While Cagliari Calcio is struggling to remain afloat in Serie A rankings, with a flattering and much-needed tie game against Como yesterday, there is an asset class, often accustomed to the bottom places of financial markets returns, which is thriving this year. Any guess? You have to look south, and even further south than Sardinia: EM debt has indeed benefited from an incredible alignment of stars this year with a combination of a softer US dollar, lower US yields and globally falling developed markets rates, improved EM fundamentals, attractive (relative) carry/yield and positive investor sentiment, technical and flows all aligned. Add to that a perception of lower default risk, likely also due to the sense that some structural weaknesses seen in EM debt in the past is now filtering into US and other DM sovereign debt (think about fiscal and overall debt trajectories, central banks independence, fiscal dominance, sticky inflation, uncertain or unstable political backdrop, …). All these factors helped push both bond price appreciation and strong income returns.

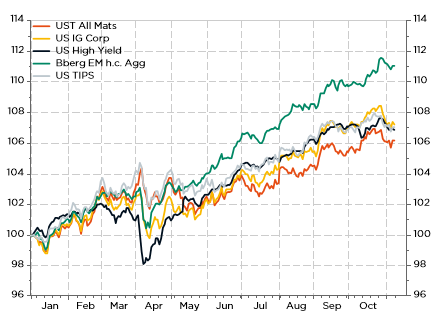

Against this favorable backdrop, EM debt, especially in hard currency, has performed quite strongly year-to-date, beating handily US credit (both IG & HY) as well as US Treasuries with double-digit returns.

YTD total returns of major USD bond indices

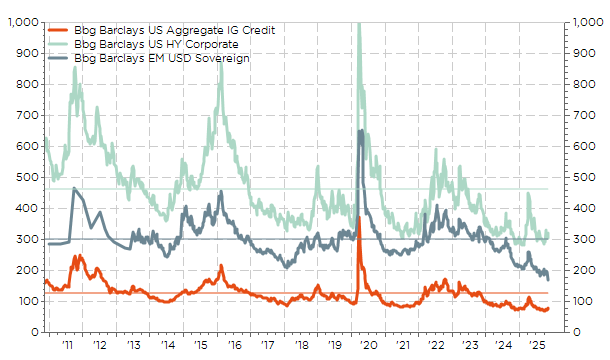

As a result, the EM sovereign USD debt average spread is the tightest in the last 15 years, which is also true for IG and HY credit by the way. However, we clearly observe on the graph here below that EM spreads have tightened much further than HY over the last few quarters (since 2024 to be precise).

Bloomberg Barclays US IG Credit, HY corporates and EM sovereign debt spreads + their respective averages over the last 15 years

As John Authers, the famous Bloomberg columnist, noticed in his newsletter today (“Emerging markets can swim naked for a while”), China just raised $4bn in US dollar-denominated bonds in 2 tranches of 3-year and 5-year maturity, which were issued at the same yields as equivalent US Treasuries!? In other words, China didn’t need to pay investors a premium for the extra risk they were taking. On top of the reasons (or absurdities depending on your stance and feelings towards this asset class) behind this fact, which are very well explained by the journalist, I see another one: large inflows chasing limited supply in an asset class that is both clustered -as it is usually the prerogative of a handful big asset managers and a few dedicated ETFs- and very heterogenous as sovereign debt of Saudi Arabia (rated Aa3 by Moody’s) or China (A+ according to S&P) rub shoulders with “less investable” or junkier debt from countries like Dominican Republican (BB), Egypt (B) or Ecuador (CCC+).

J.P. Morgan EMBI Global Core Index, geographical breakdown

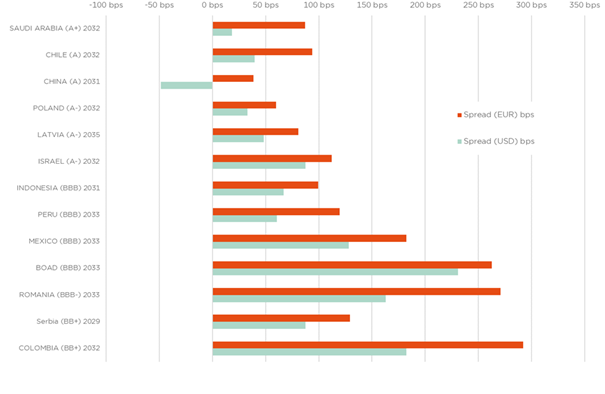

So, imagine you are an EM debt h.c. fund manager and you want to tilt your portfolio towards a relatively defensive stance in terms of credit risk… you aren’t left with many choices. Same for passive investment vehicles, which are forced buyers or followers and therefore agnostic of relative value -especially outside their universe-. Perhaps it is a good and thus a right thing to do (so far) in many asset classes, but not really in fixed income according to my views when looking forward. For those who strongly believe in the market efficiency theory, or who just think that I’m rambling or hallucinating, here is a very disturbing pragmatic proof of the opposite: EM debt denominated in EUR, which is out of the radar of the big Anglo-Saxon EM debt managers and also out of most EM debt h.c. index and ETF, offers substantially higher spreads for the same country, credit and maturity risks than the equivalent USD denominated bonds.

