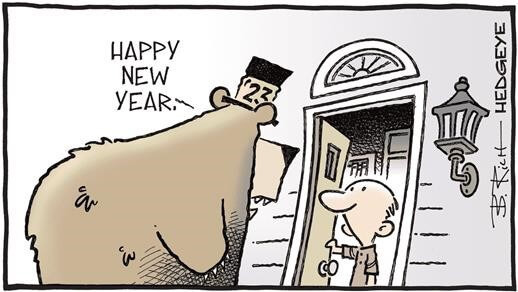

The calm before the storm

Markets have gone nowhere over the last few days, with equity indices, long rates and major forex crosses experiencing contained daily variations and an overall sideways trading after a strong start of the year for both equity and bond investors. That’s certainly a symptom of a lack of conviction among them about what comes next […]