Happy New Year and best wishes for a healthy and prosperous 2024!

I suspect that experiencing a quiet but positive year, with Cagliari Calcio remaining in Serie A as far as I am concerned, will already do most of the trick. As we start a new year, I have thus polished my crystal ball in order to make 10 predictions that could shape financial markets and portfolio returns in 2024. Some may be considered as general macro themes, a few could be provocative, many of them won’t happen, while others may seem either consensual or crazy but I still consider worth to keep them in mind.

So, there aren’t really “surprises” but more educated guesses, which are sometimes linked or bind together to lead to a consistent scenario. In other words, the risks and rewards associated to these potential “surprises” are not independent of each other. Here are the first five. The remaining half will follow next week.

- Global growth will prove again more resilient than expected, but, contrary to last year, the main positive surprises won’t come from the US but from other main economies such as Europe, Japan and EM economies (excluding China, see below). Europe will benefit from a “revival” in consumer spending (historically low unemployment rate, real disposable income growth in positive territory, still untapped excess savings accumulated during the pandemic), lower energy prices, end of de-stocking in the manufacturing sector and a rebound in exports on the back of better economic prospects from their trade partners. Moving to Japan, it will continue to benefit from easier financial conditions (negative real rates and a weak JPY) even if the BoJ may symbolically end its ZIRP (Zero Interest Rate Policy) as soon as the end of this month, as well as a revival of animal spirits on the back of the ongoing TSE reforms, a return of positive rates and, above all, the end of deflation. Finally, EM economies outside China start are sitting on a rather healthy situation as illustrated by the lack of major “accident” despite +525bps hike by the Fed and an overall strong USD: EM governments refrained from borrowing too heavily during the pandemic, central banks were more orthodox than their DM peers (they avoided QE and raised rates quickly when inflation returned), they are commodity-rich, they offer near-shoring alternatives to China. In other words, they have more rooms of maneuver in terms of budget and monetary policies, while the link with China has been somewhat broken (i.e. less China-dependent than in the past).

- The main economic disappointment will come again from China this year as it falls into a deflation scenario, similar to what Japan has experienced over the last decades. Despite the ongoing stimulus gesticulations of the Chinese authorities trying to revive demand through either monetary, budget or fiscal policies, structural headwinds (demographics, excess housing inventories, no more large infrastructure needs, already high level of debt at the country level) and lack of confidence/animal spirits will render them useless and ineffective. Moreover, China policies are somewhat constrained by the resilience of the US economy, which goes to pair with a relatively strong USD, as a significative-enough CNY devaluation is out of question (Xi doesn’t want to lose face and the Chinese currency/assets will likely lose again some relative appeal for international investors). As a result, any potential cyclical recovery will quickly hit a ceiling of lower potential growth with Chinese growth returning to a now “new normal” much weaker track. Not to mention that the world fragmentation, and especially trade tensions with the US, aren’t helping its economic prospects.

- US and EU annual inflation rates won’t fall back below central banks’ targets by year-end. Even if inflation will likely continue to trend down, the easy part of the great disinflation experienced over the last six months is now behind us. With still tight labor market and an overall resilient global economy, a more fragmented world leading to trade frictions, under-investment in key commodities production, namely metals and energy in a still challenging energy transition era, the inflation rate will quickly hit a floor not-too-far, but still above, major DM central banks targets (2% for the vast majority of them). That will be especially true if some of them start easing monetary policy “too soon” reviving (further) animal spirits, economic growth and weakening indirectly somewhat their currency.

