Interview with Roberto Magnatantini, CFA, Senior Portfolio Manager and Iana Perova, Equity Analyst

- It is not just AI that is creating the buzz these days! A new category of anti-obesity drugs has also been in the limelight since Elon Musk openly admitted to using Novo Nordisk’s Wegovy to lose weight.

- That Elon Musk does not, strictly-speaking, qualify as obese and that he is taking the drug on an off-the-shelf basis, matters little.

- The truth is that such “miracle” drugs do offer the promise of breaking the obesity pandemic – and its cohort of associated comorbidities – that so burdens our societies.

We’re introducing our new Wellness Series, where we shine a spotlight on the most captivating health trends, bringing you insights into the most recent and intriguing developments in the realm of well-being. So, grab your beach towel and get ready to dive into a world of wellness, with this first edition focusing on the obesity market and its latest promising solutions.

It is not just AI that is creating the buzz these days! A new category of anti-obesity drugs has also been in the limelight since Elon Musk openly admitted to using Novo Nordisk’s WegovyÒ to lose weight. That Elon Musk does not, strictly-speaking, qualify as obese and that he is taking the drug on an off-the-shelf basis, matters little. The truth is that such “miracle” drugs do offer the promise of breaking the obesity pandemic – and its cohort of associated comorbidities – that so burdens our societies.

Iana and Roberto, could you start by providing some facts and numbers about the obesity pandemic? Is it truly mainly a US problem?

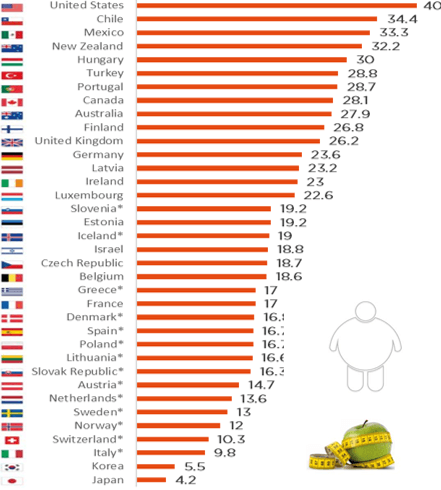

With 40% of over 15 year olds qualifying as obese, meaning that their Body Mass Index (BMI1) is above 30, the US is clearly at the forefront of the obesity pandemic. But, as the chart below illustrates, the problem has now become very much global, with obesity rates exceeding 20% in more than a dozen other countries.

Obesity Rates in % Total population (aged >15y.o.), 2016 or latest year

Note: * means that self reported height and weight data are used in these countries, while measured data in other countries.

Source: OECD (2018), OECD Health Statistics 2018

What has driven such a progression in obesity rates? And is it also correct to say that the social perception of obesity is changing, no longer solely attributing it to a lack of personal discipline?

The progression in obesity rates is driven by a combination of factors. Physiologically, the human brain is wired to enjoy eating especially sweet foods, which becomes troublesome in a world with constant access to food. The prevalence of processed and convenience foods has been shown to contribute to weight gain even with similar calorie intake, making healthy eating a greater challenge.

Indeed, the perception of obesity is evolving, recognizing that it is not solely a result of personal discipline but also considering the complex nature of the condition. While reducing calorie intake and increasing exercise are key to weight loss, long-term success is difficult, particularly for those with a long history of obesity, including from childhood. With that being said, a less stigmatizing approach is being adopted towards obesity, encouraging a healthier lifestyle without guilt.

Let us now move to potential medical solutions: what is in the pipeline?

One of the primary consequences of obesity is that it often leads to diabetes. The diabetes.co.uk platform, for instance, indicates that “obesity is believed to account for 80-85% of the risk of developing type 2 diabetes”. Unlike type 1 diabetes which is a genetic condition that develops from birth, type 2 diabetes has indeed more to do with lifestyle – as well as, more generally, ageing demographics – hence its labelling as an obesity comorbidity.

