DECALIA is a Swiss financial group which manages and advises private and institutional clients.

It offers efficient services adapted to a demanding clientele: Wealth management, Asset management, Private Markets as well as value-added investment strategies available through the family of DECALIA funds.

Wealth Management

Wealth management

DECALIA targets a private clientele looking for personalised wealth management that generates consistent performance.

Based on the advanced techniques and rigorous processes of institutional asset management, our investment approach is clearly focused on risk control.

A human-sized management boutique, DECALIA naturally pays particular attention to the quality of service.

Asset Management

Asset Management

DECALIA has developed a range of strategies focused on several investment themes offering strong long-term prospects.

DECALIA has launched its own range of UCITS investment funds (DECALIA Sicav), registered in Switzerland and other European countries. For some specific strategies, we have also established partnerships with external asset managers.

Private Markets

Private Markets

DECALIA’s Private Markets team has developed a unique capability to originate and vet private markets strategies that aim to deliver premium returns, staying away from crowded markets.

We are strong believers in active management and human talent. Our objective is to transform specialised market opportunities into institutional investment products.

Private Equity

DECALIA Capital

DECALIA Capital, an entity dedicated to direct investments in Swiss unlisted companies, was created to meet the needs of investors wishing to invest in the real economy.

Thanks to its extensive experience in private equity and broad network of partners, our team offers access to promising companies in full development.

Funds

DECALIA Funds

DECALIA’s innovative and distinctive investment strategies are available through a range of UCITS investment funds (DECALIA Sicav), registered in Switzerland and in several European countries.

The DECALIA Luxembourg Sicav has its own dedicated website, providing all useful information regarding the investment funds.

Team

DECALIA team

DECALIA’s asset management team is made up of seasoned investment professionals, whose areas of expertise are very complementary.

NEWS

Recent news

Humanoid robots: the next labour revolution

From being just a curiosity twelve months ago, humanoid robots went to taking centre stage at CES 2026. Indeed, this year’s edition of the Las Vegas “most powerful tech event” saw nearly two dozen humanoid robots on display. Robotics is entering a new phase of commercial acceleration, driven by AI breakthroughs, falling hardware costs and […]

Winning the yield race

Champion the european specialized private credit market Nicolò Miscioscia, Partner and Head of Private Markets, Co-Manager DECALIA Private Credit Strategies For this DECALIA Private Markets Focus issue we have drawn inspiration from the winter Olympics currently unfolding in Italy. Investors can learn from athletes chasing for gold medals : study the discipline, refine skills, develop […]

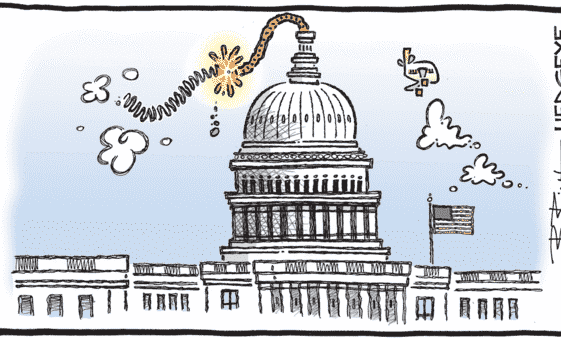

Still a supportive macro backdrop

The US Supreme Court ruled last Friday that the President cannot use “emergency” authority to impose tariffs at will (i.e. the use of the International Emergency Economic Powers Act (IEEPA) to impose broad based tariffs is unconstitutional). While that’s a great victory for the “rule of law” and thus somewhat reassuring politically speaking, it brings […]