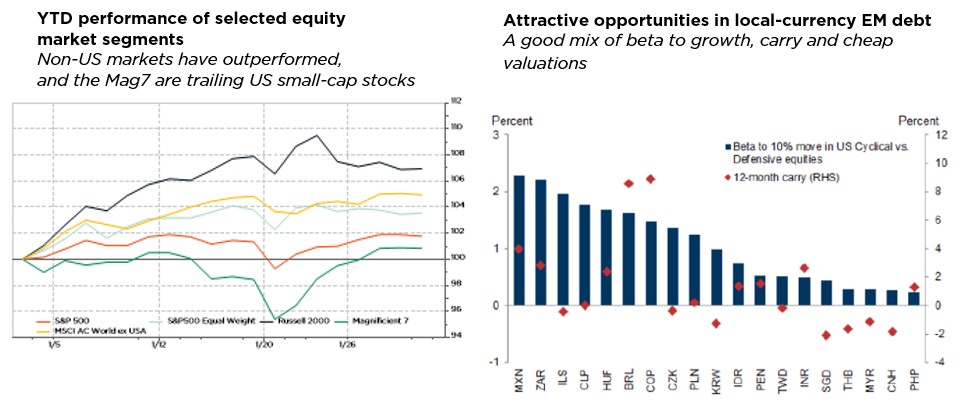

Regarding bond exposure, carry tends to matter more than duration when assessing opportunities nowadays. Selectivity remains key, with targeted appeal in credit and EM debt. For sure, long-term govies can still play an important diversifying role in adverse scenarios such as a recession or a financial crisis. By contrast, taking excessive credit risk offers limited upside and does not fit well into a balanced portfolio construction. Given this backdrop, we are warming up on local currency EM debt, which stands to benefit from the current combination of positive global growth, lower rates and USD, AI potential – mainly for Asia – and rising commodity prices – for the other regions. All the while offering the best relative opportunities in terms of carry, beta to growth and valuations. Considering its better risk-adjusted returns than HY, in our view, we thus upgraded our stance on local currency EM debt from underweight to slight underweight.

Fabrizio Quirighetti, CIO & Head of Multi-Asset

External sources include: LSEG Datastream, Bloomberg, FactSet, Goldman Sachs, American Community Survey (ACS) of Census Bureau.