Compelling opportunities in a high-demand asset class

Written by Patrick Emborg – Analyst and Andrea Biscia, CFA – Principal DECALIA Private Markets Investment Team

- The entertainment industry effectively blends arts with economic value

- Entertainment thrives in both prosperity and adversity

- Streaming platforms have transformed the paradigms of the film industry

- Traditional banks often overlook the $15-20 billion independent film niche

- Sports, especially the “Big 4 Leagues”, boast steady decade-long growth

- A resilient business, enhancing portfolio diversification for investors

Entertainment: in Constant Demand

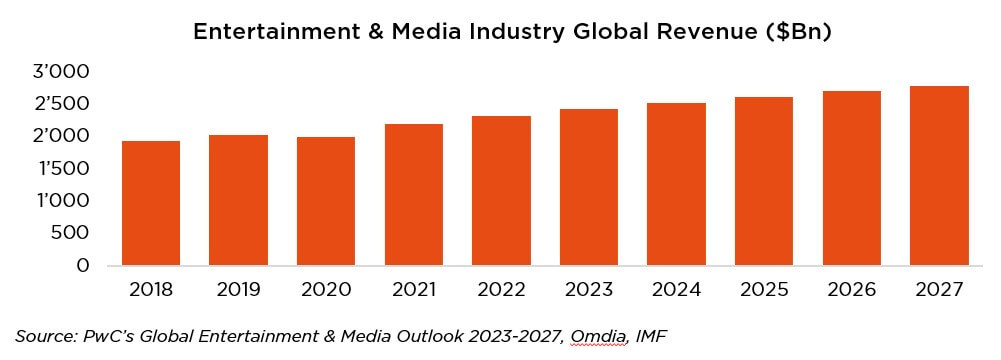

The entertainment industry, in its broadest sense, can be defined as a provider of enjoyment and diversion to millions worldwide, effectively blending arts with economic value. It is a highly competitive and ever-evolving field, rich with investment opportunities that span movies, TV, sports, music and video games. Movies and sports, in particular, stand tall as key pillars of this industry. These two sectors do more than entertain: they carry cultural significance and hold substantial economic weight, drawing continuous investor interest.

Whether times are prosperous or challenging, the desire for entertainment remains a constant.

At its core, the movie sector, with its blend of arts and commerce, acts as a mirror to our realities and fantasies. In fact, the global film industry proved remarkably resilient to the pandemic, amassing box office revenues that exceeded $21 billion in 2021. A rebound that is indicative of an undiminished global desire for movies and shared experiences, even as consumption models shift towards streaming platforms.

Running parallel to the cinematic giants are the coliseums of modern-day gladiators – sports.

This field goes beyond just physical competitions, having become key venues from an identity and community perspective, as well as significant economic events. PwC’s Sports Outlook puts the sports industry’s value at a staggering $471 billion for 2021, a figure that encompasses not only the games themselves but the entire ecosystem, from media rights and merchandising to e-sports and digital engagement platforms. The sports world has successfully adapted to the digital age, engaging fans in new ways and expanding beyond the usual stadium experience.

As they keep up with new technology and changes in what people want, both the movie and sports industries face their own set of opportunities and challenges. Investing in these industries means understanding more than just how to make money. It is also about keeping up with consumer trends, technological change, as well as rules and regulations. For those working in finance, it is crucial to blend the creative aspect of these industries with a smart investment strategy, and to consider environmental, social and governance (ESG) factors. This is key to continued growth and responsible involvement in the entertainment business.

Film Production: Quality before Quantity

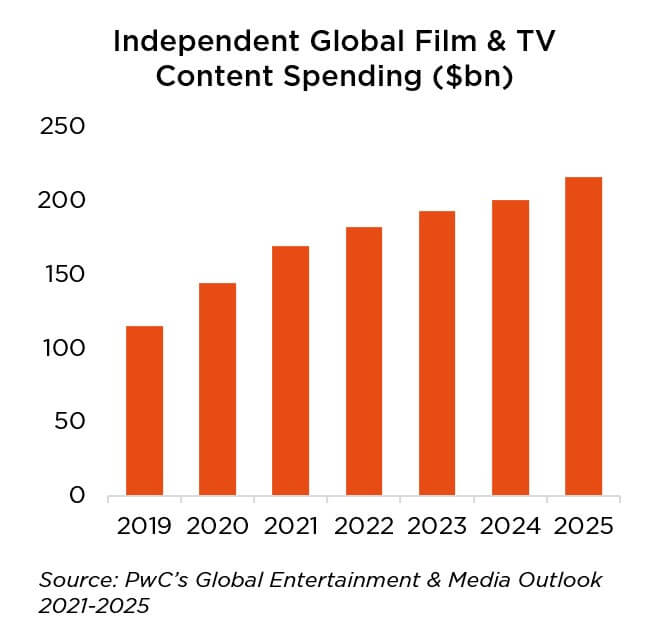

The film production industry has enjoyed substantial growth in recent years, a trend that surged with the advent of streaming services. Such platforms, notably giants like Disney, Netflix and Amazon, have heralded a new era for the film industry, a shift further amplified by the Covid-related lockdowns. The Motion Picture Association reports that in 2021, the global film market surged past its 2019 pre-pandemic levels, reaching a staggering $320 billion. Much credit for this boom goes to the meteoric rise of digital services, which skyrocketed from ca. $40 billion in 2019 to an impressive $70 billion in 2021

With the expansion of the market has come heightened competition, especially among streaming services striving to attract more subscribers. Currently, the key to success lies in the calibre of the content, leading film producers to actively seek financial backing for high-quality projects. What makes this sector’s growth particularly remarkable is its lack of correlation to the broader financial markets.

