- Another interesting week awaits us, with data releases on both economic activity and prices in the context of the new narrative of no-landing, sticky inflation and higher rates

- Welcome to March Madness with US jobs report on March 10, US CPI on March 14 and Fed meeting on March 22

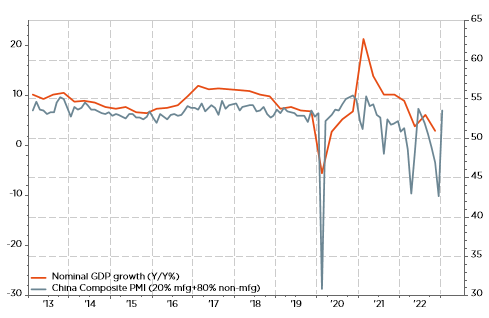

- What’s about the strength (and sustainability) of China’s post-reopening recovery? Keep an eye on PMI service this week, then open your ears open during the 14th NPC (March 5-17) and then watch how it will unfold into 2 key indicators

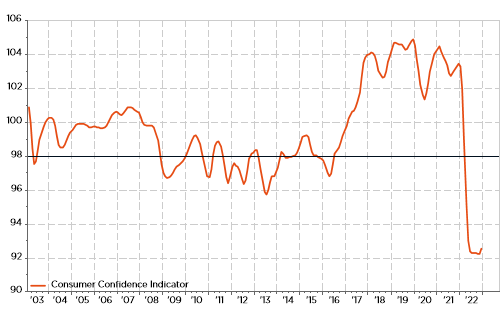

- China consumer confidence: Pessimismo… what else? You can lead a horse to water, but you can’t make it drink!

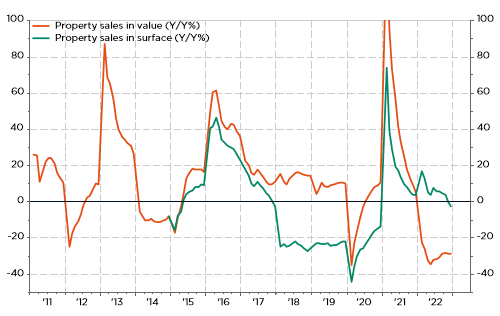

- Property sector: “Quand le bâtiment va, tout va !»

- Will this plan comes together or not? Who knows but we may already guess what could be the implications in both scenarios

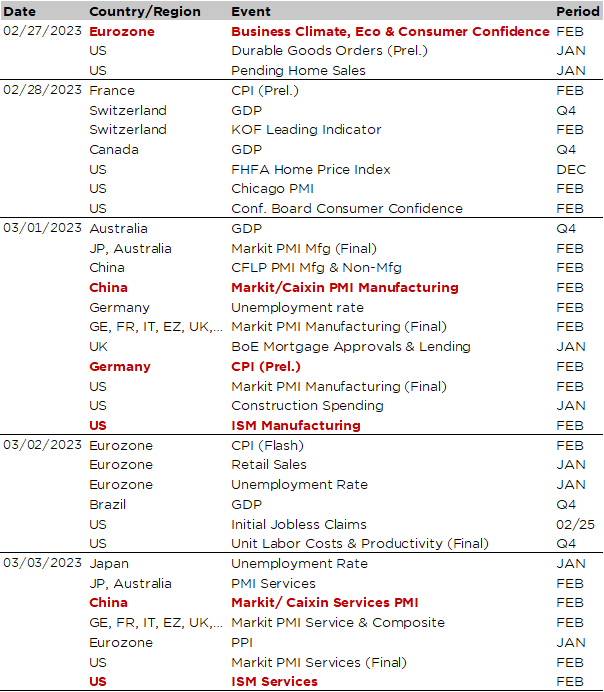

This week is likely to prove interesting, to say the least, in terms of economic releases as it will feature the very same macro ingredients than last week, namely activity indicators on one side, with the final readings of global PMI on top of US ISM indices (manufacturing on Wednesday and services on Friday), as well as inflation data on the other side in the form of European flash CPI for February (on Tuesday, Wednesday and Thursday for France, Germany and Euro Area respectively), but just with more spices and volatility given recent market’s nervousness.

Last week data tended indeed to confirm the new uncomfortable, because unsustainable, narrative of no-landing, sticky inflation and higher terminal rates. In this context, Fed and ECB terminal rates have been gradually revised higher by about +50bps each over the last 3 weeks (i.e. since the latest US jobs report) to 5.4% and 3.75% respectively. On this purpose, it’s worth also highlighting a recent working paper by economists at the Cleveland Fed who come to the following conclusion: in order for the Fed to achieve its 2% inflation goal, it would require drastically higher unemployment and a deep recession… So, the incoming data will again be closely watched by investors trying desperately to grasp how sticky and robust are inflation and growth respectively, as well as by central bankers who will meet soon (at mid-March) for setting rates and a path for their monetary policy over the foreseeable future. Before that we will have to get through the US jobs report (10 March) and the US CPI (14 March). Welcome to March Madness!

In the meantime, let’s focus on another key issue, which has somewhat fallen in the background recently: what’s about the strength (and sustainability) of China’s post-reopening recovery? The moment of truth is finally coming as the picture will get much clearer by the end of the 2nd quarter. Like an appetizer for investors trying to gauge to what extent, or not, the post-lockdown recovery in the economy is gaining speed, the China February PMI indices released this week will be scrutinized, especially the service’s one index as it is more related to the domestic/consumer components.

