- Healthcare is again underperforming in 2025, amid tariff, funding and regulatory concerns

- Worst-hit have been the Managed Care Organisations, due notably to OBBB reform of Medicaid

- Sentiment may, however, be bottoming and innovation continues to support long-term growth

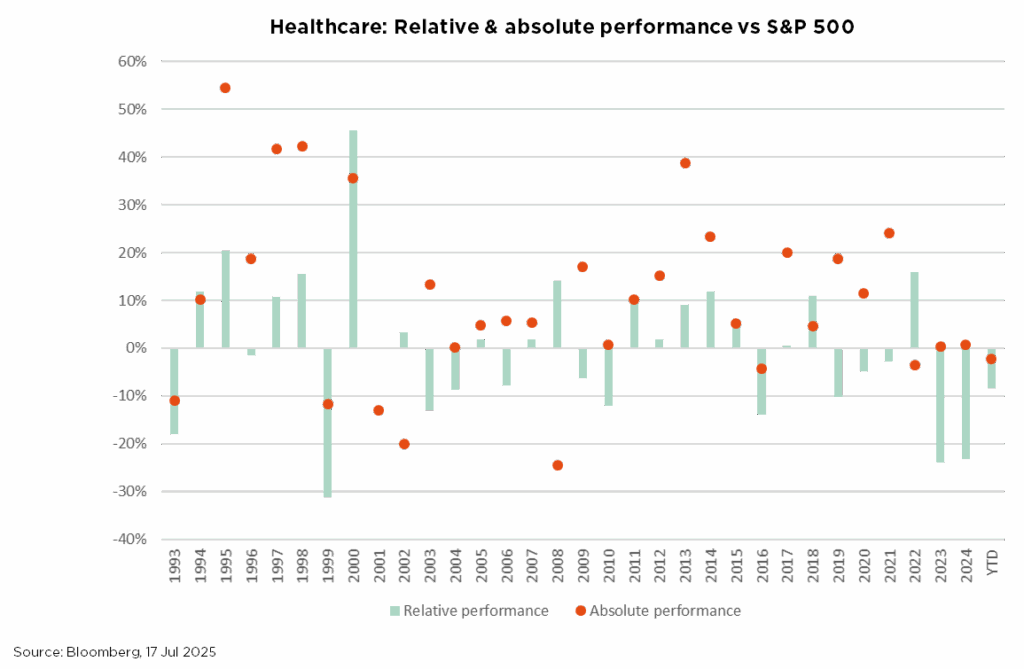

As we put pen to paper, the healthcare sector ranks last but one in the year-to-date performance table, fostering a distinct sense of “déjà-vu”. Indeed, 2023 and 2024 saw healthcare stocks take very little part in the overall equity market rally. At the onset of this year, however, the lights appeared to have turned greener: pharmaceutical spending was on the rise again after its post-Covid hangover, bioprocessing held big promises, and the Chinese economy was picking up. So why such a disappointing performance?

In effect, 2025 saw tariff and MFN (most-favoured-nation drug pricing policies) considerations take over as the boogie man for healthcare, with regulatory shifts and cuts in funding compounding investor concerns. Almost all subsectors have been negatively impacted. As regards pharmaceutical companies, President Trump’s suggested 200% tariff on imported pharmaceuticals into the US is clearly stifling investor interest. Although such a prospect remains very much uncertain and could be partly offset by a grace period and some onshoring of production, the threat remains on the table. Under MFN proposals, US drug prices would be benchmarked to those in lower-cost international markets, raising fears of price controls and revenue pressure for pharmaceutical companies. Lastly, budget cuts and changes in leadership at the US Food and Drug Administration (FDA), the National Institute of Health (NIH) and other regulatory bodies are adding to the uncertainty, with RFK Jr. at the helm of a controversial public health shakeout.

Among the biggest detractors to healthcare sector performance year-to-date, however, figure the Managed Care Organisations, hit by rising claim costs, by the changes to Medicaid subsidies included in the One Big Beautiful Bill (OBBB) and by unpredictable enrolee pools, dampening profit outlooks. In fact, the largest single detractor to healthcare sector performance this year has been UnitedHealth, down more than 45% since January 1 after having enjoyed a “darling” status for over a decade.

Still, amid such broadly negative news flow, what would it take for healthcare stocks to positively surprise the market? The share price reaction to recent figures released by Contract Research Organisations – whose valuations had in some cases fallen to levels last seen during the Great Financial Crisis – suggest that sentiment may have bottomed. Pockets of strength, such as strong bookings and stabilising cancellations, have been enough to spark sharp post-earnings rallies in those names.

More fundamentally, we believe that headwinds from Washington can do only so much damage to the amount of innovation going on in healthcare and that long-term investors are liable to focus more – and appreciate – the continuing breakthrough science within the sector. Advances in the fields of obesity, rare diseases, precision medicine and AI-driven devices, to name a few, all underpin solid future growth. Robotic surgery is but one example of the promises of innovation, enabling minimally invasive interventions and faster patient recovery.

