By Alexander Roose, Head of Equities and co-lead PM of the DECALIA Sustainable strategy

Despite the market surge in the last 3 months of 2023 and the consensual view of a soft landing, we are confident that 2024 will provide upside for equity markets.

Read Alexander’s thoughts about:

•A broader participation to market performance expected in 2024

•Little correlation between market valuation and 1 yr forward equity performance

•Quality small & mid cap companies to stage a comeback

•(Multi) thematic approach to remain key to capitalize on long term secular trends

•Well positioned for the AI revolution, increasing focus on destocking victims & the ecology thematic

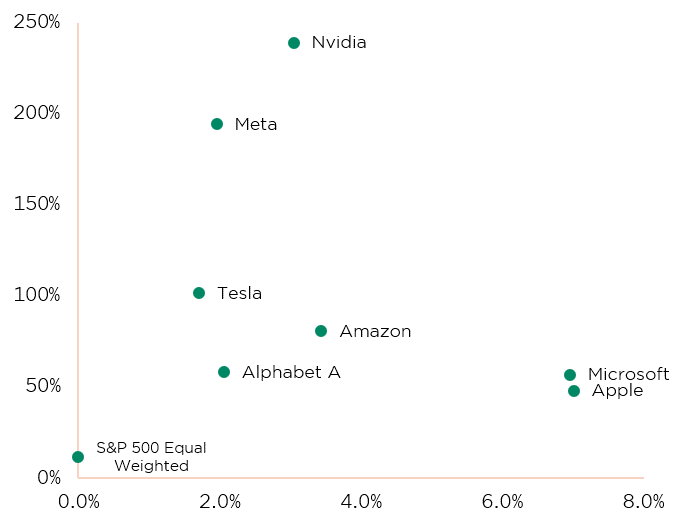

Vintage 2023 will go down in history books as a year with a remarkable narrow breadth in US equity performance, as the now famous club of the ‘magnificent 7’ skyrocketed, to a large extent driven by the emergence of generative AI (see graph below). With a changing interest rate rhetoric among prominent central banks’ members, a small reprieve of this polarized performance occurred during the last 2 months of 2023 (with noteworthy performance in small & midcaps), and we expect a broader participation to market performance over the course of 2024. This view has not been validated yet, as January has started by more of the same: significant underperformance of the median S&P500 member versus the overall S&P500 index as these 7 heavyweights (with Tesla notably falling behind) cumulatively represent 30% of the bellwether index. Already in 2023, the median stock return vs the S&P was a sizeable negative 16% for 2023 (and approaching -20% with January 2024 included), something not seen yet in this millennium.

Significant outperformance of the magnificent 7

Weight in the S&P 500 Index

Source: Baird, DECALIA, 29 Dec 2023

Although market sentiment is not as moribund as the same time last year given the now-better understood root causes of the US macro-economic resiliency – in the face of the biggest hiking cycle since the 70’s – general equity positioning among strategists is at best neutral. The consensual view among these macro pundits can be summarized as follows:

- TARA: There is A Reasonable Alternative to equities, namely bonds or cash and this will represent a significant headwind for further equity performance.

- VALUATION: the average p/e level of US indices Is not attractive, with a notable mention for US big tech heavyweights, after a stellar performance in 2023.

- MACRO context: after being wrong-footed about the macro resiliency in 2023, most market participants take a soft-landing or mild recession as a base case but envisage a subpar aggregate earnings backdrop.

As an overarching rule, we refrain from drowning ourselves into a pessimistic carousel, taking more the ‘glass-half-full approach’ especially if the consensual view is lukewarm toward equities. Moreover, as already noted in our last years’ outlook piece, macro developments are by nature erratic and thus making predictions about them are prone with errors. As a consequence, top-down considerations in an equity investment framework should certainly not be solely

based on macro, quite to the contrary. We believe that a well-established(multi) thematic investment process is key and acts as a beacon to capitalize on long term secular trends.

Except for 2022, when the rate upheaval caused a massive valuation reset in quality-tilted stocks (see last year’s article: ‘what after the Great Reset?’), adhering to these tenets have served us well over the long term and as well in 2023 (validated by the outperformance of our multi-thematic expertise despite being on aggregate slightly underweight the magnificent 7). We are confident that this will continue to be the case into this new calendar year!