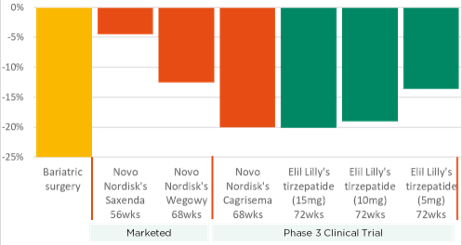

Empirically, it has been observed that type 2 diabetic patients taking GLP-1 medication, a class of drugs that targets metabolic hormones, tend to experience a considerable loss of weight, in some cases approaching what can be achieved through much more invasive surgical “solutions”, also known as bariatric surgeries. This is because GLP-1 drugs slow down the rate of stomach digestion and have a dampening effect on appetite.

Change in weight loss from baseline (adjust. placebo)

Source: Jefferies Research, DB Research

These weight loss benefits, with relatively modest side-effects (as per the decade or so of data now available) have led to these drugs being used by doctors to treat obesity on an “off-label” basis for some years already. As for “on-label” usage, it has been possible since 2021, when Novo Nordisk received such FDA approval for its Wegovy® drug.

1BMI = weight (in kilograms) divided by height (in metres) squared

What is the potential market size of the anti-obesity pharmacotherapy market?

In an extreme scenario, that would see the 100 million obese Americans be treated with GLP-1 drugs for USD 10’000 per annum, the potential annual market would amount to USD 1 trillion – for the US alone! This is a provocative and unrealistic scenario of course, but it does serve to highlight the untapped potential of such a solution.

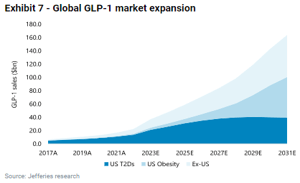

More realistically, obesity is seen to be a USD 50 billion opportunity by 2030 in the US and a similar amount outside of the US. Adding diabetes takes the total to ca. USD 150 billion which, as a point of comparison, would be roughly equivalent to current oncology revenues. Of course, unleashing such potential is not just a matter of having the medical need and solution.

It also requires doctors being willing to prescribe the drugs for obese patients without type 2 diabetes comorbidities and insurance/state medical plans being willing to cover their cost.

Acceptation by physicians already seems on good track and should only increase further under the effect of ongoing pharmaceutical lobbying to make obesity a “medical condition”. This is needed to unlock insurance coverage, which is currently the main barrier for broad-based adoption of anti-obesity pharmacotherapies. A tug of war is effectively underway, opposing the industry (that seeks to increase adoption) and insurers (that seek to rein in costs). In order to up the pressure on payors, Novo Nordisk is currently investigating whether patients taking WegovyÒ have lesser risk of cardiovascular events (known as the SELECT2 study). A positive outcome would bolster the cost-benefit of reimbursing GLP-1 treatment of obese patients. Such studies are important to demonstrate the potential for cost savings in healthcare systems, with obesity currently representing an annual burden of nearly USD 173 billion for the US healthcare system alone3.

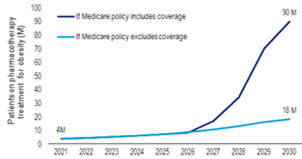

Still, coverage by Medicare, the state insurance plan for the elderly, is not expected before 2025-2026 – with private health insurers to probably follow. The chart below shows how much the adoption curve of obesity medication depends on Medicare. If coverage does indeed come to be included from 2025-2026 onwards, the number of patients treated will literally take off.

Source: BofA Global Research

2 Semaglutide Effects on Heart Disease and Stroke in Patients With Overweight or Obesity

3 Source: cdc.gov (Centers for Disease Control and Prevention)

You have already mentioned Novo Nordisk, but what are the other companies active in the space?

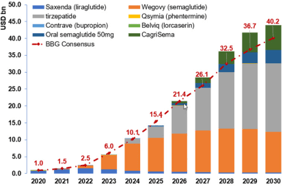

Novo Nordisk is clearly the first mover in the obesity market, and also a pureplay. It is building up a very competitive portfolio, which already comprises two GLP-1 drugs: SaxendaÒ (5-10% weight loss) and the afore-mentioned WegovyÒ (15-20% weight loss). And it is developing a new and even more potent compound, CagrisemaÒ, that targets 20%+ weight loss – on par with bariatric surgery.

