While I have eventually proved wrong on prospects of gold in the short term (“gold’s rise could very well continue—albeit at a less frenetic pace—in the coming months”), I was right -but perhaps too conservative– concerning Cagliari Calcio as it thrashed Verona 4-0 on Saturday -with some spectacular and beautiful goals, and now sits 11 points above the dreaded relegation zone. For the record, it had been almost five years since my favorite team had won three games in a row, and almost ten years since they had won by such a score (in April 2017 against… Verona). On the markets too, there are a few assets that have long disappointed and languished at the bottom of the rankings and have come back to life suddenly. Think about gold -and other more or less precious metals- for example, but also banks (the sector you loved to hate for 15 years in a row) or EM assets more recently.

In the same time, it was the all about “buy America only” and to the same extent growth, quality and tech stocks. But as the famous French soccer player, Franck Ribery, said famously “la roue tourne tourne” ?!, (i.e. the wheel turns round and round”). So, what is currently unfolding under investors eyes, is exactly the opposite with Gold price ascent over the last few years, actually since Ukraine invasion by Russia about 4 years ago, as the posterchild of the now buzzy “sell America” trade. “Gradually, then suddenly” is also a famous quote from Ernest Hemingway’s 1926 novel, The Sun Also Rises, describing how bankruptcy (or any major change) happens. Don’t misunderstand me: (1) it’s not about selling your whole US assets exposure (fx, bonds or equities), it’s just eventually reallocating them somewhat differently from now, less in favor of US, which therefore means more elsewhere – whether in terms of currency exposure, bonds or stocks allocation. (2) It doesn’t mean that US assets will perform poorly (negative performances) but they may just tend to underperform for a while -depending on the time and scale of the reallocation-

The reasons behind this structural shift are many and varied but the main culprits have clearly been Trump and his politics with:

- US tariffs threats, tricks and treats (putting at risk both the world trade – where the world was flat favoring the hegemony of the greenback- and US external debt financing),

- Very little fiscal discipline with exploding US budget deficits and the subsequent growing fiscal dominance,

- His ongoing bullying of the Fed and his current Chairman challenging de facto the Fed’s independence,

- His geopolitics vision and the fact that the “Western world”, if this denomination still makes sense today, can’t fully and blindly rely anymore on his long-time US ally (his aggressive stance on Greenland, and his current ambiguous position on NATO or concerning the Ukraine situation has just poured more oil on the cooking fire),

- The permanent reminiscence of the Mar-A-Lago Accord’s floated by Trump ally Stephen Miran in the past but still somewhere in the corner of foreign investors’ brain

- And, so on and so forth…

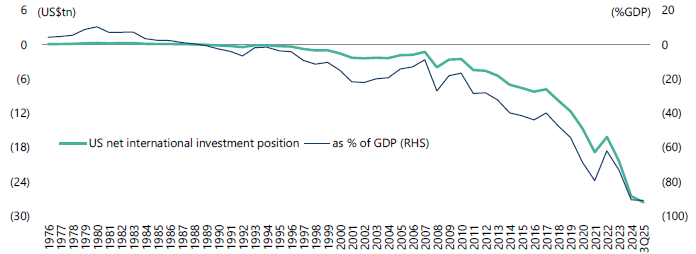

In other words, Trump politics have been the trigger of the bear market in trust (towards the US assets), and gold is just a ticket for that considering that there isn’t really an easy alternative -read safe and comfortable –. In this context the recent risk reversal in gold could be explained by the recent nomination proposal of Kevin Warsh as the next Fed Chairman, who is seen as the least dovish/most credible candidate. Furthermore, this rebalancing may have large consequences and may last for a long time. It’s already the case when you look at the moves of major financial assets -either in terms of speed and scale-. Keep in mind that the United States are dependent on foreign capital to an almost unprecedented degree. US net international investment position, which measures the difference between US residents’ foreign financial assets and foreigners’ holdings of US assets, is thus in a large deficit. It has surged from US$7.8tn or 40% of GDP at the end of 2017 to a record US$27.6tn or 91% of GDP at the end of 3Q25 (see the graph on FRED website), having been in deficit since 1989 (see graph below).

