Reji Vettasseri. Lead Portfolio Manager of DECALIA Private Credit Strategies

The Rise Of Private Credit

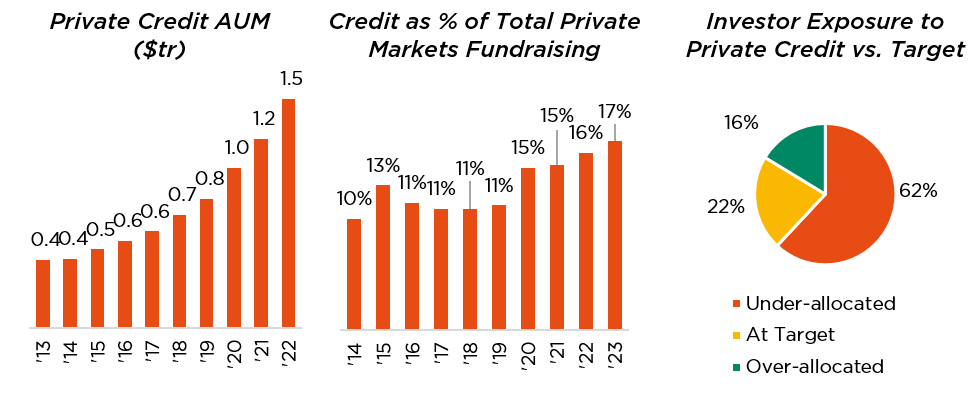

- Private credit taking a record share of private markets fundraising

- Surveys suggest investors continue to feel under-allocated

Earlier this year, Blackstone’s president Jonathan Gray claimed that private credit had entered a “golden moment”. This sentiment, and often the phrase itself, has since been frequently repeated by top brass at firms from BlackRock to Goldman to JP Morgan.

It might be tempting to dismiss these statements as mere marketing, but that’s not what our Private Markets team at DECALIA thinks. Private credit is not just getting more airtime in speeches, it is also finding significantly more space in investor allocations.

The share of credit in private markets fundraising has been a record 17% so far this year (up from 10-11% at the end of the last decade). In absolute terms it raised $242bn in 2022, on par with the previous year’s record, despite a tough year for most other asset classes. Industry AUM is now >$1.5tr (larger than the syndicated bank loan market) but surveys suggest investors still feel under-allocated.

We attribute this to both an upgrade of the outlook for the asset class, and also to a positive reappraisal of private credit’s through-the-cycle value.

Today private credit deal-making is benefitting from the historically rare combination of a high interest rate environment and opportunistic market conditions after a pull-back by traditional lenders. This should boost returns relative to historic performance and also relative to other assets (e.g. liquid credit and PE).

Meanwhile, private credit is seen to have proven its resilience by passing its first major test (the Covid pandemic) and so far weathering the current macro-economic slowdown. It has done so at a time when many are nursing steep losses on not only their stock market portfolios, but also their bond holdings. Hence, private credit’s value as a less-correlated portfolio diversification tool has become clearer.

Upgrading the Outlook

Base Rates Move Higher

ECB rates have risen 4.25 p.p. since the start of the hiking cycle in mid-2022, boosting private debt yields in turn. For segments using floating rates the adjustment was automatic. In those with fixed rates, loans have fully repriced.

Source: Preqin, PDI investor survey

The world appears set for a “higher for longer” rate environment. Yet, even if the cycle turns, private credit normally adjusts with a lag. Private debt coupons jumped in late 2022; market-sensitive bonds moved earlier in the year. The flip side is that private lenders should be the last to cut when rates go down.

Traditional Lenders Pull Back

In early 2023, the banking sector ran into turbulence, epitomised by a string of US collapses (Silvergate, Signature, Silicon Valley Bank and First Republic) and the distressed sale of Credit Suisse.

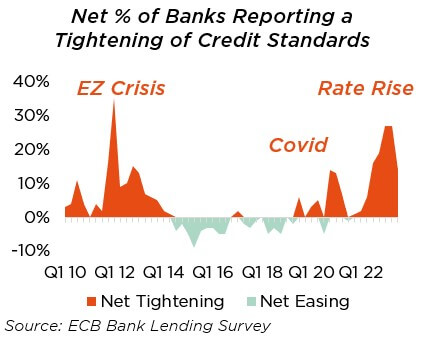

Chastened, banks have retreated. Credit standards have been tightening since Covid and the trend has accelerated. The financial system is stable, but readings from the ECB’s banking survey (below) are close to those during the Eurozone crisis. And, issues go beyond banks. European high yield issuance fell 57% y-o-y in the year ending Jun-235.

Selectivity is rational in tougher macro conditions. But we see the withdrawal of conventional credit as indiscriminate, leaving space for alternative lenders to target strong borrowers that were left behind. Nonetheless, the exact supply-demand imbalance varies by segment.

