Interview with Quirien Lemey, Senior Portfolio Manager

O2 & Ecology is one of the seven major themes in the DECALIA’s Sustainable strategy that will shape our society of tomorrow. There is enormous potential in silicon carbide, and here’s what you should know about it:

- Power chips made of silicon carbide can handle higher power, have lower resistance and boast greater energy efficiency than plain silicon ones

- When used in an electric vehicle, this means a longer driving range for exactly the same battery – as well as a considerably lower overall weight

- Producing silicon carbide is relatively simple, the difficulty lies in slicing the very brittle ingots that come out the furnaces

- Beyond the fast-growing electric vehicle space, silicon carbide has massive growth opportunities in other “green energy” technologies (notably solar panels and windmills), not to mention the huge HVAC market

Norway has just become the first country to reach 20% of electric cars on the road, with such vehicles accounting for even more impressive 80% share of new registrations.

As the automobile industry transitions en masse towards zero-emission models, silicon carbide chips stand to grab a fast-rising share of the power semiconductor pie – thanks to their much greater energy efficiency, hence the longer driving ranges they make possible.

Their advantages are undisputable, the challenge will be to ensure sufficient supply.

Quirien, could you start by explaining how power chips work and in what types of devices they are used?

Power chips represent a relatively small part of the total semiconductor market (around 10%) but are crucial to any system that contains or provides power. In effect, rather than delivering ones and zeros as do digital chips, power chips deliver electrical current. And they also serve to switch the flow of current between direct (DC) and alternating (AC).

To provide a useful analogy, power chips are like the wall of a dam, which opens and closes according to when/how the water needs to flow. They are thus used in a very broad array of devices, ranging from low-power systems such as headphone amplifiers to high-voltage electrical lines.

What differentiates silicon carbide power chips from plain silicon ones?

Silicon Valley owes its names to the ubiquitous use of silicon in the semiconductor industry. As of today, the vast majority of chips are made of silicon. The advantages that silicon carbide (SiC) boasts over plain silicon, particularly for power chips, lie in its ability to handle higher power, its lower resistance and its greater energy efficiency.

To go back to the water dam analogy, silicon carbide power chips can open and close the wall much faster (aka with “higher frequency”), better mastering the flow of current and limiting losses.

When used in an electric vehicle, for instance, this more energy-efficient profile has direct implications for the potential driving range – extending it by 5% for exactly the same battery. And that is before the other benefits that silicon carbide chips also bring, notably in terms of reduced overall vehicle weight (to handle an equivalent voltage, a SiC chip can be much smaller than its silicon counterpart, meaning that fewer cooling, less passive components and less wiring are needed).

Why the sudden emergence of silicon carbide?

Scientists have been aware of silicon carbide’s potential for half a century already. But, as has been demonstrated time and again, the adoption of an innovative technology does not take place overnight. The moment needs to be right, which for silicon carbide does seem to be the case today.

Setting the transition into motion was the adoption of SiC in the Tesla Model 3 in 2017. But the broader industry shift can be dated to the 2020 Tesla Model S vs. Porsche Taycan challenge. The former, for which Elon Musk had decided to bet on silicon carbide power chips, effectively ridiculed its double-voltage battery and double-priced competitor with a longer range! Which, needless to say, then prompted all other automakers to follow suit.

Silicon carbide must have some shortcomings though: cost, raw material procurement, manufacturing issues?

I spoke earlier of silicon carbide’s greater energy efficiency: that really is the key takeaway for readers and what makes its long-term prospects so bright. But you are correct, there are still some hurdles that need to be overcome before mass adoption.

In terms of cost, a silicon carbide power chip is indeed (as of today) much more expensive that a silicon one – although that, in itself, is not necessarily an issue. For what matters is the overall cost of build. Put differently and in the case of an electric vehicle, the savings induced by the much lower overall weight that is made possible by shifting from silicon to silicon carbide may well offset the additional cost of the chips themselves.

Raw materials are not really an issue either. Silicon carbide, as its name suggests, is a combination of silicon and carbon. On earth (unlike in space) it is rarely found in its natural form. But producing it synthetically is a relatively simple, albeit long, process: silica sand and carbon are combined in very high temperature furnaces.

Where things become trickier, and what currently constitutes the main obstacle to mass deployment, is the slicing of the silicon carbide ingots that come out of the furnaces into wafers – onto which are then built the power chips.

Silicon carbide is much harder and more brittle than silicon, meaning that it is much more difficult to slice, and far more of the ingot is wasted (40% by some estimates).

Gallium nitride is also seen by industry specialists to have great potential in the power chip arena. Should it be seen considered as complementary or a competitor to silicon carbide?

Gallium nitride power chips took off when a Chinese company started to use them in phone chargers. They are now moving into the laptop space and might eventually come to compete against silicon carbide for some devices.

