Written by Reji Vettasseri. Lead Portfolio Manager of DECALIA Private Credit Strategies

Public volatility vs. Private stability

- Private debt offers refuge from volatile public market dynamics

- Lower sensitivity to stagflation risk than bond markets

- Asset-backed deals: offering stability with upside if rates go down

- Financing for secular growth stories: in high demand and less cyclical

- Avoiding tariff-affected sectors, cyclical risk and M&A dependency

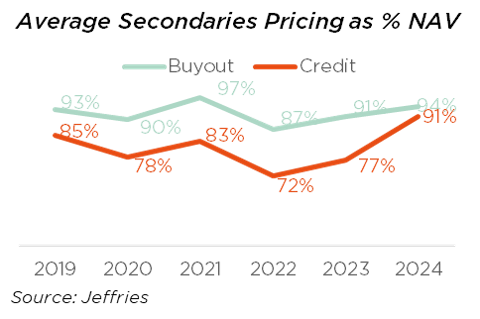

- Secondaries: increased demand and improved pricing (esp. for smaller deals)

- Credit special situations: poised for an increase in opportunistic deal flow

The “Orange Swan” Event

As a new US president upends global trade, the world is witnessing what might be called an “orange swan” event. Like a “black swan”, this a rare occurrence with heavy consequences. But unlike their dark-plumed cousins, orange swans care little for stealth. They display themselves in all their gaudy glory and quack (or tweet) loudly before they land. At least, cautious investors get a chance to prepare.

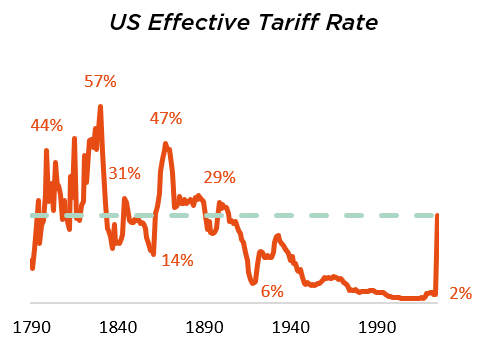

The US tariff regime faces monumental change. Even after roll-back of some measures, the average US tariff rate is now estimated to be 26% – a level not seen since 1903. While China bears 56% of the total tariff take, all countries face new levies, and secondary disruption will ricochet round the world.

The size of the economic fallout is still uncertain. Wall Street consensus is that systemic risks are unlikely, and big economies will slow but might just still grow. Goldman’s base case is 2025 GDP growth of 1.3% in the US and 0.9% in the EU. Even so, it puts odds of a US recession at 45%. In truth, with policy yet to stabilise, little is certain. The science of forecasting has descended into a political betting game.

Indeed, the key feature of an “orange swan” event is that unpredictability becomes predictable. In 2025, shocks no longer feel shocking, and downside-protected credit investing feels more relevant than ever. However, return dispersion within credit is likely to rise. Bond markets have been in turmoil and failed to protect against volatility. Private debt has been calmer, but the direct impact of tariffs, broader macro slowdown and reduced M&A will still affect many strategies.

We like to allocate across the full private credit universe, in a diversified way but selectively. This article will explain what we have avoided, and why we hope our recent focus areas (asset-backed credit and financing secular growth) should prove more resilient.

We will also talk about which credit segments might actually thrive in a new era of uncertainty. Historically, private credit deals originated in volatile times have outperformed (see chart below). Excess return in credit is less about participation in growth and more about being paid fully for differentiated financing solutions. So, when conditions get tougher, the value added by specialised strategies like secondaries and special situations only goes up.

Private Stability vs Public Volatility

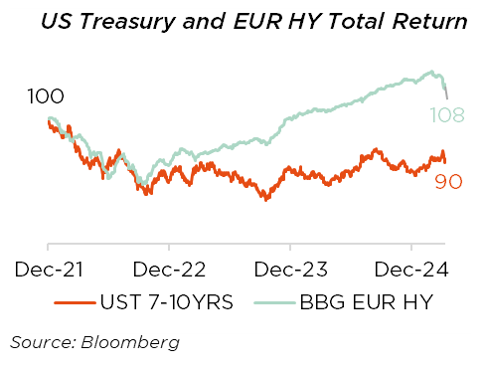

The normal inverse correlation between equity and bonds was not in evidence, in the two weeks after “Liberation Day”. Not only did Bloomberg USD and EUR high yield indices fall 2.7% and 2.1%, even 10-year treasuries were down 3.0%. When the outlook worsens, the prospect of lower interest rates, should help bonds. But this does not work when markets panic about what counts as a safe haven, nor when inflationary worries transform the rate outlook. The latter point was even more evident in the last market correction in 2022. Bonds have had a tough few years.

