Much Ado About Nothing

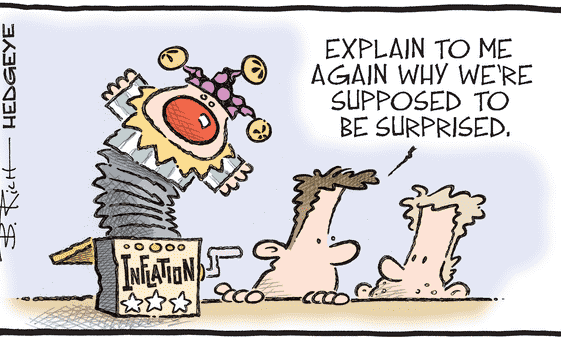

“The time has come for [monetary] policy to adjust” according to Jerome Powell during its speech at Jackson Hole last Friday, opening the door for a rate cut in September. The main uncertainty remains the path of these incoming cuts: gradually in case of a soft landing (and somewhat sticky services inflation) -our base case […]