Before dwelling on how we are positioned with our multi-thematic expertise for 2024 (and beyond), let us first tackle the above-mentioned thorny issues that concern market participants:

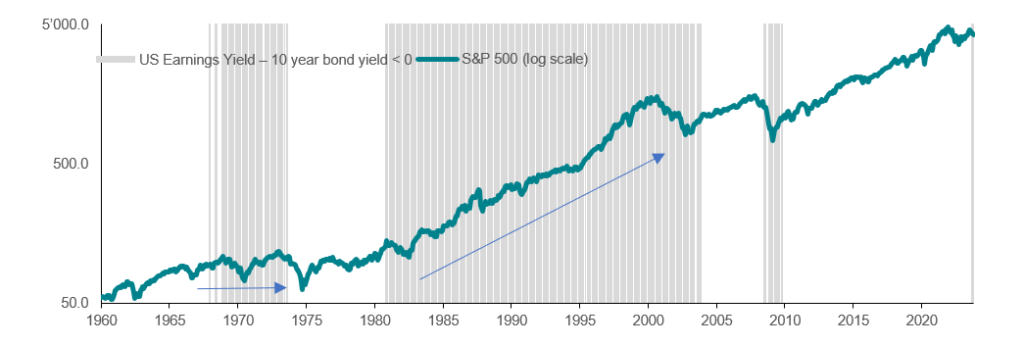

•TARA: in order for this thesis to hold any relevance, we simply went back in history to see if effectively equites perform poorly when their earnings yield is at or below bond/cash yields. Quite the contrary, as one of the longest equity bull-runs in the last millennium was marked by the same TARA phenomenon (see graph below). We’d even argue that there are some striking similarities, especially comparing the period from the mid-90’s to the current market context: above 5% Fed rates after a torrid hiking cycle, worries about the sustainability of a soft-landing, relatively high trailing p/e levels for US markets and the emergence of a technology revolution (worldwide web vs generative AI nowadays) trickling down into a productivity surge, helping inflation to be contained. Without going too much at lengths, history has shown as well that equities tend to perform handsomely whenever inflation starts falling and rates worries are put to bed (playbook for 2024 in our view).

History shows that higher bond yields are not a headwind for equities to perform

Source: BNP Exane, DECALIA, Nov 2023

- VALUATION: Conventional wisdom among market pundits tends to over-simplify the valuation debate by:

- almost solely looking at p/e ratios

- use it as precursor for future equity performance and

- avoiding quality business models such as some of the magnificent 7 cohort, due to static elevated p/e levels. One of the outcomes of this latter mistake, is a structural underweight position in the US markets, which is in our view like betting against the casino.

This narrow valuation framework has caused many to ‘miss the boat’ in 2023, with a high likelihood of a repetition in 2024.

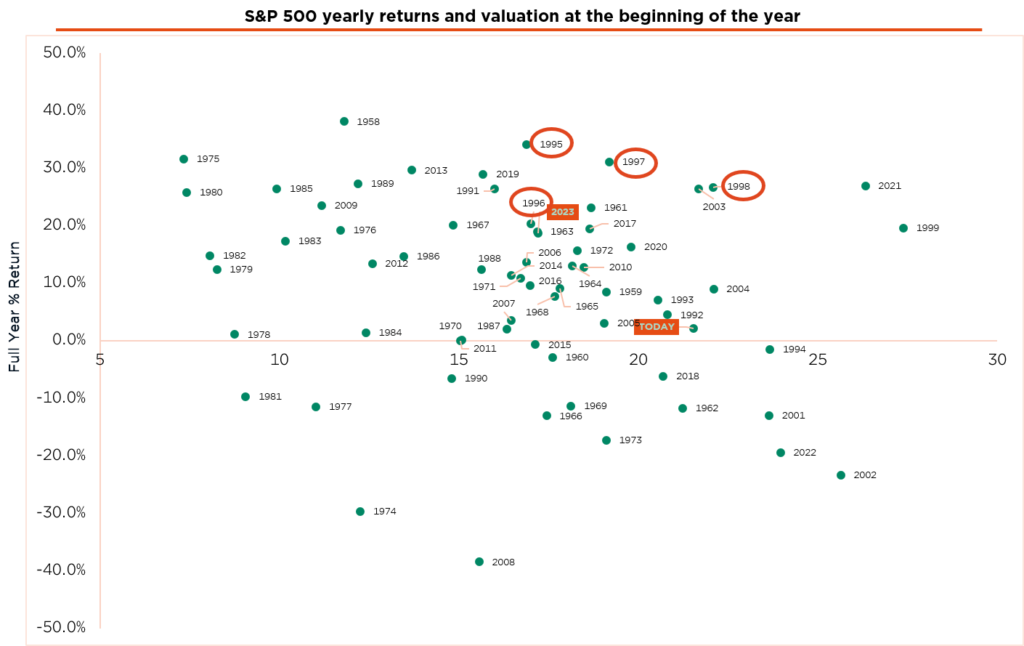

Although valuation discipline is important in an investment process, we are no fans of a p/e framework as it often underestimates the inherent free cash flow profile, especially for quality business models (most notably but not limited to software companies). As a matter of fact, numerous stock convictions of ours exhibit attractive FCF yields (on par or above market average), but show relatively high p/e levels. On top, we’d rather first understand how a company generates and grows its free cash flow, before putting it on the dump yard, based on p/e-based valuation levels. On point 2, if effectively, p/e levels are a harbinger for future equity performance, then again history is inconclusive, quite to the contrary. The below chart depicts p/e levels at the beginning of a calendar and equity performance 12 months later, for the S&P500 index and this since 1957.