Private debt faces less volatility. Some scoff that this is only because private valuations adjust too slowly. This misses a key point. Private debt is not marked-to-market as it does not bear market risk. Barring default, private loans are repaid at par at maturity (or early with prepayment penalties). But the point of liquid credit is to exit at will in public markets. This means you have to worry about bond buyers as well as borrowers.

When inflation rises and base rates are up, bonds sell at a discount as their coupons look less attractive. Investors not only face low yields while they hold, but, when they sell, must compensate buyers for future low coupons. The mismatch between hold periods and maturities (which does not exist in private debt) can be very expensive.

Furthermore, if technical factors affect the market (e.g. if hedge funds are forced sellers or big investors rotate), prices can move for reasons completely unrelated to borrower fundamentals.

Liquid credit will always have a place, but it is often under-appreciated that liquidity comes with extra risks as well as lower returns. In a stagflationary, dysfunctional world, long-term investors may wonder if private debt just became relatively more appealing. However, careful selection matters there as well.

What We Have Been Avoiding

1. Direct Tariff Exposure

Tariffs are highly dangerous. They are designed to hurt and affect activity. For some exporters or firms with affected supply chains, worst cases fall outside any normal credit underwriting. We see a simple rule for such risk: avoid it.

In recent months that was an explicit policy. But even beforehand we had limited exposure. Naturally, as a European-focussed investor that tends to avoid competitive large-cap deals, exposure to trade with the US was low. Moreover, the most affected borrowers are in industrials and consumer/retail. Often mature, cyclical and low margin these were never areas of focus.

2. General Macro Risk

If we avoid recession or see only a mild one, well-designed credits should survive. However, cyclical exposure. High leverage and loose terms could still be punished. Covid and inflation has already pushed some borrowers into unsustainable debt levels. Where covenants are weak, lenders can do little other than pray for better conditions which may not now arrive.

That is one reason we favour specialised strategies, with heavy structuring. And to limit cyclical risk, we have pivoted from corporate risk to asset-backed, or within corporate to secular growth.

3. Deal Flow Dependence on M&A

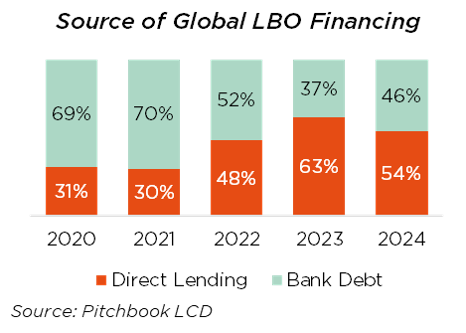

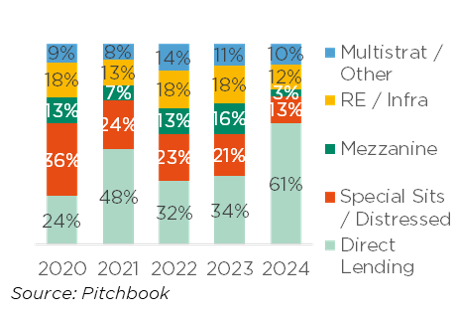

Direct lending, which finances PE buyouts, has been a fundraising success. It accounted for a record 61% of private debt capital raising in 2024. However, its deal flow depends on M&A, which is set to slow. In past slowdowns, direct lenders took market share from banks. Today they are the dominant source of LBO finance. There is less market share left to take. Accumulating dry powder and low deal flow, is likely to drive high competition in direct lending. We prefer less M&A-dependent segments.

Where We Have Been Focussing

1. Asset-backed Lending

In recent years, as interest rates rose, values of yielding assets corrected. This hurt legacy lenders, forcing them to pull back, but as competition fell, new loans were originated at better terms in lower LTV deals based on fairer valuations.

Today, asset-backed lending also offers better downside protection and has limited tariff exposure. Moreover, in a downturn, if interest rates decline, asset values would see support.

2. Financing Secular Growth

It is easy to be pessimistic, but we also live in an era full of positive changes. Unlike in the internet revolution, many big developments, from computing-heavy AI to the energy transition, are asset-heavy. Leading players can be both capital hungry and credit-worthy.

