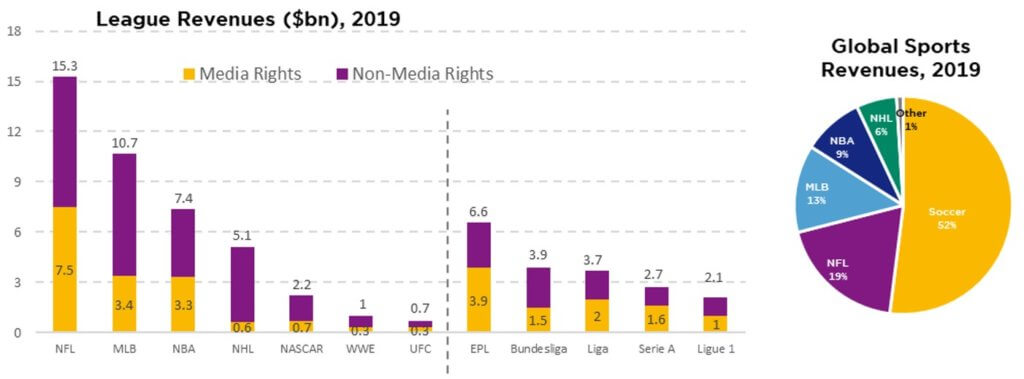

- Sport is more than a game; it is a highly attractive – and lucrative – industry

- The advent of streaming has only added to media hunger, making for ever-larger deals

- Long held by billionaire “benefactors”, the US leagues are slowly opening up to investors

Among the usual new year resolutions, adopting a healthier lifestyle tends to figure high on the list. In 2023, investors too may be well inspired to increase their exposure to sport, with the industry looking extremely attractive at this juncture – particularly in the US. Solid top-line growth, margin expansion and business resiliency: the ingredients for rising valuations are all there, as buttressed recently by a number of high-profile deals.

For billions of fans, supporting their team is a true passion, when not part of their very identity. From a business perspective, the key lies in ever better monetising this devotion. First and foremost on the media front, where more dollars are today chasing the same content – with tech having entered the fray and streaming become a rising part of the landscape. Over the last five years, media revenues for the key purchasers of sport rights have grown by 20% per annum. And each renewal of TV rights brings about a step-up in annual revenues, by 1.7x most recently for the US NFL (a USD 110 bn package was secured for 2023-2033, from both traditional channels and platforms such as Amazon and Paramount+).

Beyond media rights, other sizeable opportunities are up for grabs, whether in sports betting (teams are striking deals worth billions for sponsorship and data rights with betting firms), in boosting foreign revenues (the US NBA and NFL currently generate only 16% and 6% of their revenues internationally vs. 46% for the English Premier League), in better exploiting real estate assets (stadiums can be used for other events and surrounded by synergistic retail, entertainment and hospitality venues) or in the budding sports technology field (e.g. data analytics, social media and augmented live video).

Alongside solid top-line growth, US clubs are also seeing their margins improve. This thanks to a collective bargaining agreement between all five major leagues and their players, which prevents salary costs from getting out of control. In European football by contrast, the big clubs tend to compete to outspend each other, sometimes overreaching in the process. Not to mention the huge financial loss in the event that a team be relegated, an outcome that simply does not exist in the US league system.

Mention should also be made, in these very uncertain economic times, of the resiliency of sports revenues, thanks to them being largely derived from multi-year deals with sponsors and media companies. As such, revenue growth has proved stable even through historic crises and, in the very difficult equity markets of 2022, listed sports stocks managed to close the year almost flat.

The challenge, however, lies in the limited number of investment vehicles. Historically in the hands of very wealthy individuals, the US leagues started to open the door to private investors in 2019 – but still it is only partly ajar. Stringent league rules mean that just a handful of private markets firms qualify for minority equity ownership of the marquee name clubs. As for publicly traded names, they are far and few between. MSG Sports, owner of the New York Knicks (basketball) and Rangers (ice hockey) is one of the exceptions, and currently trades at a market value almost half of what its franchises are worth according to Forbes (USD 6.1 bn and 2.2 bn respectively).

However huge these estimates may seem, they certainly are supported by recent deals: a majority stake in the NBA’s Phoenix Suns went for USD 4 bn last December and the bidding process for UK’s Manchester United football club is due to formally begin this month, with a price tag seen at no less than £5 bn and interest to come from all parts of the world… starting with UK billionaire and life-long fan of the Reds, Sir Jim Ratcliffe.

