- Solar stocks have suffered a massive de-rating since the end of 2020

- The time might be coming for investors to reconsider the sector…

- … acknowledging its numerous long-term drivers, but also inherent risks

For most companies active in the solar space, the stock market ride of the past few years has been very rough – a far cry indeed from the performances of the “Magnificent Seven”. Massive Chinese production of solar panels has caused a global supply glut, exerting downward pressure on end prices. Combined with the failure of European regulators to sufficiently shield local manufacturers, lesser investment incentives in the residential segment (notably California’s policy shift in late 2022) and considerable de-stocking, it is no surprise that solar stock multiples have plummeted since late 2020.

At that time, ca. USD 5 billion were invested in the Invesco Solar ETF (ticker: TAN), one of the largest in the space. As of today, its assets under management stand at USD 1.4 billion, and its price is down 64% from the peak. The same goes for the Ishares Global Clean Energy ETF (one third of which is invested in solar names): its assets fell from a high of USD 7 billion to USD 3.6 billion last October – with a form of bottoming having seemingly taken place since.

Closer to us, Meyer Burger, a Swiss producer of solar equipment, has been hard hit by Europe’s lack of firm commitment towards energy independence. The company is having to close its major German factory – incidentally, the largest manufacturer of solar modules in Europe – because of the lack of European and German government support. Instead, it will refocus on the US, lured by the subsidies and tax rebates involved in the Inflation Reduction Act (IRA) of 2022. Among the smaller, second and third tier, solar companies, the number of bankruptcies due to Chinese competition has been considerable, in Europe and elsewhere.

That said, investor appetite seems to be coming back, in part perhaps because of the sector’s strong sensitivity to interest rates.

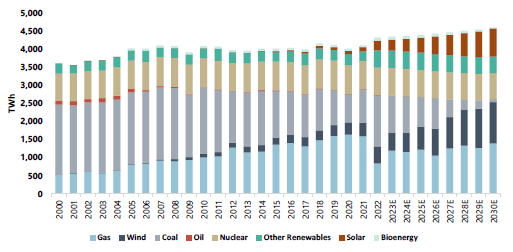

From a more fundamental standpoint, while it is still early days to sound the all-clear, there do seem to be some interesting opportunities emerging. And the positive drivers for the sector are certainly numerous: the necessary transition to cleaner energy of course, but also the outcome of the recent COP28, the aforementioned US IRA program to promote reshoring, the European Union’s Green Deal and Net-Zero Industry Act, technological improvements in energy storage and electric vehicle charging… not to forget the gigantic Chinese plans to deploy solar (and wind) capacity across the country’s desertic plains.

As always, though, with investment opportunities also come risks. In particular, we should mention competition from other renewable energy sources, continued price pressure by Chinese manufacturers, potential technological disruptions brought about by the rapid pace of innovation, as well as evolving government incentive programs and protectionist measures (which may even lead to a tariff war on solar components).

Adopting a selective approach is thus paramount, favouring leading companies that boast a unique positioning along the solar value chain, that are profitable, that have solid balance sheets and whose patents are sufficiently protected. We would also focus on companies whose end-markets are adequately diversified between the residential, project and industrial segments, and on makers of inverters rather than – much more commoditized – solar panels. It follows that ETFs are not necessarily the best means to invest in the solar space. One may be better inspired to pick individual stocks or to consider actively managed specialised funds.

Written by Sandro Occhilupo, Head of Discretionary Portfolio Management

Solar to contribute ~17% towards US Power Generation in ’30

More of the same – with a pinch of reflation salt lately

- Disinflation narrative still intact despite recent upside growth and price surprises

- Back to EPS growth, back to reality… magnificently bullish, what else?

