You don’t have to have good news for things to get better; you just have to have less bad news. Such is the case with Cagliari Calcio, who may have lost to Udinese (1-2) at the weekend, but it is now one step closer to staying in Serie A thanks to … the defeats of their main rivals in this survival fight. With a 7-point lead over the first relegation zone and 9 points at stake (3 matches), the “Liberation” day is getting closer for my favorite soccer team and my self-esteem. Same could be said for markets, by adding the following corollary: “The best returns often come when things go from awful to just bad”, which is now making the infamous “Trump’s Liberation day” a distant memory… just after one of the most tumultuous months in financial markets.

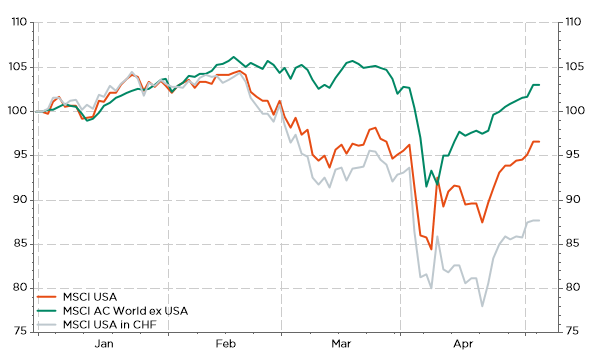

With the always perfect insights of the rear-view mirror, the impressive rebound of equities could be explained by the extreme pessimism and the subsequent underweight positioning, good news from Tech companies lately confirming that the AI story remains intact so far, lower probabilities of an imminent US recession thanks to still resilient hard data, including a supportive US jobs report last Friday, as well as, obviously, some concessions and potential trade deals that will lighten the bill -in terms of economic damage- compared to the initial announcement of US reciprocal tariffs.

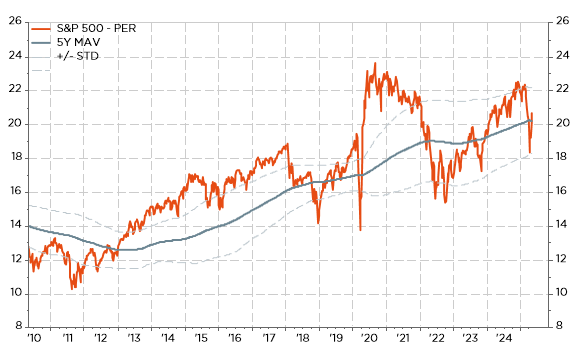

While the outlook seems therefore less awful than a few weeks ago, there are still many downside risks on growth and a lot of uncertainties. Not only on the global equity outlook, and especially on the US equity market, where valuations are not supportive, or cheap enough, to add some risk at this very uncertain stage, but also on the US bond market. Trump tariffs have indeed increased the risk premium attached to US assets with the greenback as the main atonement victim.

S&P500 Price/Earnings Ratio: fairly valued assuming US avoids a recession

And the biggest loser is… US equity market has rebounded but are still lagging YTD, especially when adjusting for the currency impact

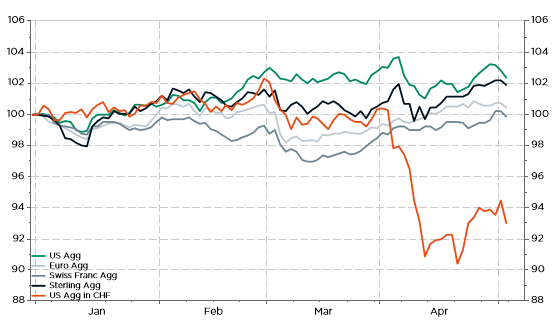

Turning to the fixed income market, the narrative is similar: US bonds are clearing lagging YTD when adjusting for the USD depreciation, while the outlook for US rates remains more uncertain than elsewhere. In fact, even the Fed, which meets on Wednesday, will continue to play for time by deciding not to choose as it remains torn between its two objectives. For the time being, unemployment rate remains close to historic low, whereas inflation has been over its 2% target for the last 4 years. The former is expected to pick up, while the latter has been trending down. The double shock of tariffs & uncertainty is likely to increase unemployment but also push inflation higher again. So, what happens next? Should it support maximum employment by lowering policy rates, or continue focusing on price stability? It will be a delicate balance for Jerome Powell and his colleagues to decide which is the most unbalanced part of their mandate requiring the most urgent reaction.

