- Energy drinks are the fastest growing beverage category, with 9% CAGR since 2019

- Their still low market share and the structure of the industry should keep growth strong

- Regulatory risks, owing to the high caffeine content, nonetheless warrant monitoring

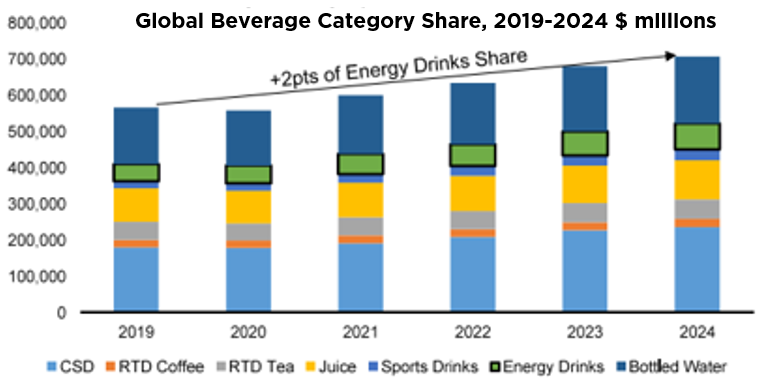

As much of Europe suffocates under unusually hot early-summer temperatures, health authorities are insisting on the right gestures to adopt – with ingestion of sufficient fluids topping the list. A timely occasion to take a closer look at the beverage industry, focusing in particular on its fastest growing segment: energy drinks. Currently accounting for ca. 10% of non-alcoholic ready-to-drink sales, well below the 34% share of sodas, we see significant runway for further expansion.

According to Euromonitor data, which includes China-specific brands, energy drinks represented a USD 70 billion market in 2024, boasting a 5-year compound annual growth rate of ca. 9%. In the US, Red Bull and Monster dominate the market, holding respective shares of 36% and 31%, with Celsius/Alani Nu (10.5% + 6%) as runner-up. Among this peer group, distribution constitutes a differentiating factor. Monster is mainly reliant on Coca Cola’s channels (Coca Cola being a near 20% shareholder), Celsius on PepsiCo’s (ca. 8.5% ownership), while private company Redbull has its own sales channels and smaller brands mainly use e-commerce.

The drivers of strong growth in energy drinks are multiple. First and foremost, this category is viewed as innovative. In terms of packaging formats, of flavours and ingredients, of so-called “limited time offerings” (which create buzz) but also – and perhaps most importantly – of sugar-free offerings (that now account for ca. half of total sales). In addition, energy drinks enjoy less private label competition than other beverage categories, and good potential outside of the most-developed US market. Interestingly, they also show a correlation to gasoline prices, since 60% of purchases are made at convenience stores. Looking at price trends within the broader food & beverage market, energy drinks figure among the categories that have experienced the least inflation over the past three years – making for some scope to hike prices.

A potential that is reinforced by the consolidation underway in the industry, with three manufacturers already controlling over 80% of market share.

As always, however, there are also risks involved when investing in this space. To be monitored in particular is prospective competition from Keurig Dr Pepper, which recently acquired GHOST – giving it a much-enhanced presence in the energy drink category. The other, perhaps bigger, risk pertains to the high caffeine content of energy drinks. Which puts them under close watch by regulatory authorities, particularly since Robert F. Kennedy, Jr. has taken the helm of the US Health and Human Services department. Although not a proponent so far of a ban on energy drinks, his positions on public health do suggest that the negative potential side-effects (sleep disturbance, anxiety, heart issues) could be put forward as a reason to encourage lesser consumption.

But who, more specifically, are the consumers of energy drinks? Analysing the audience breakdown of Celsius and recently purchased Alani Nu provides some interesting insights – as well as highlighting the potential synergies stemming from the acquisition. Celsius is largely gender-neutral (54% female, 46% male), while Alani Nu has a strong female followship (92% share of social media). In both cases, repeat buying patterns are high (73% of Celsius and 65% for Alani Nu) – signalling a strong form of customer loyalty. As for other client characteristics, Celsius appears to cater to higher income households, with active and healthy lifestyles, whereas Alani Nu has a more youthful and “fun” vibe, almost half of its customers being aged 25 to 34.

All told, for this newly combined company, as well as other energy drink manufacturers, odds are that growth will continue strong… particularly with the long summer season lying ahead.

