No miracle for the Cagliari Calcio -and subsequently for Inter Milan fans- last Friday evening as my favorite team lost “logically” against the Napoli. However, its “sustainability” in Serie A was already in the cards. The sustainability story has been somewhat less rosy as far as US government debt is concerned last week on the back of Moody’s US credit rating downgrade to Aa1 from Aaa, which wasn’t really a surprise as it occurred… 14 and 2 years after the one notch downgrade from S&P and Fitch respectively from their top rating. However, add to that weak demand at the long JGBs and US Treasuries auctions, focus attention on this US fiscal risk as the big but not so beautiful US tax bill is making its way through the Congress, and overall uncertain economic policy settings going forward -including the Fed- due to Trump erratic management and, as a result, last week backup in global long yields, but especially in the US, was more concerning than reassuring for risk assets.

Indeed, the recent rise in long yields is likely the number one threat for the global markets. If it wasn’t the case until recently it was because the rebound in long rates from the lows experienced just after the “Liberation Day” chaos (US 10y yield reached 4.0% at that time) was essentially related to a recession relief. As investors got more relaxed about the downside risks on growth, both rates and equity markets recovered in tandem. Note that higher rates aren’t always detrimental to risk assets… you have to basically understand what’s driving the upward move in rates, consider valuations and have also a look at the inflation expectations component eventually. At current 4.5% level for the US 10y rate and considering the points here above, with investors’ concerns shifting lately from recession fears to debt sustainability concerns, further upward pressures on long rates -not really related to a meaningful improvement in growth prospects- will represent a big headwind for risks assets and may even lead to troubles for equities (and credit) market, as well as for the greenback. The good news? The converse is also true! Risk assets, and especially equities, may benefit for some Fed’s relaxation about inflation risks, a not too hot economy, a somewhat cooler US job market, and who knows, a quiet, silent and inconspicuous Trump. That could be a true miracle for the incoming months, is not it?

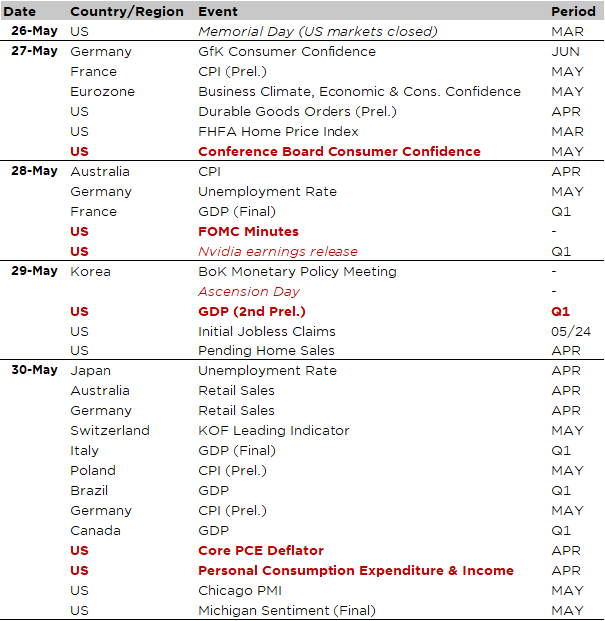

Economic Calendar

While the number of working days will deflate this week due to the US Memorial Day and UK Bank holiday on Monday (US markets will be closed today) as well as the Ascension Day on Thursday, the inflation theme will strike back with a vengeance on Friday with the releases of US April PCE deflator and the preliminary print of German May CPI. Furthermore, investors will also assess the “ascent” trend, or not, of several economies as Q1 GDP growth figures -either 1st, 2nd estimates or final ones- from the US, Europe, Brazil or Canada will be out. Finally, we will also get the minutes of the latest FOMC meeting on Wednesday evening, followed by the Nvidia Q1 results once US markets close.

The main macro highlight will thus be the release of core PCE deflator, along with the personal consumption expenditures, income and saving rate for April, on Friday. The consensus expects a small MoM% change (+0.1%) for both the headline and core index, which should lead to a marginal decrease in YoY pace to 2.2% and 2.5%. Consumption and Incomes are expected to have grown modestly (around +0.2%-0.3%) last month after stronger gains the prior month. Other notable economic indicators due in the US this week include April durable goods orders and Conference Board’s consumer confidence for May (tomorrow).

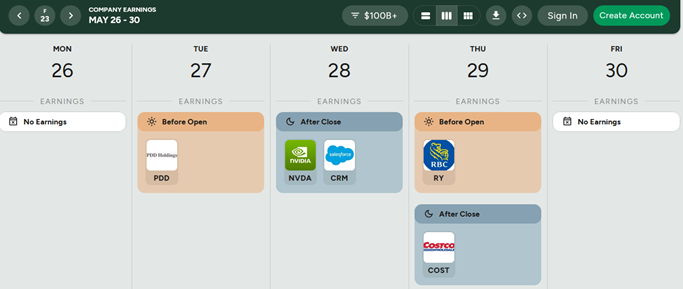

Non-exhaustive list of major earnings releases over the week (market cap > $100bn)

Source: Week of May 26, 2025 | Earnings Calendar | Earnings Hub

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.