US net international investment position, in $tn (LHS) and as % of GDP (RHS)

Source: Jefferies (Greed & Fear), U.S. Bureau of Economic Analysis https://fred.stlouisfed.org/graph/?g=qF7j

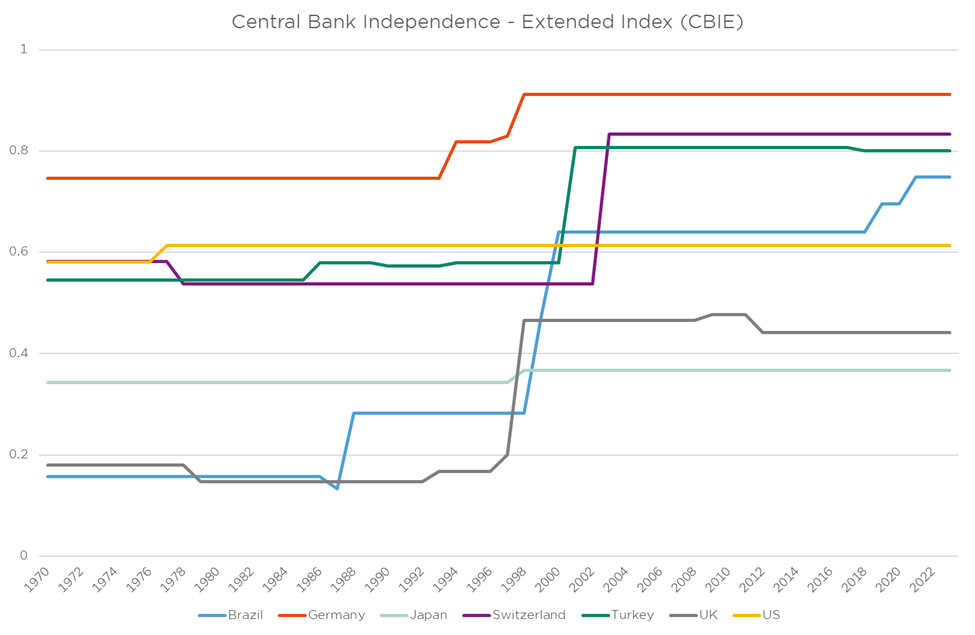

It means there are potentially several USD trillions that could exit the US, more or less quickly (read in a more or less orderly manner), going forward. And the current flows tend to indicate that EM assets, the uninterrupted losers for a long decade, could be the main beneficiaries of the eroding trust towards the US and the subsequent diversification out of the America. As often on the markets, by a system of communicating vessels, “One man’s misfortune can be another man’s fortune”. Against this backdrop, we are warming up EM assets, and especially in EM debt in l.c. as it benefits from the current backdrop (positive global growth, lower USD, stable to declining US/DM policy rates, AI theme – for Asia; rising commodity prices elsewhere) while offering the best relative opportunities in terms of carry, beta to growth and valuations. Moreover, if it could be argued that some developed economies are in decline on different aspects including also politics and institutions on top of economic growth and population. There has been indeed some unnoticed progress in certain areas for some of those emerging markets -at least in terms of financial markets, economic policies, institutions and broader rule of law in general). In any case, the gap between DM and EM is certainly closing as illustrated for example by this index of central bank independence (Davide Romelli, “Recent trends in central bank independence”)

Central Bank Independence Index (CBIE)

Source: https://cbidata.org/

In addition, several EM economies, especially in Latin America, are going through a trifecta of change (geopolitics, monetary policy and election cycle) that could also lead to the emergence of a virtuous circle of better growth prospects, a more favorable investment background in terms of law, initiatives and institutions, renewed interest from global investors and subsequent inflows. As usual, selectivity remains key and it won’t be a smooth and unchallenged ride. There will be doubts, risk-reversals and eventually some disappointments or impatience, but as long as current supportive macro backdrop persists and President Trump continues in the same way, the losers of the last decades may continue to regain some relative shinning within global investors portfolios. To end with another famous quote, attributed to Talleyrand, which I may use to convince the most skeptics on the “brighter” prospects of EM assets: When I look at myself, I feel sad; when I compare myself to others, I feel better (“Quand je me regarde, je me désole; quand je me compare, je me console”). At the end, the beauty is always in the eye of the beholder!

