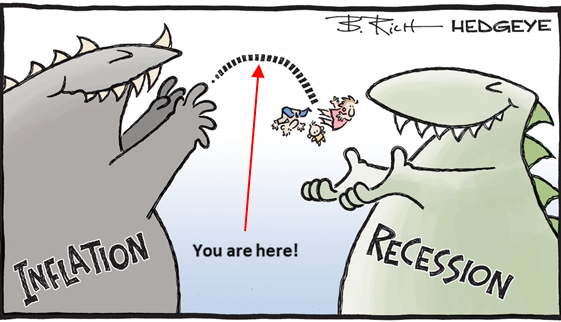

Beware of the Grinch

Latest US data and some Fed members statements reinforced the current optimistic views made of resilient growth and ongoing disinflation. Consumers income and spending are indeed still expanding, manufacturing activity is holding well according to latest ISM, while the Fed’s favorite inflation gauge, the PCE deflator, decelerated further in October. The headline reading was actually […]