- Physical inactivity is associated with increased prevalence of disease and premature mortality

- Conversely, regular exercise brings about proven benefits – for the body but also the brain

- There is no age to begin, although habits earned as a child tend to support lifelong participation

More than just another running competition, the early December Course de l’Escalade has become a true Geneva tradition. And what drives thousands of participants, of all ages and levels, to regularly don their sporting gear despite bleak autumn weather conditions and dwindling daylight time.

Beyond the actual results on the day of the race, such regular activity has been shown to yield numerous benefits: physically but also mentally, and both from an individual standpoint and for society at large.

Did you know that Arsenal let go of Harry Kane as a junior because he was “a bit chubby” ? Or that David Goggins, considered to be one of today’s fittest and toughest athletes, stood close to 135 kgs when he embarked on his quest to become a US Navy SEAL? Nor need age be an obstacle to sporting prowess.

Ed Whitlock was not only the first 70+ person to run an under 3-hour marathon, but later (when 85) became the most senior person to complete the 42.195 km distance in less than 4 hours.

As for Harriette Thomson and Fauja Singh, rookie marathoners at ages 76 and 89, they then continued to take part in such events into their 90s and 100s respectively. And we should also mention Diana Nyad, whose epic swim from Cuba to Florida at age 64, after several attempts since her twenties, is currently all the rage on Netflix.

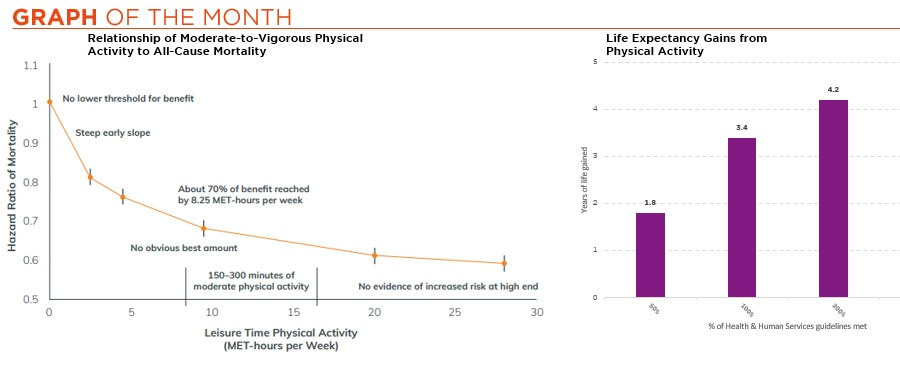

The impact of sport on physical well-being is well-documented in medical journals and spans a broad range of areas. Indeed, regular exercise has been shown to serve as a protective factor against many noncommunicable conditions, such as cardiovascular disease, stroke, diabetes, osteoporosis and some forms of cancer. It is thus key in ensuring not just a longer life expectancy, but also a better quality of life during these additional old age years. A notion that we at DECALIA term “healthspan”.

Physical activity also induces proven benefits on brain health and cognitive functions – that start to be visible after just 10 minutes!

And thanks probably to the production of endorphins, it brings about positive emotions and behaviour or, put differently, lessened symptoms of anxiety and depression.

Not surprisingly, a Canadian study of activity patterns and mental health during the Covid-19 period showed that both declined in tandem, with pandemic-related restrictions worsening (what were already declining) rates of physical activity, particularly so in certain demographic groups and neighbourhoods. Roman poet Juvenal had it all understood when he wrote almost 2000 years ago that one should pray for a “mens sana in corpore sano” (a healthy mind in a healthy body).

As for societal considerations, healthier ageing is obviously key to reducing overall medical system costs and enhancing cohesion within communities. Importantly, policymakers can play a part in staging conditions that are supportive to greater physical activity. Starting, if possible, from a young age, since it has been shown that lifelong sporting experiences and habits influence the extent to which adults continue to engage in physical activity at older ages.

The new class of GLP-1 drugs also deserves a word of mention in this regard. Developed to fight type 2 diabetes, they happen to induce considerable weight loss, in some cases approaching what can be achieved through much more invasive bariatric surgery. This is because, alongside helping the body produce insulin only when necessary and limiting the glucose generated by the liver, they slow down the rate of digestion and have a dampening effect on appetite. As such, they are now being used also as a treatment for obesity and can help jumpstart a virtuous cycle – whereby a person sheds enough weight to be able to begin some form of physical activity, which helps further the weight loss process.

As closing words, and hoping to have convinced our readers about the power of sport, may we perhaps challenge them to consider participating in the Geneva Course de l’Escalade as one of their 2024 goals?