Two conclusions can be drawn from this graph:

- there is little to no correlation between trailing p/e levels and 1-yr forward performance, clearly the upper right quadrant would not be so densely populated if that were to be the case.

- as already mentioned, the period from the mid-90’s was also characterized by high p/e levels but that did not curtail its performance potential, with obviously the caveat that in 1999, there was a blow-up phase based on unsustainable high valuation levels and not self-sustaining (i.e. based on free cash flow generation) business models. Although trading at higher p/e levels, our conviction is that the cohort of AI beneficiaries will ‘grow into their valuation levels’ (just like Nvdia did in 2023), based on superior top-line and underestimated margin progression (given superior pricing power and retention of AI-driven productivity gains). Contrary to the mid-90’s, these businesses have significant moats and generate tons of free cash flows.

- MACRO: 2023 was characterized by a vigorous macro-economic environment, especially in the US but a lackluster earnings development. The equal weight S&P500 has effectively seen its earnings recession and we expect a better earnings development in this calendar year, based on an ending de-stocking cycle in some subsectors (e.g. companies in the life science tools, chemicals or ingredients space), margin progression on subsiding cost increases (and for some, AI-induced productivity gains) and a vibrant consumer backdrop (given a positive income-cost gap and full employment). Quality small & mid cap companies should stage a comeback as the soft-landing scenario materializes, central banks finally start lowering rates, in which case, earnings of smaller companies have in the past demonstrated to rebound much stronger than larger cap peers. Worth pointing out as well, that on aggregate, FCF yields for quality small & mid cap companies are high in a historic context.

In conclusion, we definitely expect to see a broader equity participation in 2024, which should benefit the balanced & diversified approach we have applied consistently over the many years for our multi-thematic expertise. The key tenets of the positioning of the multi-thematic expertise can be best summarized as follows:

Focus on the structural 7 themes defined by the acronym SOCIETY (Security, O²&Ecology, Cloud & Digitalization, Industry 5.0, Elder & Wellbeing, TechMed and Young Generation), whatever the macro scenario.

1.Focus on innovative companies, as innovation is often the ground cause for quality business models

2.Well positioned for the AI revolution, in a balanced way

3.Selective overweight position in small and midcaps, source of significant alpha generation in the past Increasing focus on destocking victims and companies in the Ecology thematic.

P/E (Adjusted Trailing 12mo) at Start of the Year

Source: Bloomberg, DECALIA, 24 Jan 2024

Despite the market surge in the last 3 months and the consensual view of a soft landing, we are confident that 2024 will provide upside for equity markets on the back of tangible signs of disinflation (helped further by AI-driven productivity gains), affordable valuation levels (especially but not only limited to the small & midcap space), accommodative central banks and prospects for solid earnings growth in 2024, contrary to 2023. Although markets participants remain mesmerized by interest rates and when central banks will start the rate cutting cycle, we are of the opinion that in 24, it will be a fruitful environment for stock-picking as the tightening cycle has come to an end (and it is more back to fundamentals). Besides, these top-down interest rate or macro considerations are of less importance for longer tern equity returns.

Indeed, we remain convinced of investing through the seven themes regrouped by the acronym SOCIETY as a good ‘framework’ to outperform markets over a reasonable time period. Our conviction is strengthened by an aggregate FCF yield of the portfolio close to the MSCI World, while being investing in better quality companies.

Alexander Roose, Head of Equities and co-lead PM of the DECALIA Sustainable strategy

Quirien Lemey, co-lead PM of the DECALIA Sustainable strategy

About DECALIA Sustainable strategy

- a multi-thematic global equity strategy, investing in innovative sectors and disruptive companies shaping our SOCIETY in the future

- invests in the 7 themes (Security, O2 & Ecology, Cloud & Digitalisation, Industrial 5.0, Elder & Well being, Tech Med, Young Generation) regrouped by the acronym SOCIETY

- managed by an experienced team: Alexander Roose (ex-CIO of the Fundamental Equity of Degroof Petercam AM) & Quirien Lemey (ex-Lead PM of a Multi-thematic fund at Degroof Petercam AM)

Copyright © 2024 by DECALIA SA. All rights reserved. This report may not be displayed, reproduced, distributed, transmitted, or used to create derivative works in any form, in whole or in portion, by any means, without written permission from DECALIA SA.

This material is intended for informational purposes only and should not be construed as an offer or solicitation for the purchase or sale of any financial instrument, or as a contractual document. The information provided herein is not intended to constitute legal, tax, or accounting advice and may not be suitable for all investors. The market valuations, terms, and calculations contained herein are estimates only and are subject to change without notice. The information provided is believed to be reliable; however DECALIA SA does not guarantee its completeness or accuracy. Past performance is not an indication of future results.