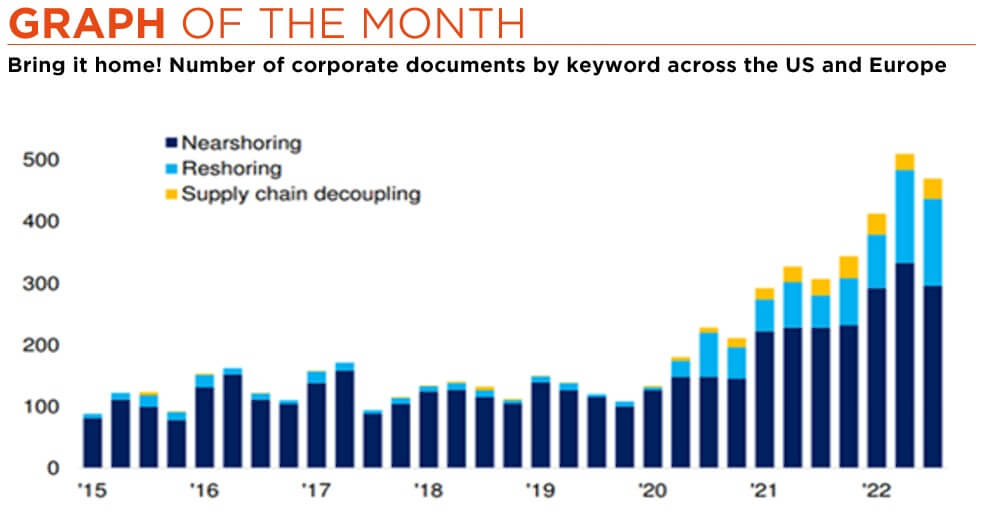

- Geopolitical tensions and procurement constraints are supporting a reshoring trend

- Particularly so in “critical” industries such as semiconductors and pharma/biotech

- Semiconductor equipment companies stand to figure among the prominent beneficiaries

Global dependency on a few specific regions for semiconductor and pharmaceutical manufacturing has long been a concern. In both of these critical industries, a shift towards reshoring — bringing manufacturing back to home countries — has been gaining traction recently. A move driven by a number of factors, including geopolitical tensions, supply chain disruptions, and the desire for technological and medical independence.

Taiwan currently produces more than 60% of the world’s semiconductors, a share that even exceeds 90% for the most advanced chips. Yet the country’s geopolitical situation is delicate: while operating as a sovereign nation, it is considered by China as being part of its territory. This dynamic has led to concerns about potential disruptions in the semiconductor supply chain, particularly given China’s increasing assertiveness in the region. Indeed, President Xi Jinping has openly spoken of reuniting Taiwan with mainland China, as reported by the Guardian: “We should actively oppose the external forces and secessionist activities of Taiwan independence. We should unswervingly advance the cause of national rejuvenation and reunification.” Xi has also ramped up China’s military capabilities, especially naval forces.

The fact that Taiwanese semiconductors are for the largest part manufactured by one single company, Taiwan Semiconductor Manufacturing Corporation (TSMC), only serves to amplify sourcing concerns, leading many nations to consider reshoring as a means to mitigate potential risks. For advanced semiconductors are not only used in smartphones, computers, artificial intelligence and data centres. They also play a critical role in defence and military applications, with radar and sonar systems, guidance/control of missiles and drones, and cybersecurity being but some examples of applications that require advanced chips. It should thus come as no surprise that countries across the globe are today re-evaluating their security needs and procurement chains.

In the US, to address these challenges, Congress passed the CHIPS Act of 2022, which includes semiconductor manufacturing grants, research investments, and an investment tax credit for chip manufacturing. Similar incentives to bring back or boost domestic semiconductor manufacturing are at play in many other countries and regions, aggregating by some estimates to a whopping USD 66 billion per annum, over the next five years.

Note that the US government also introduced export controls on 7 October 2022, which were then updated in October of this year, so as to limit shipments of AI chips and semiconductor capital equipment into multiple regions of interest for the commerce department, including China and Saudi Arabia. This, of course, to prevent the latter from using them (in the case of AI chips) or bolstering their own production (in the case of equipment).

And such restrictive measures are not limited to semiconductor manufacturing. For example, on 12 September 2022, US President Biden signed an executive order to launch a National Biotechnology and Biomanufacturing Initiative designed to bolster the domestic supply chain, reduce reliance on foreign materials and bioproduction, and protect the US biotech ecosystem.