Written by Roberto Magnatantini, Senior Equity Fund Manager

Enjoy the Christmas ride

- Equities – Upgraded to neutral, on a Santa Goldisocks backdrop

- Bonds – Adding to eurozone govies, where rate cuts and lower rates overall are more likely

- Forex – Shallow USD depreciation in the absence of better alternatives

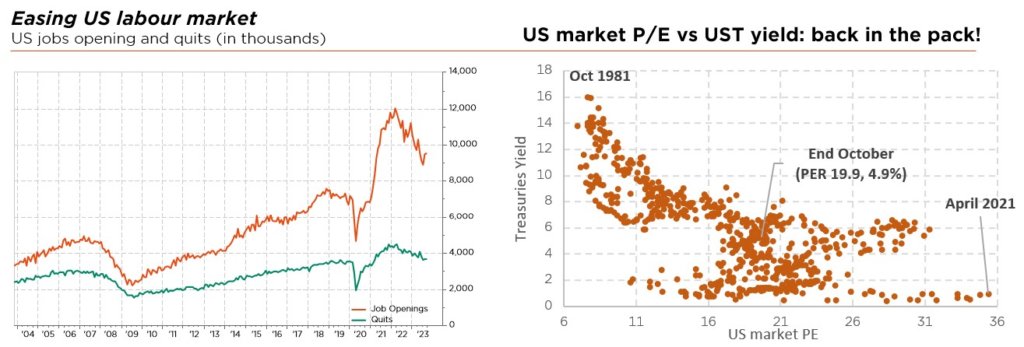

A soft landing scenario is now consensual, with recent market-friendly data signalling resilient growth (solid US consumption, European de-stocking over, government support in China), continued disinflation trends, and central banks now clearly on hold.

As for the latest geopolitical concerns, they have largely taken a backseat, driving bonds yields lower again and providing an early relief Christmas gift for investors.

Meanwhile, the Q3 reporting season proved just fine. Despite a well-flagged slowdown, corporate results once again spoke for themselves (mixed top-line trends but improved margins) – with still no signs of an imminent earnings depression. Consensus expectations for flat global earnings this year and a 10% rebound in 2024 thus remain valid, in our view. Moreover, looking beneath the surface of expensive global, and especially AI-powered US, equity indices still reveals attractive pockets of value.

Both peaking rates and a more upbeat earnings outlook support today’s controversial lower risk premia, with relative valuation opportunities in Europe, energy, and most small- and mid-caps in particular.

In fixed income, the long end of most DM sovereign curves now seems fairly valued to us, but we continue to favour short maturities (including cash instruments). Indeed, the yield curve may remain inverted for longer in a higher rates policy regime, while we still question the duration buffer potential of govies in a scenario of sticky inflation, “hawkish hold” monetary policies, government debt (over-) supply and milder recession (positive correlation with equities).

As far as credit is concerned, we see only few pockets of value, mainly in hybrid/subordinated bonds and in 1-5y IG European corporate bonds with a buy & hold approach. We thus still recommend a selective and overall “up quality” stance, staying away from most fragile segments or issuers.

Within the forex space, this is not the first time in 2023 that the USD has experienced some weakness on the back of softer inflation data and subsequent peak US rate expectations.

That said, the US is not alone in this disinflationary process and, despite some growth convergence expected in 2024, the USD will likely still offer the highest yields and economic growth among developed markets.

In other words, we expect a shallow and bumpy depreciation journey for the greenback, rather than a sharp decline.

All told, we adopt a more constructive tactical view, with peaking rates and bond yields at a key inflection point – providing a near-term window of opportunity for equities. Today’s more benign macro backdrop is undeniably supportive, but we still need to gain further visibility on next year’s trends before turning resolutely more bullish.

Though leaving our regional preferences unchanged with a focus on higher quality markets, we recommend adding a pinch of undervalued small-mid caps, keeping an overall focus on cash-rich plays, well balanced across regions and sectors.

As regards fixed income, we stick to our slight underweight stance as we still prefer cash vs. bonds. That said, we are adding to eurozone sovereign bonds (from underweight to slight underweight) as the bar for ECB rate cuts (and lower yields overall) is probably not as high (weaker growth, inflation falling more rapidly and debt sustainability issues) as in the US.

While likely to be a(nother) bumpy one, the closing 2023 “gift” should be worth it. Assuming a soft landing scenario for the global economy and the removal of earlier macro overhangs, the onset of 2024 is now looking more promising for both equity and fixed income investors. Still, we continue to favour a diversified all-terrain approach to portfolio construction at this stage.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

External sources include: Refinitiv Datastream, Bloomberg, FactSet, US Department of Health & Human Services (Physical Activity Guidelines for Americans, 2nd edition, 2018), National Institute of Health