- The Fed will commit a policy mistake. Let me be clear: it has no other choices! Either it will cut as soon as expected (in March or by the end of April) with the risks of pouring oil on the still firing economic growth and booming financial markets, or it will have to wait until it is fully convinced that inflation risks are really under control, which will ultimately prove unfortunately too late. Anyway, ECB will certainly not move before the Fed, especially if activity data start to surprise on the upside (see above), and is clearly in the same situation, if not worse with the odds of a policy mistake even higher than those of the Fed. Finally, the SNB may be the first major central banks to cut rates on the back of low inflation (below target) and a too strong CHF, but they will proceed just a few days/weeks they are 100% sure that a Fed’s rate cut is coming

- In this context, long rates won’t fall much further with 10 bond’s yields in the US, Germany, Japan & Switzerland ending the year respectively close or above 4%, 2.5%, 1% & 1% respectively. The only way to experience a major decline in long rates this year will be in a scenario of global recession, which could obviously happen, especially if central banks refrain from easing (rate cut of hair cuts?). Otherwise, monetary policy easing/normalization will impede long rates to fall much further as it will support economic growth and potentially offer a “floor” to inflation risks. In other words, rate curve will steepen (i.e. becoming flatter from a currently inverted situation).

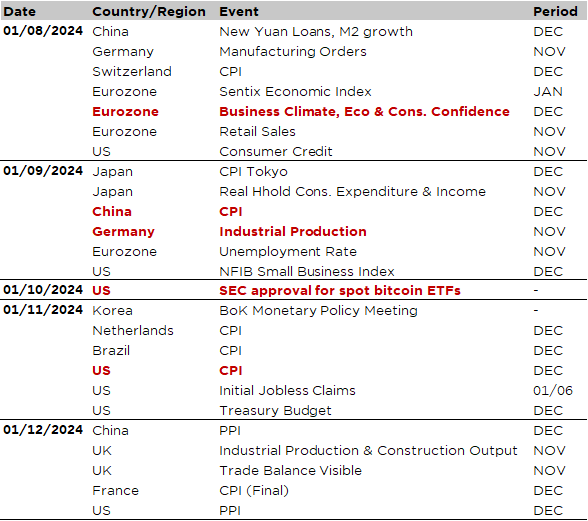

Economic Calendar

As a result, both bond and equity market started the year on the wrong foot as expectations of a Fed rate cut as soon as in March have receded recently. This air pocket may be considered healthy given the overbought conditions/stretched positioning after the strong rally they both experienced since the end of October as they were ridden on a fast and furious way (i.e. perhaps too quickly and too confident) the broadening disinflation wave in tandem. Anyway, the recent price actions confirm they remain both positively correlated (positive real rates, inflation > 2%, no recession in sight) with rates in the driving seat. In this context, the US inflation report for December on Thursday will be the key release this week as investors continue to assess & reassess the likelihood and timing of monetary policy easing. The consensus expects headline and core CPI to advance by +0.2% and +0.3% MoM respectively (+3.2% and +3.8% YoY vs. +3.1% and +4.0% the prior month). Lower/higher (read friendly/unfriendly) prints should thus lead to positive/negative reactions on markets. Other notable data releases in the US include consumer credit (today), the US NFIB Small Business Index (tomorrow), weekly jobless claims (Thursday) and the PPI report (Friday).

Outside the US, other economic data to keep an eye on this week include the China CPI (Tuesday) as it continues to flirt with outright “core” deflation, and several economic activity indicators in Germany (factory orders today and industrial production tomorrow) on top of European sentiment indicators this morning.

Note also that the results from several big US banks will kick off the earnings season with the reports of JPM, Citi, BofA and Wells Fargo on Friday. Finally, that’s an important week also for the crypto-currencies aficionados as the SEC (US regulator) is expected to give its greenlight to ETFs that hold bitcoin directly. Actually, it has until this Wednesday (Jan. 10) to rule on one planned spot bitcoin ETF in particular: the fund proposed by Ark Invest and 21Shares (they were the first to re-submit an application for such a fund) but analysts expect the regulator could rule on the Ark-21Shares ETF as well as others ETFs proposed by BlackRock, Fidelity, Invesco, etc. at the same time in order to prevent giving any one spot bitcoin ETF issuer a first-mover advantage. Fingers crossed for the crypto-lovers.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.