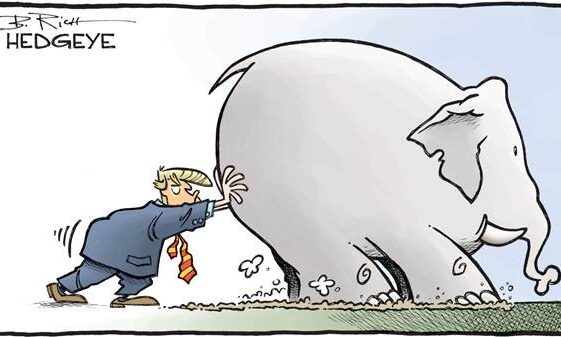

Challenging the status quo

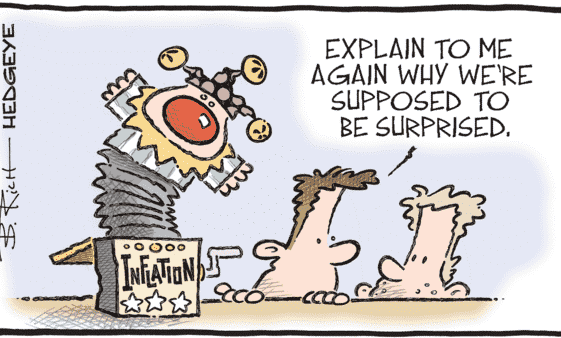

No miracle for Cagliari Calcio this weekend, who logically lost to Juventus by the narrowest of margins (0-1) against one of Serie A’s tenors. But sometimes in soccer, as in the market or in life, there are surprises, unexpected turnarounds and even some unthinkable flip-flop that shake up the established order. A case in point […]