That being said, healthcare is on track to suffer its third consecutive year of relative underperformance. And if history offers a small silver lining, never has the sector experienced four such years in a row…

Written by Iana Perova, Equity Analyst

More bark than bite so far… complacency takes over

- So far so good, thanks to resilient economic data and better-than-expected earnings

- Valuation remains expensive (nothing new!) but current complacency may be misplaced

- Despite its recent rebound, the US dollar remains at risk of further depreciation ahead

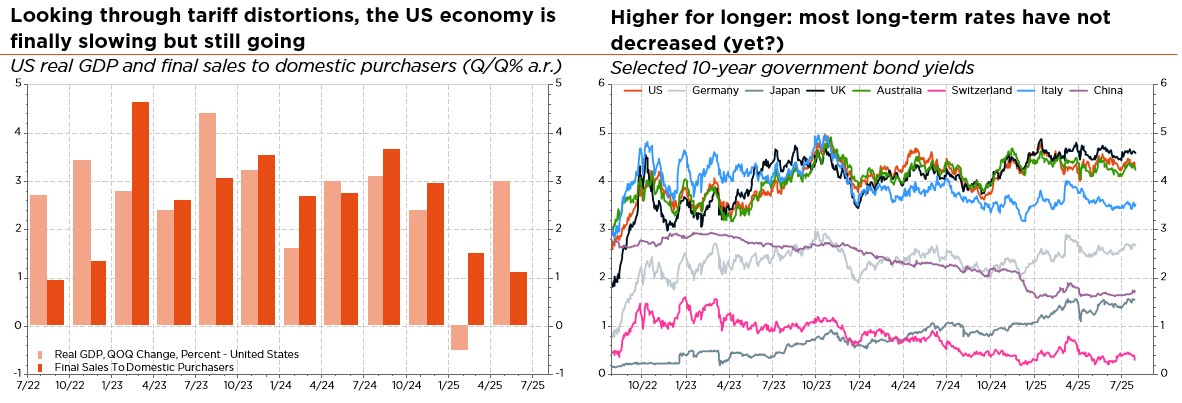

It seems that President Trump’s tariff saga is slowly coming to an end. He managed to strike key trade deals with Japan and, just recently, the EU, while an additional 90-day truce with China has been agreed. In the meantime, no clear and significant impact on growth and inflation in the US, or elsewhere, has been observed. As a result, the stock market has continued to celebrate these less-bad-than-expected outcomes, supported by resilient economic data and a strong earnings season so far, with most reported results ahead of relatively low-bar expectations.

Unfortunately, both Donald Trump and investors are showing growing confidence in the fact that tariffs, already at their highest level since WW2, on top of all the other potentially disruptive US administration policies such as immigration or the OBBB, will not damage the US/global economy, reignite some unwelcome upward pressures on prices or derail the Fed’s monetary policy trajectory. In fact, it could be only a matter of time before some of these negative impacts start to show up in the data, as existing front-loaded inventories are depleted, while consumers and companies adjust and find “sustainable” turnarounds. Considering the current complacency, the lofty valuations, as well as the narrow market breadth, a whole series of potential sparks, in the form of surprising enough economic data releases, could indeed easily ignite the powder keg – leading eventually to a healthy short-term correction.

To sum up, the economic earnings momentum backdrop remains supportive but is expected to become more fragile going forward, valuations of risk assets are stretched and even historically expensive in some specific areas, and sentiment has now moved into bullish territory. However, investor positioning does not yet reflect this complacency. As a result, we remain in wait-and-see mode, still dancing as the music goes on (i.e. the soft-landing consensual scenario holds) while keeping a close eye on the exit door. We use tactical protections to retain the projected upside potential, but with a lower risk profile.

As a result, there have been no changes at the portfolio level. We are maintaining our overall neutral stance on both equity and fixed income. Our current balanced positioning and well-diversified allocation reflects our cautiousness on assessing the wide range of potential outcomes. It should allow portfolios to benefit from expected positive, but contained, returns in most asset classes in the near term, mitigating the bumps, while maintaining sufficient flexibility to adapt to evolving conditions along the journey. That said, in an opportunistic manner, we may continue to embark tactical protections as is the case currently.

We continue to view diversification as a key requirement for portfolios, within both equities (regions, sectors, styles and company size) and bonds (regions, maturity buckets, sectors and credit risks), but also via exposure to gold (still preferred to government bond duration, absent a severe recession scenario) as a broad safe haven in various risk-off scenarios.

As regards currencies, we remain structurally bullish on the Swiss Franc and bearish on the greenback, even if the latter is now rebounding on better-than-expected economic data releases, further delayed Fed easing and renewed AI enthusiasm surrounding some big tech earnings figures and capex plans. We doubt, however, that these tailwinds will last for long, while the diversifying features (risk-off hedge) of the US dollar are now also jeopardised by Trump policies (including latent risks surrounding an eventual “Mar-a-Lago Accord” or the incoming nomination of a new Fed president) and US public debt ballooning concerns. In other words, we prefer not to chase what we consider a dead cat rebound.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

External sources include: LSEG Datastream, Bloomberg, FactSet, Euromonitor, Stifel estimates.