One of the most interesting aspects of the markets since the start of the year has been that investors have been caught completely off-guard. Your scribe included. Actually, it has been completely upside down compared to the consensus expectations and positioning that prevailed in January: underweight in equities, long China on re-opening narrative, negative techno-long energy, assuming an ongoing positive correlation between bonds and equities, betting on a Fed pivot in the second half, while no one expected a banking crisis of course, which would ultimately (or at least so far) prove less severe than feared. And the list may go on further… only to be proved either materially or completely wrong at this point of the year. As we are looking and preparing for the back-to-school season, which is just around the corner, here are my thoughts and a few ideas about what could happen next. I hope they may help you to frame your own macro backdrop or eventually take the opposite side of the trade in a contrarian mode… that I have paid off well so far this year.

So, what to expect on markets until the end of the year? Not much could be the short answer. With a latent downside asymmetry for risks assets to be somewhat more incisive. Here is why…

Recession concerns have been dissipated, disinflation process is ongoing, DM policy rates are at or closed to peak (they have become again data dependent) and the Fed’s imminent has been removed. Think about it and you will realize that markets have now adjusted to this goldilocks-lite backdrop compared to the beginning of the year. Note that it’s a goldilocks-lite environment because inflation has fallen without a recession, while we usually speak about goldilocks when you have satisfactory growth that is not triggering inflationary pressures. Somewhat upside down. Anyway, what could justify further gains for risk assets over the next few months: stronger (or stable) growth from here with stable (or lower) inflation will certainly be the most favourable scenario but also likely the one with the lowest probability. It’s indeed hard to imagine growth accelerating from here, without some upside risks on inflation and/or on rates. Similarly, inflation won’t decline much further without an accident on growth. Last but not least, equity and credit current valuations don’t offer much room for error, risk appetite has grown since May as investors have priced in this more favourable context and cash has thus been largely redeployed. A perfect recipe for a new twist, don’t you think?

In terms of more pragmatic views on positioning or convictions, here are some of my thoughts in bullet points:

- Neutral equity with a well-balanced and diversified all-terrain positioning given the still wide range of potential outcomes. Cover your back with some still-relatively-cheap protection (put-spread). Favour carry with high-dividends low volatility stocks. Beware of stocks vulnerable to a backup in yields or a recession.

- Not yet brave enough to go overweight China because it could go worse before it goes better and it may prove challenging for the government to restore confidence and break the current vicious circle, but I would keep a neutral exposure to EM equity as either valuations remain cheap (China) or benefit from favorable tailwinds (resilient growth, no inflation issues, easing monetary policy, near-shoring structural trend, high commodity prices).

- As we speak about EM assets, I prefer local currency debt (in a supportive soft-landing backdrop with US rates and USD not moving higher and even softening somewhat) than hard currency (for valuations purposes – too expensive compared to IG credit according to me… except China property developers obviously).

- IG 1-5y credit should still represent the bulk of a fixed income portfolio. Like for equity, it still makes sense to favor carry over rates and credit spread directionality until we get more clarity. Here too, avoid the most fragile issuers, who are by definition more vulnerable to a shock on rates, spreads or growth (which thus means favor active vs. passive management for credit related investments).

- US 10y rates are now fair-valued. Time to add to duration in balanced portfolio with 10y rates above 4% but don’t expect a rates’ rally soon (except if you believe in a severe recession leading to deflation risks). And don’t rely solely on this bonds duration exposure to hedge your equity risks absent a sharp slowdown in economic activity. So, it’s still in a context of a balanced portfolio “risk-adjusted carry” that you may add to long bonds (staying anyway slightly underweight given the more appealing cash returns in addition with a certain absence of volatility and uncorrelated pattern with other assets).

- TIPS are worth a look too for those who are more optimistic about growth prospects in the near term and/or believe that inflation will remain structurally above 2% in the future. In other words, it’s time to lock in some real rates as they are close to the high.

- Japan is likely the last big macro trade with more YCC tweaks coming and eventually a potential hike by year-end, a rebound of the JPY at some point and an equity markets that may continue to outperform in the meantime. Its assets bring decorrelation features in balanced portfolios. Japanese banks, high yielding equities or restructuring stories may do the trick.

- Keep an eye and an exposure to commodity -gold included- as a macro call about higher prices on demand-supply structural mismatch, which could also work well if inflation concerns re-emerge, or geopolitical tensions increase, or economic policies seem too loose (gold will likely shine). Or temperatures are too cold this winter. Have also look at US oil reserves and US shale gas production… In other words, it also brings some valuable decorrelation/hedging characteristics.

