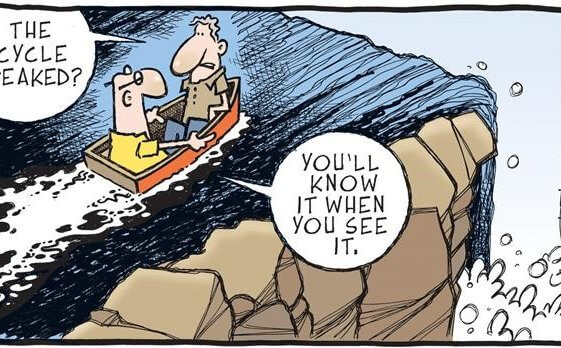

Let’s speak about another peak

For the last few months, investors have been focused essentially on peak inflation and peak terminal rates, but little attention has been devoted to peak cycle since last summer as the soft landing and even the no-landing scenarios were almost taken for granted. However, the latest events, namely the collapse of SVB (and 2 other […]