Selected EM debt spreads of equivalent USD and EUR denominated EM sovereign debt

Amazing, isn’t it?

While I expect conditions to remain favorable for EM debt in the foreseeable future, I am well aware that many of these tailwinds could quickly reverse: a renewed strength in the dollar, global growth slowdown, or spike in US (developed-market) yields could all hurt EM hard currency debt. Furthermore, many EM issuers still carry elevated risks (geopolitical, commodity price dependency, fiscal vulnerabilities): the fact that risk perception has improved doesn’t mean risk is gone… So, selectivity remains key especially in this overall tight spread context. However, I still see some relative value in EM sovereign debt in h.c., especially on the EUR curve, compared to USD denominated IG and especially HY corporate bonds.

To paraphrase the conclusion of today’s article by John Authers on EM assets, inspired by one of my favorite and likely the most famous Warren Buffett’s quotes: if you’re going to dive naked into this over-brimming global liquidity, you might as well choose a spot where the water is deeper and there are fewer people!

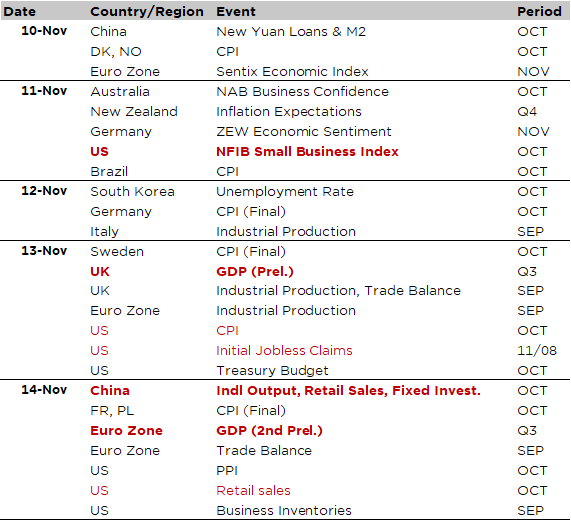

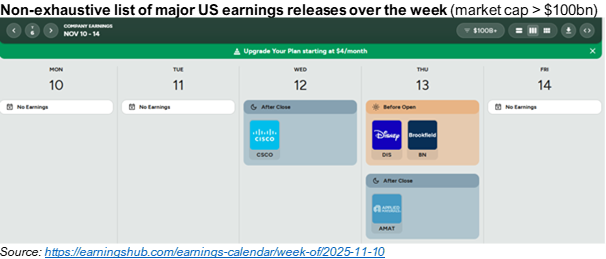

Economic calendar

The incoming weeks were expected to be a little quieter in terms of macroeconomic data releases – notably due to the ongoing US government shutdown, which would have continued to delay/prevent the publication of major US economic data such as the CPI and retail sales figures for October this week. However, the end (of the shutdown) seems suddenly near… as some moderate Democrats have voted to advance a bill that will end it. The vote on this bill may happen as soon as today or tomorrow (Tuesday). In this context, there is now more than 90% probability that the shutdown will be over before next week-end, according to Polymarket, with the consequences of being then flooded by a tsunami of delayed data releases once the government reopens.

Anyway, corporate earnings releases are for sure experiencing a lighter schedule ahead as more than 400 companies from the S&P500 have already reported. Cisco, Walt Disney and Applied Materials in the US, Siemens, Enel, Deutsche Telekom, Sony, Tencent and JD.com elsewhere, are among the major companies to report over the week.

We will nevertheless be monitoring inflation figures in the rest of the world, with final data for the eurozone and other European economies, sentiment surveys in Germany (ZEW) and the US (NFIB small business confidence index) on Tuesday, as well as industrial production and trade balance figures in Europe and the UK on Thursday. Finally, in terms of overall economic activity, we will have Q3 GDP figures for the UK (Thursday), which could have some influence on the BoE’s next meeting in December (BoE decided last week not to cut rates in a very close 5-4 decision), and above all October activity indicators for China (industrial production, retail sales, and investment). Finally, speeches and interviews by various Fed members during the week will also influence the markets in a context where the Fed’s next rate cut in December seems less and less certain (65% probability currently vs. 100% in mid-October).

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.