- Bottom-line: we would rather be in than out (of the market)

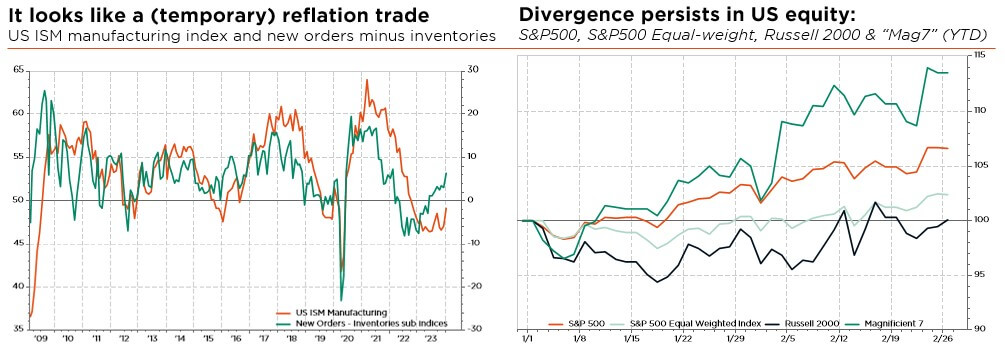

Recent hotter US data should be taken with a pinch of salt (seasonal adjustments). The disinflation narrative is still largely intact owing to softening wage growth, improving productivity and falling inflation expectations, meaning that Fed rate cuts are a matter of when, not if. Meanwhile, the recovery in global manufacturing momentum should help drive more resilient-than-expected growth, reinforcing the outlook for risky assets – despite revived geopolitical tensions.

As a result, our base case macro scenario remains unchanged (soft landing, with slower but positive growth, and sticky but acceptable inflation that will eventually lead to more “relaxed” monetary policies). Lights are obviously not fully green on both the growth and inflation fronts, but associated tail-risks have dropped markedly over the last few months. That said, among the key downside risks, it would be somewhat premature at this stage to rule out a potentially disruptive shift to (necessary) fiscal consolidation or a major credit event, which would likely result in slower-than-expected growth, as markets would hit the liquidity brakes.

In this context, both resilient margins and easing destocking trends still support consensus estimates for a 10% earnings rebound this year, driving healthy equity upside – factoring in the limited leeway implied by rich valuation multiples. For sure, global equity markets do seem expensive by (almost) all metrics today, although a look beneath the surface of elevated, especially AI-powered US, indices still reveals attractive pockets of value among non-“Magnificent” stocks. While a significant re-rating appears unlikely in the near term, a further pullback in bond yields, combined with improving earnings and sentiment, should continue to lend support to current low risk premia. Admittedly, equity sentiment and positioning have gone from being a strong tailwind to a modest headwind: investors have largely re-risked their portfolios in recent months, enthusiastically embracing the crowded “Magnificent 7” (or “Magnetizing 5” year-to-date) and thus pushing most sentiment indicators temporarily into overbought territory. Still, current equity allocations are only close to average historical levels, leaving plenty of upside. As such, we maintain our constructive view on the asset class for the first half of 2024, on the back of improving market breadth and a continuing re-rating in the small- and mid-cap space.

At the same time, investors have now repriced their expectations of central bank rate cuts to a more reasonable trajectory (consistent with our global macro scenario depicted above). While fixed income performances have been disappointing so far this year, relative to some unreasonable expectations, we still expect positive single digit returns before year-end once evidence of disinflation resumes and/or growth softens. In the meantime, the embedded carry should shield investors from the misfortunes experienced by this asset class in 2022. In the current context, we judge bonds to be fairly valued across the board and recommend an overall neutral/benchmarked positioning, our preference for cash having now been dashed by pending central bank rate cuts.

So, do the right thing, do nothing… Although the ride is likely to prove bumpy, today’s more benign macro backdrop and improved near-term visibility support a further re-rating in equity markets – warranting that we stick to our constructive view for 2024. The same goes for fixed income: volatility has picked up somewhat, but it should be largely offset by the carry at the short end of the curve and a downward trend in rates. Finally, we are keeping a slightly overweight stance on gold and an underweight exposure to commodities, whereas we do not foresee sustainable forex trends and thus have no strong convictions in the currency space. In effect, we expect no major divergences or time lags in the forthcoming monetary easing process.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

External sources include: Refinitiv Datastream, Bloomberg, FactSet, Jefferies, BNEF