It is thus clear that a major shift away from globalisation and towards local production is currently underway. The time when companies operating in a broad array of industries would seek out manufacturing possibilities in faraway locations – to take advantage of cheaper labour, lower rents and less stringent regulation – is seemingly coming to an end. For investors, this also brings opportunities. An obvious place to look for beneficiaries is in the semiconductor capital equipment sector, i.e. companies of the likes of Applied Materials, ASM International or ASML. Indeed, once built, all the new fabs will need to be filled with capital equipment…

Written by Quirien Lemey, Senior Equity Fund Manager

Higher for (much) longer policy rates

- Macro backdrop – Mind the divergences and the global forces at play

- Still cautious overall, despite the absence of recession and emerging pockets of value

- Bottom-line: Don’t (yet) take a Walk On The Wild Side

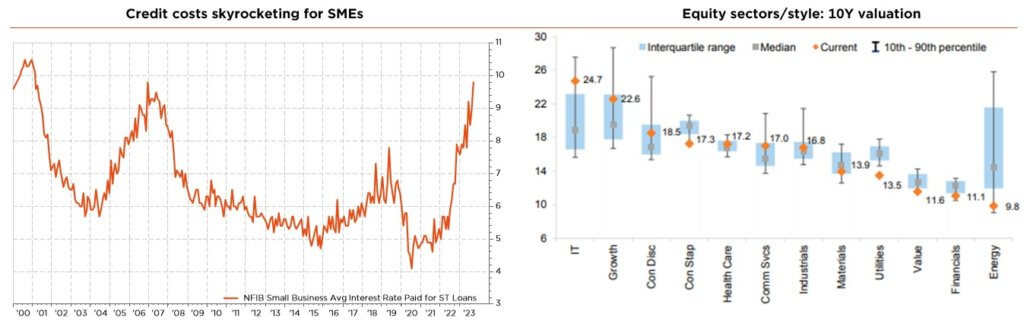

“Higher for longer” seems to have become a stark reality for investors, forcing them to further reprice expectations in what proved another volatile month for global financial markets. A combination of negative factors eventually led to a bond sell-off: “higher for longer” policy rates, surging energy prices, the BoJ to soon abandon yield curve control, and concerns regarding persistent budget deficits at a time of central bank QT. Meanwhile, though slowing, economic activity remains resilient, inflation is sticky but receding, destocking trends have likely peaked, labour markets are showing signs of easing, and the central bank hiking cycle is finally coming to an end. Regional and industry divergences persist, however, with trends in Europe subdued, China struggling to implement bazooka stimulus measures, and credit tightening starting to hurt smaller enterprises – just as tensions in the Middle East are again flaring up after the attack of Hamas on Israel.

Our macro scenario still foresees an economic slowdown, with lower but sticky inflation leading to hawkish “hold” monetary policies for the time being. The services recovery is now almost complete, but a large part of the slowdown is the result of tighter monetary policy required to tame inflation. This is indeed starting to bite, although its transmission is uneven across countries, industries and company sizes. DM labour markets remain healthy, with historically low unemployment helping support activity but also acting as a floor for inflation. We thus anticipate a continued tug of war between restrictive monetary policy headwinds on the one hand and unusually resilient growth/sticky inflation on the other… until something eventually breaks, particularly given persistent latent risks (energy prices, Chinese structural woes, growing debt supply or deepening geopolitical fragmentation). With this mind, we are keeping a tactically prudent stance on overall asset allocation.

The latest corporate results have once again spoken for themselves, with still no sign of the great earnings depression predicated earlier this year. We believe the stabilisation in earnings should continue to reassure investors, prompting lower sensitivity to rippling interest rates going forward. In terms of valuation, there are still some attractive pockets of value to be found, notably in selective high-quality equities in Europe, financials, energy and, to a lesser extent, small- and mid-caps. In this context, we have reshuffled our regional equity preferences, adding some exposure to higher quality value by upgrading the inexpensive Eurozone to a slight overweight and adopting a more cautious stance on EM – where we see higher rates, a stronger USD and greater geopolitical uncertainties further weighing on the segment’s already negative earnings momentum and unattractive relative valuation (ex-China).

With long rates having continued to edge higher, reaching a peak since 2007, we now view them as fairly valued, encouraging us to again add back some duration (favouring convex instruments). Furthermore, looking ahead, we cannot rule out some cracks or fault lines as excess savings are running down, inflation is trending lower and the economy will slow sooner rather than later, suggesting that the next refinancing needs will likely emerge at a time when both economic and financial conditions are not so favourable. In other words, monetary policy stands to bite, potentially quite severely at some point, with the view that long govies may ultimately prove a safe haven if nominal growth collapses. All in all, we stick to our slight underweight stance on fixed income and remain below neutral in terms of duration risk.

The impact of higher rates on certain asset valuations and/or expected IRR will likely take longer than previously anticipated. In this context, we reiterate our cautious stance on real estate (now downgraded to underweight), while moving market neutral & uncorrelated strategies up one notch to a slight overweight. And we continue to recommend a selective approach in private debt strategies and direct investments.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

External sources include: Refinitiv Datastream, Bloomberg, FactSet, Alphasense, Deutsche Bank