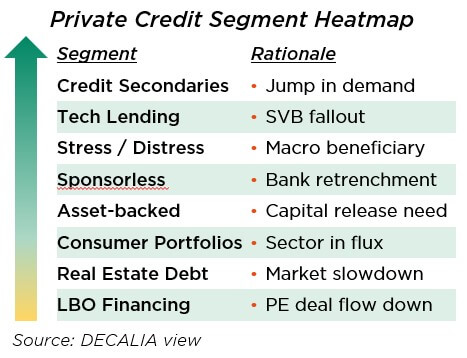

For instance, the fall of SVB removed a key lender to the tech sector; but many tech firms continue to perform and can pay up for growth capital. In credit secondaries, the limited number of buyers are inundated with deals, as more asset owners look to sell positions (e.g. due to internal liquidity issues). It is still early in the stressed/distressed cycle, but big opportunities should arise.

Elsewhere, the benefits of lower competition are partially offset by a fall-off in demand. Notably, direct lending to finance PE deals (the largest segment in private credit) has to handle a reduction in the number of LBO deals and lower debt needs per deal as leverage levels moderate. A similar deal flow dynamic may be playing out in real estate debt. A rising tide should still lift all boats, but some are in calmer waters.

The Stars Align

This is not the first time that banks have retreated, nor the first time rates have risen. Yet it is the first time since private debt emerged as an asset class, for both to happen in tandem. Rates rose in the mid-2000s and late-2010s, but “easy money” was everywhere. Dealmakers could be opportunistic after the GFC and Covid, but rates were rock bottom.

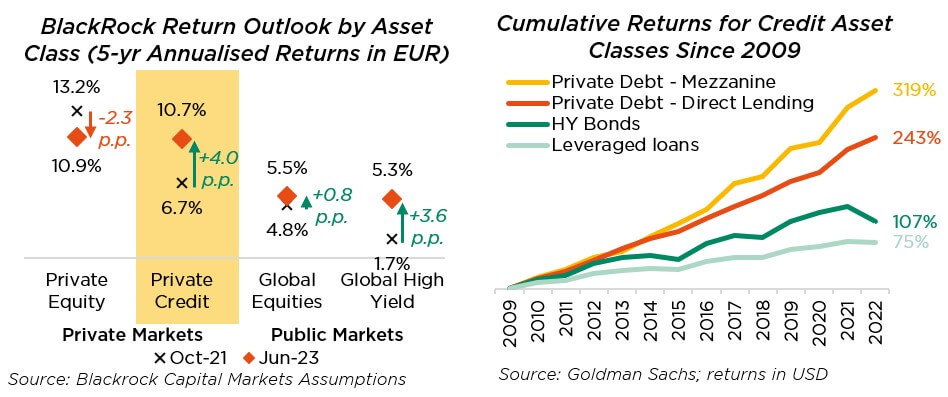

Today’s combination is powerful. The BlackRock forecasts (above) show how private credit return expectations have risen by c.4.0 p.p. since late 2021. Rate rises also help high yield; but, even so, the private debt premium has also gone up. And, this is based on direct lending to PE, in our more favoured strategies, spreads over bonds could rise further.

Even more striking is the change relative to PE. Lower leverage, higher interest, weak growth and muted valuations limit buyout prospects. The gap between PE and elevated private debt returns might even all but disappear in the short run.

Reappraising the Track Record

Passing the First Big Tests

Private credit only truly took off after the financial crisis. Through the 2010s, critics used to point out it had never been truly tested. After the stormy start to the 2020s, that is no longer the case.

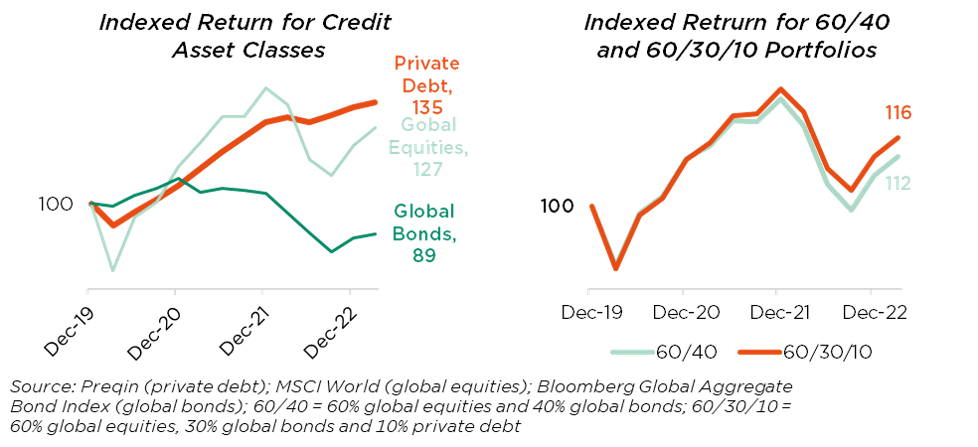

Since the GFC, private debt generated twice to three times the return of bonds and leveraged loans (see top right). It has also been less volatile, as is especially apparent in recent years when conventional credit took a tumble.