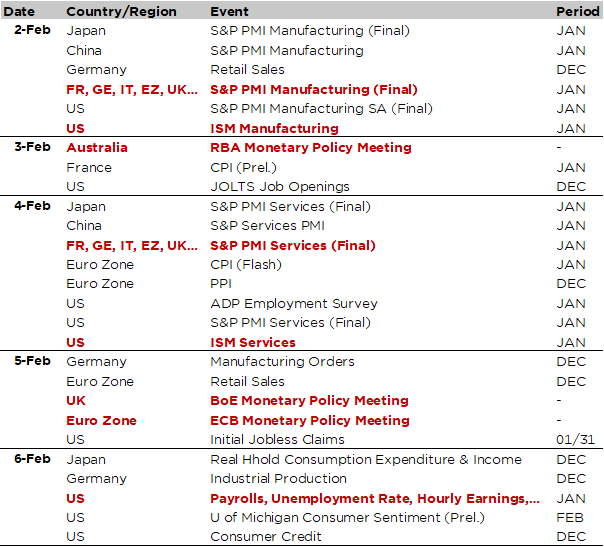

Economic Calendar

Welcome to February, or the season 2 of the “Surviving Volatility” available already on your Bloomberg screens this morning! The season 1 (i.e. January) ended with extraordinary volatility in precious metals prices actions with Silver down -26% and gold -9% last Friday. It seems that Kevin Warsh nomination as the next Fed Chairman has been the straw that broke the (speculative) camel’s back as the greenback experienced a strong rebound and US long rates backed up in the same time. Furthermore, this new season starts with a new US government shutdown, which is fortunately only “partial” and is expected to get resolved before the end of the week.

Without spoiling this new season, the teasers for the week ahead show a dense scenario full of stunts and possible twists and turns as we will get several key economic data releases (global PMIs, US ISM indices, US job report), central banks meetings (RBA, ECB and BoE) and plenty of corporate earnings results. Let’s start with monetary policy: decisions are due from the RBA (Tuesday), the ECB and the BoE (Thursday). While the ECB is widely expected to keep rates on hold in a non-event meeting, RBA and BoE decisions and subsequent press conference could be somewhat more uncertain as the jury is still out there. In Australia, the consensus expects rather a rate… hike from the RBA to 3.85%, or at least restrictive threats or a hawkish hold at 3.60%. This should help to consolidate the recent strength of AUD. For the BoE, a dovish hold remains in the card with a vote split between a few but growing dissenters for easing and a narrowing majority for a hold.

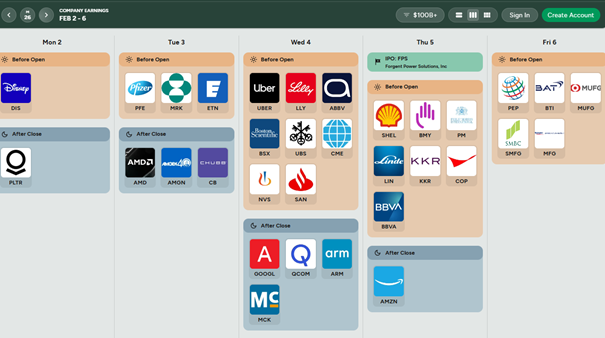

Moving to economic data, the highlight will be the US jobs report for January, due Friday. The consensus expects payrolls to gain +65k (+50k in December), with the unemployment rate steady at 4.4% and the hourly earnings growth rate up +0.3% MoM like in December. In other words, almost no change compared to last month’s report. Before that we will get bot the global PMI and US ISM indices for the manufacturing (Monday) and services (Wednesday) sectors. We expect an improvement, or at least an encouraging trend, in US ISM manufacturing, whereas services activity expansion consolidates with indices remaining above 50 both in the US and globally. Wrapping up with corporate earnings, the focus will be on two Mag7 stocks, namely Alphabet (Wednesday) and Amazon (Thursday), as well as other tech stocks including Palantir, AMD and Qualcomm. Several large healthcare firms will also report, including Eli Lilly, Pfizer, Merck & Co, McKesson, or Novartis and Novo Nordisk in Europe. Other US large caps reporting feature Pepsi, Walt Disney and Uber. Elsewhere, the focus will also be on a number of banks in Europe and Japan (BBVA, UBS, Santander, MUFG) among others large companies to watch in those markets.

Non-exhaustive list of major earnings releases over the week (market cap > $100bn)

Source: https://earningshub.com/earnings-calendar/week-of/2026-02-02

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.