Written by Sandro Occhilupo, Head of Discretionary Portfolio Management

Sweet spot today, more challenging tomorrow

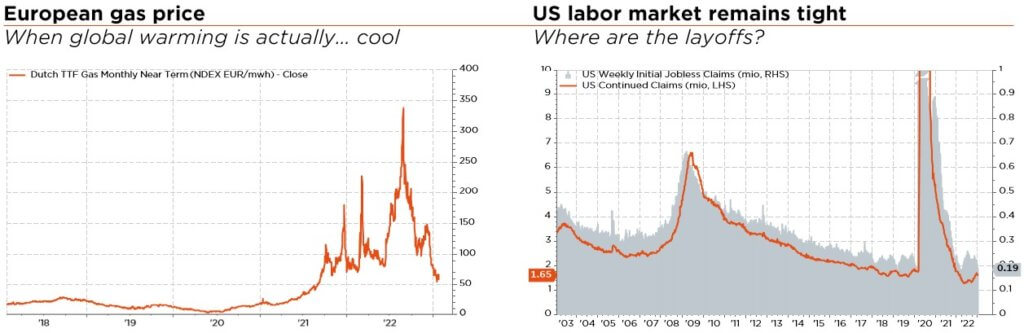

China’s reopening, lower European natural gas prices and softer inflationary pressures in the US have helped boost global growth prospects, tame inflation concerns, renew hopes of a Fed pivot and thus increase the odds of a soft landing. In other words, these latest developments have cut the tails off the most worrisome macro scenarios. While the recent equity rally on the back of this supportive narrative is welcome, we continue to view 2023 as another challenging year, with non-negligible risks of recession in most DM, as well as stickier inflation in the latter half, leading to higher-for-longer central bank target rates.

As a result, we expect another tortuous path for investors in 2023. The global economy and markets are still in a transition phase, moving out of a decade of stable growth, low rates and globalisation, towards a more fragmented, volatile and uncertain landscape – with lower growth overall, higher inflation and less accommodative central banks. In this context, the timing and interplay between inflation, real rates and economic slowdown/recession is set to remain the key near-term market driver. While we still presume a soft-landing scenario, the time sequence of falling inflation and slowing growth will be crucial, uncomfortably leaving equity markets at the mercy of further “tightening” policy decisions.

We thus remain wary of the latest bear market rally. Near-term visibility has certainly improved with China’s reopening, the mild winter in Europe, swift corporate earnings downgrades and receding real yields (on the back of softer US inflation and average wage growth), but caution is still warranted in our view, as investors seem again overly optimistic about a pending Fed “pivot” and US equity valuations leave little margin for error.

The same could be said about the bond market, especially for long term govies, which have also experienced a significant bear market rally. The current level of long-term yields in most DM makes little sense to us given inflation expectations and uncertainties, the future expected path of monetary policies, the resilient – even if not great – global growth backdrop, as well as technical headwinds owing to the massive net supply of sovereign bonds, especially in the eurozone, and major central banks’ ongoing quantitative tightening.

As such, we retain our cautious tactical stance (slight underweight) on both equities and bonds, accounting for positive real rates, a higher risk and inflation premium, the emergence of a new “world order” compared to the past decade (involving consequent rebalancing moves) and the advent of new reasonably-valued low risk investment alternatives (i.e. from TINA to TARA).

Mid- to long-term equity upside does obviously remain. Investors’ still cautious equity positioning, combined with improving valuations, may well provide some downside protection but we need greater visibility on inflation/growth/rates/earnings trends before turning more constructive. We did, however, fine-tune our regional views this month, upgrading the EM (incl. China & Hong-Kong) on the back of China’s reopening and easing regulatory crackdowns, a more favourable macro backdrop overall and still reasonable valuations.

In fixed income, we still favour cash instruments (over bonds) and the short end of the curve globally. Beyond providing a nice yield, “cash is a priceless call option on every asset class with no expiration date and no strike price” (Warren Buffet). We thus continue to underweight duration risks but favour US vs EUR long rates. Finally, we prefer corporates over sovereigns, targeting the upper end of the credit spectrum, mainly investment grade quality, so as to limit exposure to the most fragile issuers, which stand to suffer most from deteriorating financial conditions.

Elsewhere, we keep our tactical slight underweight on commodities and gold, the latter’s upside being capped by the Fed’s willingness to restore its inflation-control credibility and its diversifying effect now being increasingly challenged by rising opportunity costs, thanks to positive real rates.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies