Is this economy different?

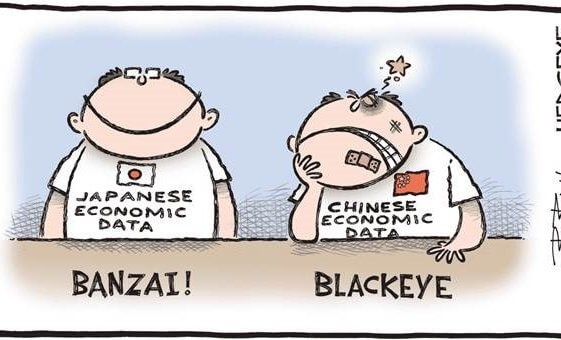

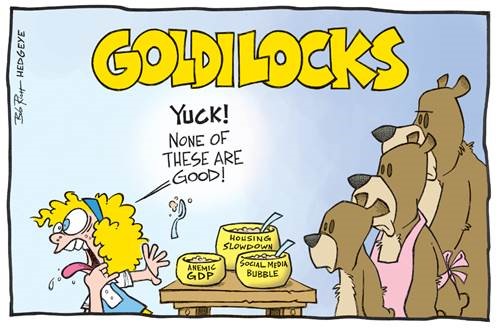

In general, seasoned investors are wary when they hear or read somewhere that “this time is different”. Interestingly, there have been plenty of articles in the financial press lately about China turning eventually Japanese. With weakening growth and inflation already nearing 0%, the current 2nd largest world economy seems indeed on the brink of experiencing […]