Written by Alexander Roose, Head of Equities

Détente but no deals yet

- The clock is ticking for tariff negotiations, while the economy is slowing but still going

- Recent tensions in the Middle East have already eased, with oil prices back below USD 70

- The US dollar remains the main collateral victim of Trump policies

The clock is ticking for tariff negotiations, with few deals achieved so far. China is trying to buy time, by linking strategic rate earth exports to the talks, while the euro area clearly needs more time to sort things out internally. In the meantime, tensions in the Middle East have picked up again, with Israel’s attack on Iran – initially without US consent. These geopolitical concerns have already eased, however. Oil prices have dropped back below USD70/barrel, close to the levels prevailing before Israel’s strikes against Iran. As such, the past few days look set to join the long list of geopolitical shocks that proved temporarily disruptive but had modest lasting effects on markets. As for the “One Big Beautiful Bill”, it continues to move ahead in the US Congress, raising concerns among foreign investors about US fiscal sustainability and the eroding greenback’s hegemony.

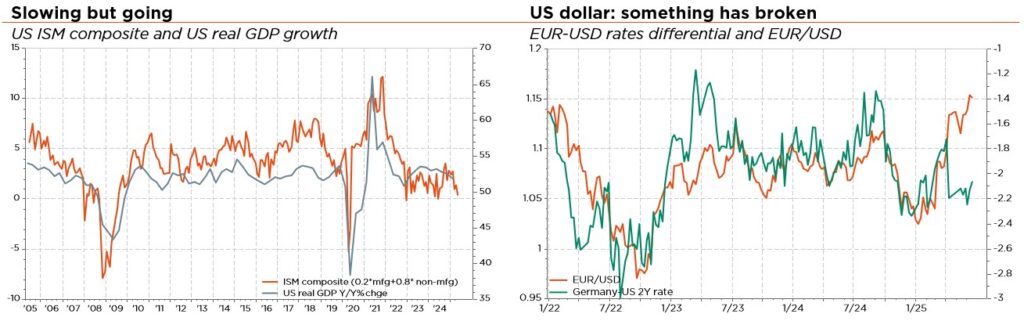

Turning to economic considerations, US activity is slowing but still going, while the disinflation process remains in place – to date. The Fed has not yet cut rates though, sticking to its cautious stance on both growth and inflation projections, as some stagflation risks cannot be completely ruled out for the second part of the year. Still, both investors and the Fed foresee two rate cuts to 3.5-3.75% before year-end. In Europe, growth has stabilised, with manufacturing sentiment picking up but services having lost some momentum lately. As expected, the ECB cut rates by 25bps to 2.0% in June and kept the door open for further easing if needed – the impact of pending tariffs or a prolonged rebound in energy prices on both growth and inflation remaining unclear. Finally, the SNB cut rates to 0% and is contemplating negative rates down the road to tame CHF strength – likely a vain approach in our view.

At the portfolio level, we are definitively turning bearish on the US dollar with now underweight exposure, following an already more cautious stance during recent months. The same goes for US equities and USD-denominated bonds (all downgraded to slight underweight over the past 3 months).

Given a still rather elevated USD Purchasing Power Parity valuation against most major G10 currencies, as well as Trump policy objectives (lower rates, weakened currency) and risks (fiscal sustainability, de-dollarisation), the greenback is now liable to suffer from an increasing forex hedge ratio or just slow but ongoing outflows by international investors – be it for capital repatriation or diversification purposes. We are not calling the US dollar hegemony into question but do expect it to diminish going forward. That is especially true after several years of US exceptionalism that worked as a magnet for the European and Asian savings glut, times during which the US was considered to be a reliable and trustful economic and political ally.

On a final note, we continue to view diversification as a key requirement for portfolios. Not only between asset classes, with gold (still preferred to government bond duration, absent a severe recession scenario) and CHF exposure as broad safe havens in various risk-off scenarios, but, more importantly, also within equities (regions, sectors, styles and company size) and bonds (regions, maturity buckets, sectors and credit risks). Globally, we reaffirm our overall neutral stance on both equity and fixed income. Our current balanced positioning and well-diversified allocation reflects our cautiousness in assessing the wide range of potential outcomes, largely inherent to erratic Trump politics. It should allow portfolios to benefit from expected positive, but contained, returns in most asset classes this year, while mitigating the bumps and maintaining sufficient flexibility to adapt to evolving conditions along the road. That said, we did also recently add some tactical protections for the summer – to maintain projected upside potential albeit with a lower risk profile.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

External sources include: LSEG Datastream, Bloomberg, FactSet, Euromonitor, Stifel estimates.