We would point out, however, that gallium nitride chips, because of their horizontal build, are limited as to the power of the devices they can serve. The more powerful the device, the larger the chip needs to be. Silicon carbide chips, being built vertically, do not have such limitations – making for even better prospects in our view.

To put some numbers on this, silicon carbide currently accounts for 6-7% of the power chip market today vs. ca. 1% for gallium nitride (in value terms, not volumes).

Over the next 5 years, we expect these shares to move up to at least 20% and 5% respectively, which could even be an underestimation given the large amounts of capex that Wolfspeed (the only silicon carbide pureplay) and other industry players are putting to work.

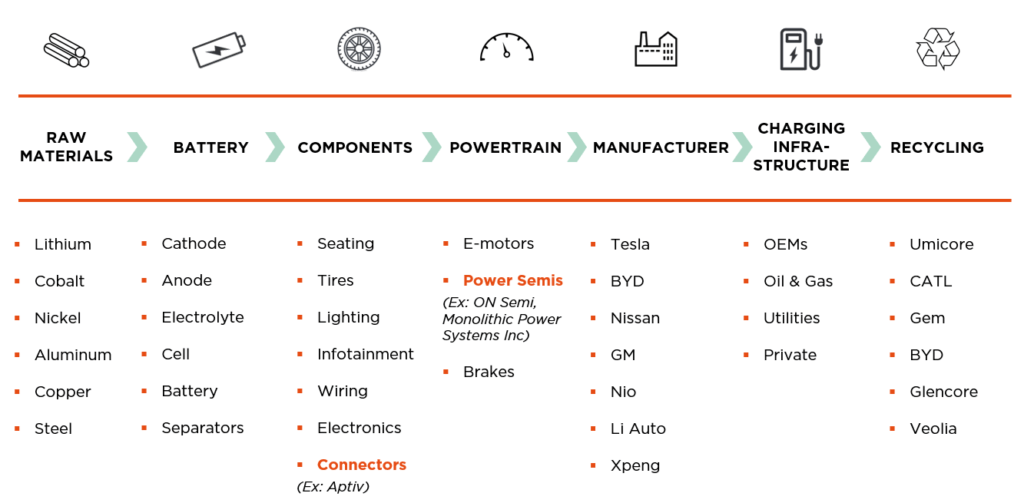

Speaking of the companies involved in this space, could you provide some light on the value chain of an electric vehicle?

As investors, we suggest focusing on the segments of the electric vehicle supply chain (depicted above) that boast the greatest value added, as well as sound business models.

For instance, we like the power semis space, with companies such as ON Semi, where we note relatively high barriers to entry, long-term contracts and a huge tailwind coming from the transition to electric vehicles. Connectors, including companies like Aptiv, are another attractive part of the value chain and stand to benefit from the electrification of the automobile fleet.

Much of our discussion regarding silicon carbide’s potential has revolved around electric vehicles. But there are surely many other potential lucrative applications?

As mentioned at the onset of this interview, power chips are used in a very broad array of devices. Beyond the electric vehicle space, we see massive potential for silicon carbide in other “green energy” technologies, namely solar panels and windmills. And then there is the HVAC (heating, ventilation and air conditioning) space, which is a market that is probably some 50 times larger than the automotive one (in volume terms)!

As an end word, could you touch on the US-China technological rivalry? Where do the two powerhouses stand when it comes to silicon carbide?

Thus far, the strategic tensions between the US and China have been focussed on accessing technology to build high-end central processing units (CPUs) and graphics processing units (GPUs), an altogether different ballgame to power chips.

The US government wants to prevent US companies from selling such leading-edge chips – or the machines to make them – to Chinese companies, as they can be used for artificial intelligence and military applications. China meanwhile is intent on bridging its technological gap vs. the Western hemisphere. The fact that most top-notch chips are currently produced in Taiwan, TSMC having overtaken Intel by leap steps over the past few years, only adds to the tensions.

Although silicon carbide plays no part in this battle, it could become a subject of US-China rivalry at some point in the future. Both countries are certainly investing considerable capital into this arena, not wanting to miss out on the next frontier – smart electrification.

About DECALIA’s Sustainable strategy

- a multi-thematic global equity fund, investing in innovative sectors and disruptive companies shaping our SOCIETY in the future

- invests in the 7 themes (Security, O2 & Ecology, Cloud & Digitalisation, Industrial 5.0, Elder & Well being, Tech Med, Young Generation) regrouped by the acronym SOCIETY

- managed by an experienced team: Alexander Roose (ex-CIO of the Fundamental Equity of Degroof Petercam AM) & Quirien Lemey (ex-Lead PM of a Multi-thematic fund at Degroof Petercam AM)