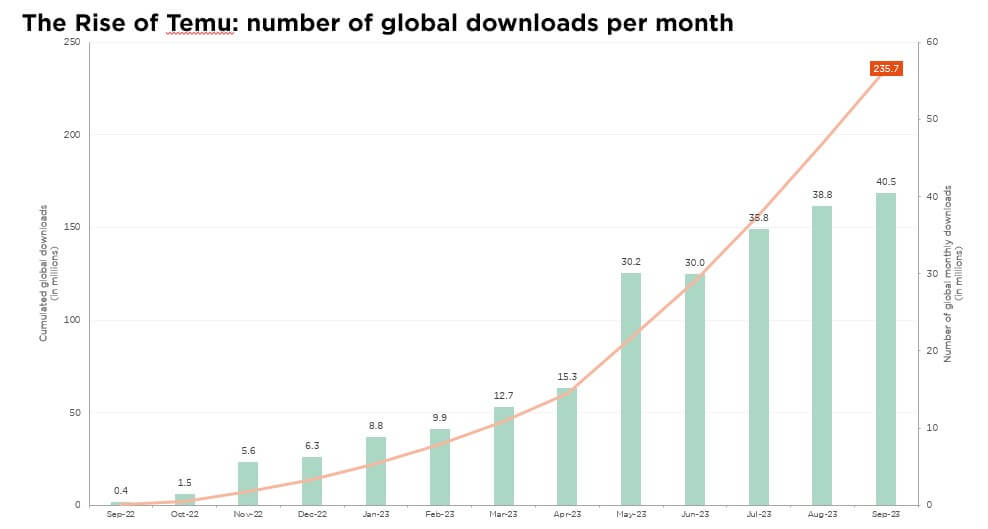

- In just over a year, e-commerce newcomer Temu has garnered a massive user base

- Cheap products shipped from China and exempt from US tariffs: appealing to consumers…

- … but a business model that raises a number of regulatory and environmental concerns

The holiday season has come and gone, with its usual shopping frenzy. What has long been known as “Black Friday” probably warrants renaming into “Red Friday” though. Indeed, e-commerce took on a decidedly cross-border tone this Christmas, with Chinese platforms disrupting the market and testing the limits of US tariff laws. Which in turn could rekindle fears of a trade war and certainly raises sustainability issues.

Since its US launch just 16 months ago, with massive advertising and a catching “shop like a billionaire” tagline, Temu has expanded into 47 countries and now boasts 120 million active users globally. Owned by Chinese online retailer Pinduoduo, Temu is a pioneer of the “fully-entrusted” e-commerce business model, which sits between the standard first-party model (whereby a platform sells products directly) and the third-party model (whereby a platform serves as a marketplace for retailers to do their own selling). In effect, merchants set up shop on the Temu platform, but their sole responsibility lies in shipping products from their factories to Temu’s China-located warehouses. All the rest (product selection, pricing decisions, logistics, after-sales services…) is out of their hands.

From a customer perspective, this makes for ultra-cheap selling prices – alongside generally free shipping, delivery assurance and a 90-day return period. As such, one might think that Temu caters mainly to low-income households. Yet recent Morgan Stanley research reveals that 31% of Temu’s US shoppers fall in the USD 50-100,000 income bracket and 14% earn more than USD 100,000 per annum. Traditional e-commerce players such as Etsy, Farfetch, Stitch Fix or eBay are thus being displaced, and even discount retailer Dollar General, with its 19,400 stores across the US, could come under pressure. Amazon should be able to resist better, thanks to the high barriers it has established over the years in terms of delivery time and product mix. That said, we note that it has modified its price searching algorithm (which checks whether the products sold on Amazon are competitively priced vs. rival platforms), to protect the already thin margins in the e-commerce segment. Indeed, Temu is loss-making, which is feasible due to the high profitability of the Pinduoduo platform in China (pure marketplace model).

Not surprisingly, the US Congress has already voiced concerns regarding the practices of Temu and its fast-fashion peer Shein. As per the “de minimis” provision of the US Tariff Act, international packages shipped to US consumers are not subjected to tariffs if the value of their content is under USD 800. By some estimates, Temu and Shein are currently sending 600,000 such packages to the US per day! Beyond exploiting a tax loophole to gain an unfair advantage over domestic retailers, US lawmakers have stressed that this allows the two platforms to limit the data provided to US customs.

Importantly, we must also address the environmental implications. These business models often encourage consumption of inexpensive goods, many of which are not essential. This leads to extensive long-distance shipping, culminating in substantial waste. However, it is not entirely fair to place the burden solely on these emerging platforms. One of e-commerce’s key challenges lies in the prevalent free return policies. As reported by CNBC, US returns reached a staggering USD 761 billion in 2021, of which a significant portion (ca. one-third) were discarded rather than reused or recycled. Potential solutions could involve making these business models more circular or, alternatively, converting returned products into a lucrative liquidation market : a whole different topic for a future edition of our monthly Investment Insights…

Written by Gian-Luca Grassini, Junior Portfolio Manager

Let us ride the great disinflation wave!

