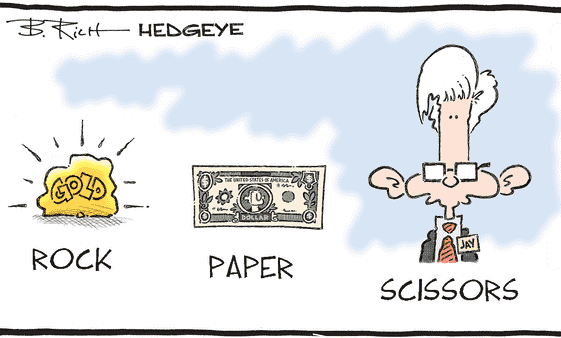

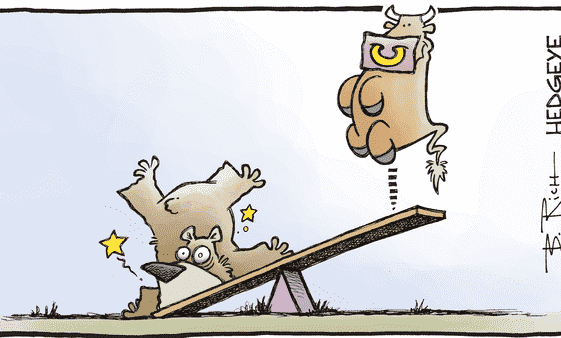

Scary movie(s)

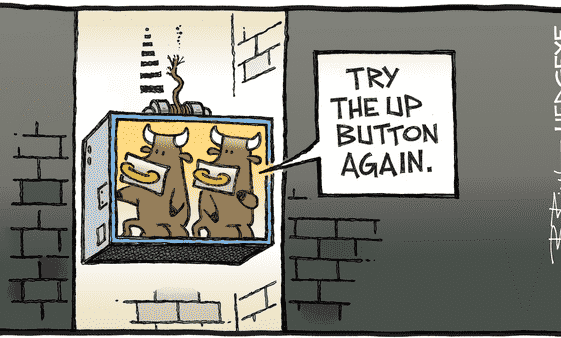

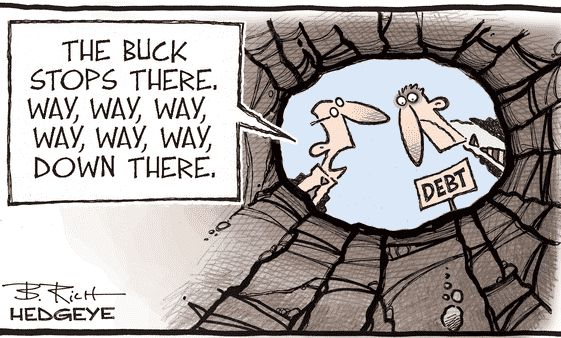

Last week, I asked somewhat ironically “what could go wrong?”, while being fully aware of the many risks and challenges ahead of us. As a result, Cagliari Calcio lost miserably on Friday against Udinese… In the same time, we are entering into November this week through the Halloween backdoor, while investors have already had many […]