Growth financing in such areas can offer high returns, but the main risks are idiosyncratic (and thus diversifiable) rather than cyclical. A slowdown in M&A and equity raising may even give a fillip to deal flow, if it means companies turn to credit to finance rapid growth.

Where The Next Opportunities Lie

1. Credit Secondaries

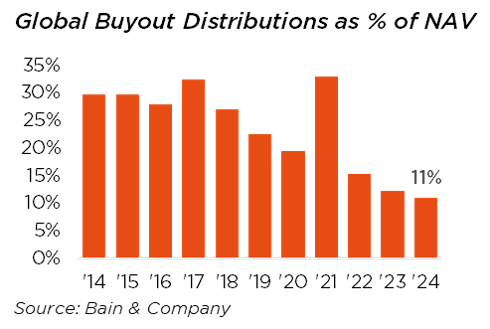

Credit secondaries is already one of our key themes but could get even more interesting. PE distributions have been sub-par for years and hit a new low as a percentage of AUM of 11% in 2024. With hopes of a revival in exit activity now scotched, the need for secondary liquidity in private markets is rising. Add the fact that some LPs will need cash for difficult times and others will rebalance for changed conditions, and conditions are ripe for a demand boom.

The credit secondary market is still immature. Deal volume in 2024 was only 0.4% of market AUM (less than half of the 1.1% seen in PE). Buyers obtain higher discounts than in PE. These shrunk recently for the largest deals, but remain high for smaller deals. And, with improving supply-demand dynamics, there is every chance discounts will soon rise sharply across the board.

2. Credit Special Situations

In recent years, we have shied away from special situations strategies, which typically focus on helping borrowers with operationally sound businesses or valuable assets but that have broken capital structures in need of repair.

After strong returns in the wake of the GFC, the strategy attracted too much capital while deal flow was drying up. Even when new stress events like Covid occurred, generous government support or voluntary lender forbearance left little scope for special situations.

Things might be about to change. Deal flow looks set to jump. Lenders who kicked the can down the road by accepting capitalised interest and extended maturities on difficult loans after Covid or inflationary shocks, may finally capitulate after yet another crisis. Governments and central banks are not well placed to ride to the rescue. Furthermore, the capital overhang has finally gone. Special situations was only 13% of private credit fundraising in 2024 (vs. 36% in 2020). Opportunistic deal making might well be about to return.

Private Credit Capital Raised by Type

Blue Hedgehogs vs. Orange Swans

This article started with orange swans, and will end with another analogy involving a colourful animal: video game character Sonic the Hedgehog.

Investors might feel like curling up into a defensive ball. This is not unreasonable. But we think our best role model right now is Sonic, who with his supersonic spin attack, shows that defensive postures do not preclude also going on the attack and that moving fast also gets you out of trouble.

In private credit, it is certainly time to reinforce downside protection. It is also time to adjust positioning and keep looking for opportunity.

Reji Vettasseri is Lead Portfolio Manager for alternative funds and mandates in private markets. Reji was previously a portfolio manager at Morgan Stanley Alternative Investment Partners, an executive director at Goldman Sachs Investment Banking and a consultant at Bain & Company. Reji received a B.A. (Hons) in Law and a Master of Laws from the University of Cambridge, and an M.B.A. with Distinction from Harvard Business School.

Copyright © 2024 by DECALIA SA. All rights reserved. This report may not be displayed, reproduced, distributed, transmitted, or used to create derivative works in any form, in whole or in portion, by any means, without written permission from DECALIA SA.

This material is intended for informational purposes only and should not be construed as an offer or solicitation for the purchase or sale of any financial instrument, or as a contractual document. The information provided herein is not intended to constitute legal, tax, or accounting advice and may not be suitable for all investors. The market valuations, terms, and calculations contained herein are estimates only and are subject to change without notice. The information provided is believed to be reliable; however DECALIA SA does not guarantee its completeness or accuracy. Past performance is not an indicator of future results.

External sources include:

- Yale Budget Lab, “State of US Tariffs: April 15, 2025”

- Goldman Sachs

- Preqin

- Bloomberg

- Pitchbook LCD, “US Private Credit Market Overview Q4 24”

- Bain & Company, “Private Equity Report 2025”

- PJT Park Hill, “H1 2024 Secondary Market Insight”

- Jefferies, “Global Secondary Market Review Jan-25”