In the role of the challenger is Eli Lilly, with a much more diversified therapeutical profile. In the diabetes field, which accounts for half of total company sales, its MounjaroÒ drug was approved in 2022 by the FDA for type 2 diabetes and stands to gain anti-obesity approval by the end of this year. During the trials, depending on the dosage, MounjaroÒ induced weight loss similar or greater than WegovyÒ, making it a serious competitor.

We should also mention Zealand Pharma, a small Danish biotechnology company focussed, like Novo Nordisk, on peptide-based drugs for metabolic diseases. As well as CMO and CDMO companies such as Swiss Bachem, that manufacture these peptide components.

Expectations for patients on pharmacotherapy treatment for obesity

Global Net Sales: Branded Anti-Obesity Drugs

Another opportunity relates to producers of continuous glucose monitoring (CGM) solutions, such as DexCom, Abbott or Insulet. These provide patients with continuous updates on their blood glucose level, allowing it to be kept within a normal range. Which is very different to the conventional approach to glucose monitoring, involving strips and blood glucose meters (BGMs), with patients having to prick their finger up to ca. 15 times a day.

That said, given the potential size of the obesity market alluded to above, it would be surprising not to see more companies join the fray over the coming years.

As an end word, could you touch on the risks in predicting such a promising future for anti-obesity treatments and the companies that develop them?

First and foremost, as always in the pharmaceutical industry, are the risks of non-approval and/or of serious negative side-effects becoming apparent. Then, more specifically to GLP1 drugs, is the fact that weight loss in most cases reverts as soon as patients stop the treatment, implying the need for a lifetime prescription.

Pricing is also a potential risk, given the huge margins currently enjoyed by GLP-1 drugs (being made of peptides that are relatively easy to produce).

Downward price pressure could be exerted by payors or by new players entering the market, somewhat akin to what has happened to insulin, which is now effectively a commoditised product.

Another risk is valuation, as these stocks currently trade at high multiples given the current market hype surrounding anti-obesity drugs. We consider this to be more of a short-term risk, however. On a longer term perspective, consensus expectations regarding the potential market size appear relatively conservative in our view, mostly because many investors still expect reimbursements to be limited in the future.

To conclude, with continued advancements in medical research, the future looks promising for combatting obesity, paving the way for individuals to embrace healthier lifestyles and for our healthcare systems to curb costs.

Roberto Magnatantini, CFA, Senior Portfolio Manager,

Iana Perova, Equity Analyst

About DECALIA’s strategies exposed to the subject of this newsletter:

- DECALIA Silver Generation is a thematic strategy investing into companies that will structurally benefit from the longevity trend. The strategy intends to capture opportunities across the full spectrum of the longevity value chain: Consumption plays, Healthspan plays and Transformational companies.

- DECALIA Sustainable SOCIETY is a multi-thematic strategy investing in the 7 themes (Security, O2 & Ecology, Cloud & Digitalisation, Industrial 5.0, Elder & Well-being, Tech Med, Young Generation) that will shape tomorrow’s SOCIETY. The Elder & Well-being & Tech Med themes currently represent 22% of the fund.

- Both strategies are managed by an experienced investment team.

About DECALIA SA

Established in 2014, DECALIA SA is a Swiss investment management company. With more than 70 employees and assets under management that stand at €4.9 billion, DECALIA has expanded rapidly, in particular thanks to its active-management experience built up over the last 30 years by its founders. The strategies developed by DECALIA focus on four investment themes deemed promising in the long term: the disintermediation of the banking sector, the search for yield, long-term trends and market inefficiencies. DECALIA is regulated by FINMA through a collective assets manager’s license. In addition to its Geneva headquarter, the group has offices in Zurich, Milan & distributors of the DECALIA Sicav in Spain & Germany.