Notable within this landscape is the independent film niche, valued between $15-20 billion and still largely overlooked by conventional banking institutions. Given the market’s relatively small size and the diverse financing needs of individual film projects, banks find it challenging to provide tailor-made solutions.

Film producers often turn to governmental grants and subsidies from local, state or EU bodies as their initial financing sources. These funds not only support the arts and culture, but also bring economic benefits to the regions or countries involved. Nevertheless, for smaller entities, turning to private market solutions often proves more advantageous. Private equity investments are a common route, with investors being rewarded once all lenders have been paid off. During a film’s production stage, there is an opportunity for senior debt financing, anchored on the anticipated revenues from distributors.

The current state of the market is also shaped by the aftermath of a recent actor strike in the US, which has had a limited impact.

All told, the film production industry continues to flourish, fuelled by the rise of streaming platforms and changing viewer preferences. Its ability to adapt and grow, despite global challenges and changes in the market, underscores its dynamic and vibrant nature.

The ongoing evolution of the film industry ensures its place as a key part of the entertainment world.

Sports Industry: an Uncorrelated Thriving Strategy

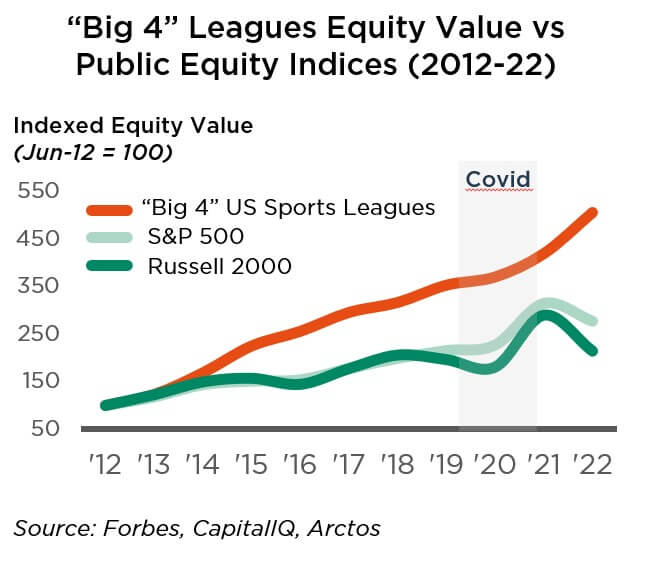

Over the past decade, the sports industry has experienced substantial growth, with franchise valuations increasing consistently year after year. A trend that has proved particularly pronounced in the US “Big 4 Leagues” (NFL, NBA, NHL, MLB), whose returns have even outpaced traditional financial markets. The figure below shows a cumulative annual growth rate (CAGR) of 18% for the “Big 4 Leagues” since 2012, markedly above that of both the S&P 500 and Russell 2000 indices over the same period (11% and 8% respectively). This highlights the growth trends backing investments in sports and the high return potential on offer – something that appears increasingly difficult to find in conventional markets at this point in time.

In fact, this has started to be reflected in portfolio allocations, with an increasing number of investors seemingly recognising the opportunity that the sports industry presents. The fact that sports leagues are tending to expand ownership opportunities, now making them accessible to investors beyond the ultra-high-net-worth segment and pension funds, has also played its part.

And it is not just its level that makes the aforementioned performance impressive, but also its stability. While the S&P 500 and Russell 2000 experienced volatility rates of 17% and 22% over the past 10 years, sports leagues maintained a much steadier course with a volatility rate of only 8%. This stability has been particularly evident in recent years, with sports franchise valuations growing despite COVID and then 2022 proving to be the worst year for equity markets since the GFC.

This brings forth an important point: the low correlation that sports franchises and related ventures often demonstrate versus traditional financial markets, providing a valuable hedge against market volatility. Sports investments may therefore also serve as an effective means for investors to add a layer of resilience to their portfolios.

Among other factors, part of this resilience stems from the structural stability of many of these franchise organisations. US leagues are generally highly regulated, with agreements that limit wage spends and impose salary caps. This provides a form of cost predictability that helps franchises deal with changing market conditions. At the same time, the adoption of digital streaming services has served to evolve the landscape of sports consumption and monetisation. It has opened up new revenue streams, and broadened the audience base and fan engagement.

Not only do these adjustments future proof the asset class, but they also serve as a reminder that, like it or not, sports are likely here to stay.

Andrea Biscia joined DECALIA in 2019 as a buyside equity analyst for DECALIA’s public equity programme and moved to the private markets team in 2023, where he is a principal for the DPCS programme. Andrea holds a Master’s Degree in Finance from HEC Lausanne and he is a CFA Charterholder. Moreover, Andrea completed the Executive Programme In Sustainable Finance at University of Oxford.

Patrick Emborg joined DECALIA in 2023, where he works as an analyst for the DPCS programme. Patrick holds a Master’s Degree in Finance and a Bachelor’s degree in International Business Administration from the Rotterdam School of Management.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.