Selected Aggregate Bond Index: US IG bonds are clearly underperforming when taking into account the currency risk

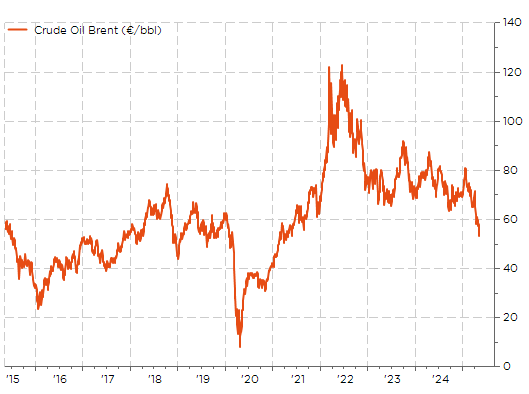

In the meantime, European central bankers are experiencing relatively less uncertain or challenging times as far as the direction of policy rates and monetary policy stance are concerned. Inflation is trending down faster and is already or will soon be back to their targets, especially as it has been less related to (services) wages inflation than in the US, their economies haven’t been so much under steroids and thus economic growth has been moderate, at best, on our continent, while tariffs threat risks are more tilted towards weaker growth than stickier inflation going forward. Furthermore, the recent decline in energy prices and the indirect appreciation of their currency, thanks to the overall depreciation of the greenback, will help further the disinflation process in Europe. In other words, European central banks current task should be easier by opting, without much hesitation, for an easing direction.

Mind the (steep) decline in energy prices in Europe YTD

Against this backdrop, the outlook for European bond’s market over the next few months seems to me far less challenging than the US one. While the reward could eventually be higher with US Treasuries, especially in the case of a recession, I fear that their overall volatility and embedded risks (public deficit, inflation, currency, geopolitics) will act as powerful if not structural headwinds. Keep in mind that the term « credit » comes indirectly from the Latin verb credere, meaning « to believe » or « to trust »… That’s why US bonds deserve more than ever an underweight in a global bond allocation.

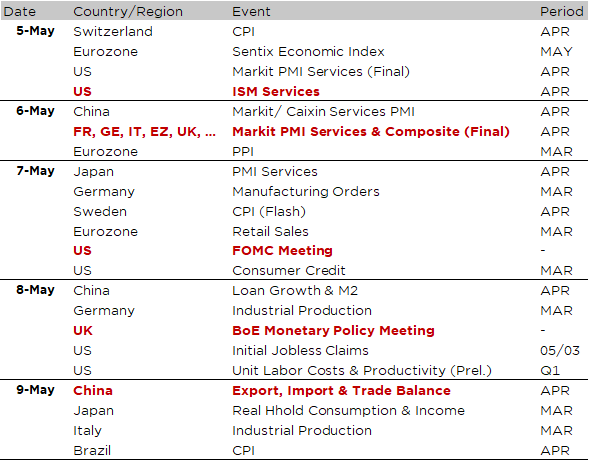

Economic calendar

Excluding hypothetical Trump’s tweets, pump fakes and skids, it should be a slightly quieter week as far as economic data and corporate earnings releases are concerned. However, it will be worth keeping an eye on:

- The monetary policy decisions from the Fed (Wednesday) and the BoE (Thursday). In the US, there should be no surprises as the Fed is widely expected to stay put with policy rates unchanged at 4.25%-4.50% (note that there won’t be any economic projections and dot plot this time). The press conference afterwards should be more interesting, although I can’t imagine Jay Powell retorting or sending even indirect jabs at Donald Trump. However, I do think he’ll take the opportunity to dot some i’s and cross some t’s, explaining why the Fed isn’t cutting rates (for now), especially when it comes to the tension between growth and inflation risks… due to some extent to US trade policy. More challenging and potentially funky, the Q&A following the testimony of US Treasury Secretary Bessent to the House Appropriations Committee on Tuesday, could be. Finally, in the UK, the BoE will likely make a dovish turnaround in both rhetoric and facts with a -25bps cut to 4.25%.

- The US ISM services index (today), which has been waning of late (50.2 expected vs. 50.8 in March), as well as the prices sub-component (60.9 last month). In Europe, PMI Services, which have been rather stable recently but still below 50 overall, will be released tomorrow.

- April trade figures from China (Friday) to assess the first impact of the US tariffs on China’s trade.

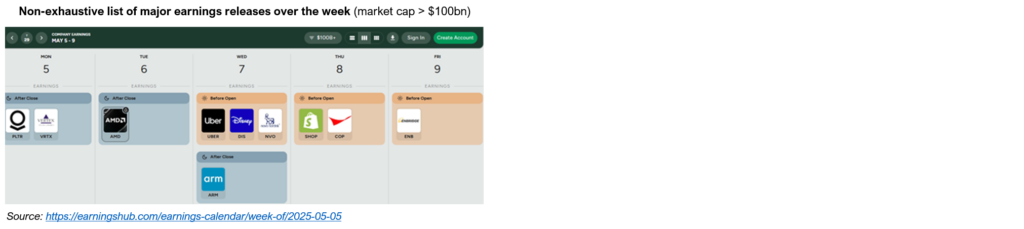

Finally, in corporate earnings, not many mega caps (>100bn) will be reporting this week. However, there are still plenty key companies reporting over the next few days, including tech companies such as Palantir, AMD, Shopify and ARM, on top of Walt Disney, Uber and Vertex in the US. In Europe, earnings are due from Novo Nordisk, Ferrari, BMW, AB InBev and Rheinmetall, while we will get the results from Toyota and Nintendo in Japan.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.