Private credit does not mark-to-market daily, which may optically smooth short term volatility. But trends over a long time frame imply more fundamental resilience. We see a few key drivers:

- Deeper DD: When working under exclusivity with a private lender that can move at pace, borrowers open themselves up to much deeper due diligence. In traditional processes, concerns over process manageability or confidentiality hold them back. Private lenders may offer higher leverage, but only after having better understood and mitigated the risks.

- Active management: Bonds typically do not have covenants. Bank loans do, but bank syndicates rarely have the capabilities or the co-ordination to react optimally to a breach. In contrast, private lenders are typically quick to negotiate solutions (e.g. equity injections, cost cutting plans) or else enforce aggressively.

- Less rate sensitivity: Bond prices are rate-sensitive, leading to potential for significant losses if liquidated ahead of maturity. Private debt is often floating rate, reducing fundamental sensitivity, and is a short-to-medium duration hold-to-maturity asset class.

Enhancing the 60/40 Portfolio

Private credit may have passed its first big test, but on the other hand it seems that bonds failed their last big test.

Those with liquid credit allocations, have been reminded that rate-driven re-pricing means that even “risk free” bonds are not really risk free (unless they are held to maturity, in which case they are not really liquid). Furthermore, the negative correlation between bonds and equity broke down completely as rates rose going into a downturn, undermining the most basic assumption behind traditional 60/40 portfolios.

Lacking live market data, investors schooled in modern portfolio theory often struggle to analyse illiquid assets. But longer-term statistics clearly imply that private credit has not only a strong standalone risk-return profile, but also a lower correlation with liquid assets. It can play a powerful defensive role even when bonds fail to deliver.

Below, we compare a 60/40 portfolio to a 60/30/10 alternative (where a quarter of fixed income exposure is swapped for private debt), starting just before the outbreak of Covid. Only 10% of the basket is varied, but still the 60/30/10 portfolio outperforms by 458bps over three and a half years. The difference is not driven primarily by the good times but by resilience in the downturn.

Moreover, this analysis uses a market average dominated by direct lending for private debt. Direct lending acts as a substitute for bonds and syndicated loans in PE deals. But other strategies offer exposure to areas that are otherwise simply inaccessible to most investors. Our preferred approach of allocating more to specialised credit should not only boost absolute returns but also reduce correlations further.

Conclusion

Allocators have often treated private debt as an “eccentric second cousin” to their liquid holdings – nice to have at the party, yet not fully in the core family.

We believe this is unfair. The portfolio enhancement that private credit offers merits a permanent seat at the table. And, given how well positioned it is for the current high-rate, low-competition credit environment, today it may even deserve a “guest of honour” status.

About DECALIA SA

Established in 2014, DECALIA SA is a Swiss investment management company. With more than 70 employees and assets under management that stand at €4.9 billion, DECALIA has expanded rapidly, in particular thanks to its active-management experience built up over the last 30 years by its founders. The strategies developed by DECALIA focus on four investment themes deemed promising in the long term: the disintermediation of the banking sector, the search for yield, long-term trends and market inefficiencies. DECALIA is regulated by FINMA through a collective assets manager’s license. In addition to its Geneva headquarter, the group has offices in Zurich, Milan & distributors of the DECALIA Sicav in Spain & Germany.

Copyright © 2023 by DECALIA SA. All rights reserved. This report may not be displayed, reproduced, distributed, transmitted, or used to create derivative works in any form, in whole or in portion, by any means, without written permission from DECALIA SA.

This material is intended for informational purposes only and should not be construed as an offer or solicitation for the purchase or sale of any financial instrument, or as a contractual document. The information provided herein is not intended to constitute legal, tax, or accounting advice and may not be suitable for all investors. The market valuations, terms, and calculations contained herein are estimates only and are subject to change without notice. The information provided is believed to be reliable; however DECALIA SA does not guarantee its completeness or accuracy. Past performance is not an indicator of future results.

External sources include:

- Blackstone, Q1 21 Earnings Call

- Financial Times, “The Private Credit ‘Golden Moment’” (6-Jul-23)

- Preqin

- PDI, “H1 23 Investor Report”

- Blackrock Investment Institute, “Capital Markets Assumptions”

- Goldman Sachs, “Private Credit Monitor” (8-Jun-23)

- KKR, “The Benefits of Private Credit in the ‘Traditional’ Portfolio”

- BlackRock, “Rebuilding Resilience in 60/40 Portfolios”

- Bloomberg

All analysis based on latest available data as of 11 Sep 2023