The list may go on further but I want to keep some ideas for my next letters, or I may develop some here above depending on the events, and finally I also realize that I only risk to lose your attention or add confusion in your mind, which has already been shaken upside down by Lord Markets mysterious ways…. So, to conclude, here are the Diana Ross “Upside Down” song lyrics, slightly adapted by your humble funky servitor. Or for those who prefer the original ones interpreted by the magnificent Miss Ross, here is the link.

Upside down

Markets, you turn me

Inside out

And round and round

I know FANMG got growth and cash appeal

They always play the field

I’m crazy to think they are mine

As long as the goldilocks continues to shine

There’s a place in my portfolio for them

That’s the bottom line

Upside down

Markets, you turn me

Inside out

And round and round

Instinctively you give to me

The performances that I need

I cherish the bull markets with you

Respectfully I say to thee

I’m aware that you’re expensive

But no one makes me feel like you do

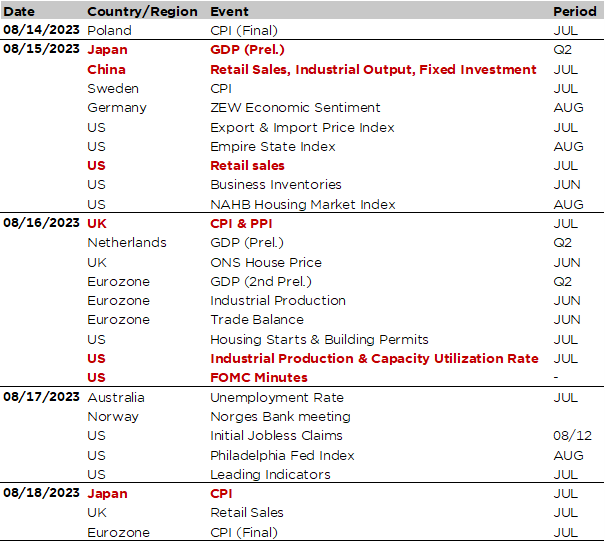

Economic Calendar

No big macro event this week but still plenty major economic data released to keep an eye on. Starting with Asia for once, investors will focus tomorrow morning on Chinese economic activity indicators for July (industrial production, retail sales and fixed investments), especially given last week’s disappointing trade data, negative annual inflation print and ongoing woes in real estate sector that raised both eyebrows about growing deflation risks and expectations of a subsequent stimulus. Will there be a turning point? May it get even worse before it gets better? The jury is still out especially given the Chinese government may play a Joker card at any time. Staying in Asia, we will also get Japan preliminary Q2 GDP (tomorrow) as well as the July CPI (on Friday). Growth is expected to have remained solid and above potential (2.9% a.r. expected after 2.7% in Q1), while the inflation reading will be scrutinized to gauge if there are some signs of stickiness and potential pass-through for the BoJ, following its recent YCC tweak (NB: there will be another CPI release before the next BOJ meeting on September 22nd).

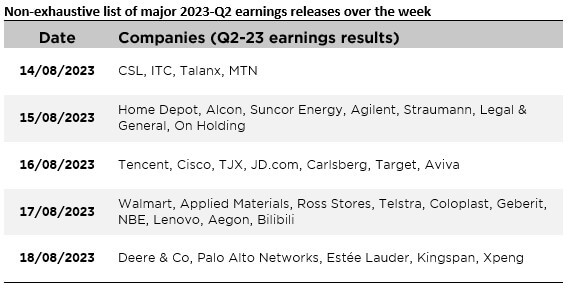

Moving to the US, July retail sales (tomorrow), July industrial production (Wednesday) and latest FOMC minutes (also on Wednesday) will be the key releases this week. Investors will look for confirmation about the soft landing and peak rates narratives. Another insight about the strength or resilience of the US consumer will come from the earnings results of Walmart, Home Depot, Target or TJX, which will thus also be closely watched. Last but not the least, with the releases of both Empire mfg and Philadelphia Fed indices for August, we will have a first estimate of the US ISM manufacturing print for this month (released on Sep 1st).

Over in Europe, all eyes will be on UK July inflation on Wednesday for another potential upside or downside surprise … especially after the stronger than expected Q2 GDP preliminary reading released last week. Prior to that, we will get German ZEW economic sentiment tomorrow and then industrial production and trade balance for June in the Euro Area (Wednesday).

To conclude, Q2 earnings season is coming to an end now. Apart from the US retailers mentioned above, investors will keep an eye on the few large cap names yet to report, including Cisco, Applied Materials or Deere in the US and some Chinese emblematic names including Tencent, JD.com, Lenovo or Bilibili.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.