- Dovish Fed Christmas carols on the back of a broadening disinflation trend

- A similar – but better – global scenario thanks to inflation/rates normalisation

- Bottom-line: be invested as It’s The Most Wonderful Time of The Year

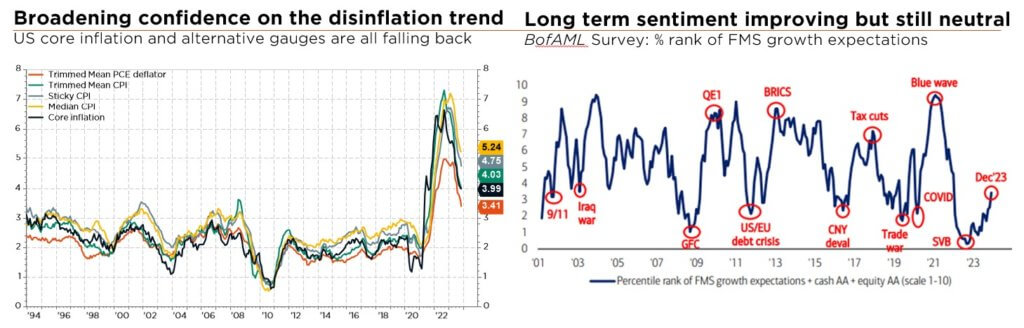

While a soft-landing scenario was already the consensus, thanks to both market-friendly economic data (resilient growth, solid US consumption, broadening disinflation) and geopolitical concerns taking a backseat, the Fed provided investors with an unexpected Christmas gift in the form an ultra-dovish last speech of the year. Calling for a more front-loaded pivot, this prompted lower bond yields and easier financial conditions.

In this context, our base case macro scenario has further improved. It foresees a soft landing with slower but still positive growth and sticky but acceptable inflation (falling to central bank target levels faster than previously expected) – implying more “relaxed” monetary policies as central banks can now envisage the normalisation of interest rates. Risks obviously remain on both the growth and inflation fronts, although the rapid drop in inflation markedly reduces the odds of a policy mistake/market accident.

In the meantime, most technical signals undeniably turned bullish in recent weeks, as investors eagerly resumed their equity purchases. The latest readings are, however, still far from stretched and there is upside to equity portfolio allocation (currently near its neutral historical average), even after the recent re-risking move. Furthermore, looking beneath the surface of seemingly expensive global, and especially AI-powered US, equity indices still reveals attractive pockets of value. The recent sharp pullback in bond yields and a more upbeat earnings outlook warrant an equity re-rating, lending support to current lower risk premia. The strong advocates of a 2023 earnings recession were in fact proved wrong: recent solid corporate results again spoke for themselves despite a well-flagged slowdown and easing pricing tailwinds, with expectations of a supportive 10% rebound in 2024 now clearly achievable in our view.

In fixed income, the Fast & Furious relief rally in rates and tightening of credit spreads has erased most under-valued opportunities. In the current context, we view bonds as fairly valued across the board and recommend an overall neutral/benchmarked positioning, our preference for cash having been dashed by the soon to come central banks rate cuts. In any event, we still recommend selectivity within HY/EM, staying away from most fragile segments or issuers.

With inflation now rapidly falling back to central bank targets, the hedging/decorrelation purpose of commodities stands to diminish, especially in a slower global growth context. Conversely, gold may benefit from lower real rates and a somewhat weaker greenback, alongside some structural tailwinds (US fiscal trajectory, constrained supply, de-dollarisation and FX reserves diversification).

Having already upgraded our equity stance last month, we thus now adopt an even more positive view going into 2024. The undeniably more supportive recent macro backdrop, thanks to broadening disinflation, combined with improved near-term visibility on fundamentals, argues in favour of an extended window of opportunity for equities. In light of the current low equity volatility levels, and following the recent market rally, we would, however, also consider “cheap” tactical protections on a selective basis.

In fixed income, we upgrade our stance from slight underweight to neutral, while also lifting our duration target to benchmark level (5-7 years). That said, we now have less of a preference for UST duration (from overweight to slight overweight), favouring a more balanced positioning as the bar for ECB rate cuts (and lower yields overall) is probably not as high (weaker eurozone growth, inflation falling more rapidly and debt sustainability issues) as in the US.

Finally, we are cutting commodity exposure to underweight for the above-mentioned reasons, while keeping a slightly overweight stance on gold.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

External sources include: Refinitiv Datastream, Bloomberg, FactSet, BofAML Survey, Statista

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.