China composite PMI & real GDP growth

An official growth target, likely “above 5%”, close to the current consensus expectations which is in between 5% and 5.5%

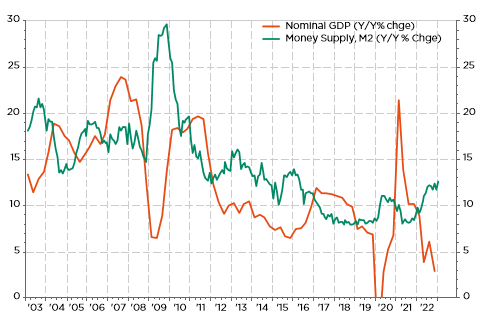

Money supply and Total Social Financing (TSF) growth to “come back in line with nominal GDP growth”. Note that China removed this statement about keeping credit growth in line with nominal growth last year… in a timely manner as the later literally collapsed (see graph below).

A fiscal target and potential further measures to support consumption and rescue the property sector.

Employment targets in the form of new jobs creation (it was 11mio the last 2 years) and an unemployment rate not higher than… 5-6%?.

An inflation target “around 3%”: it has been the same for most years in the past decade (except 2020), which isn’t really an issue in China nowadays (deflation has been actually the main threat over the last few years given the ballooning debt issue)

In addition to these numerical targets, the NPC would also provide details of economic and industry policies, as well as a framework for the overall economic reforms and financial adjustments needed to bring China to a (more) sustainable growth trajectory in order to escape from the middle-income trap.

China M2 & nominal GDP growth: deleveraging effort was abandoned during the pandemic

China consumer confidence: Pessimismo… what else?

China consumer confidence is currently at historic depressed level. Even if there have been some timid signs of stabilization recently, I can’t resist to paraphrase Georges Clooney in his most famous advert: “Pessimismo… what else?” as Chinese households have faced forced deleveraging, deflating housing bubble, regulation crackdown, severe lockdowns and rising youth unemployment rate over the last 3 years… The only thing missing to complete this bleak picture is soaring pork’s price! Anyway, it has been a very different and challenging backdrop for Chinese consumers compared to the previous “20 glorious years” of their economy.

As a result, I suspect that Chinese government has now no other choice but to rescue/sustain the property sector in order to jump start growth, restore overall confidence and eventually bring China to a sustainable growth trajectory in the next few quarters. It will be a challenging balancing act for the government as it certainly wants to avoid past mistakes by allowing indirectly some re-leveraging and speculation (“Housing is for living not for speculation”). As we say in French: “Quand le bâtiment va, tout va !»

Property Sales (Y/Y%): “Quand le bâtiment va, tout va !»

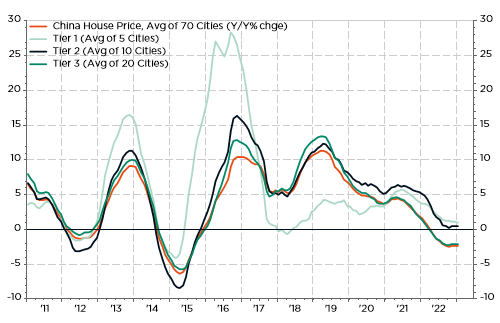

China House Price (Y/Y%)

To sum up, China is now facing a moment of truth in three acts: an official growth target, practical commitment measures to achieve it & their outcome results on consumer confidence and the property sector. If this plan comes together it will likely defeat the recent skepticism about the strength of China’s growth recovery, improve global growth prospects, propel energy and base metals prices higher and boost China, and overall EM, equity markets as they may have scope to rally further on the back of a rebound in earnings growth. If this plan fails, then the “R word” may come back in force in H2 as investors will have to face a new issue: the global economy has definitively lost a key growth engine.

Economic calendar

In the US, on top of the February ISM manufacturing and non-manufacturing indexes, investors will also focus on January durable goods orders this afternoon (a proxy of business investment when stripping out transport and defense components), the Conference Board consumer confidence tomorrow (watching for any easing, or not, in inflation expectations) and weekly initial jobless claims on Thursday (signs of any weakness to come… or not). It will be interesting to keep an eye on the US ISM manufacturing (Wednesday) as it has been a surprising outlier so far with sentiment actually underperforming hard data, pointing to a slowdown that hasn’t happened… yet?

In the Eurozone, the inflation figures for February will dominate the news and could be a key input to the next ECB meeting. At the aggregate Eurozone level, the headline is expected to slow from 8.6% the prior month to 8.1% in February (Thursday), but there the risk to the upside vs. consensus expectations can’t be ruled out. Anyway, it will be more important to watch if core inflation keeps on creeping higher (January print was revised higher to a new record of +5.3% lately). Other notable indicators due include retail sales and unemployment rate (still on Thursday too), as well as the PMI indices on Wednesday and Friday, which are expected to confirm the overall improvement in business sentiment. Finally, there will be several ECB speakers also this week. While a +50bps hike in March is already in the cards, the jury is still out for the May meeting. Until recently, the consensus was foreseeing a step down to +25bps but recent upbeat activity indicators and stickier inflationary pressures are now challenging these expectations.

Over in Asia, China PMIs will be scrutinized as they will provide insights about the extent of the post-reopening recovery. The service index, more related to the domestic/consumer components, will be the key focus. In Japan, more insight about potential wage pressures will come on Friday when the Japanese Trade Union Confederation is expected to release its survey of wage hike demands in the “shunto” labor talks, while the future BoJ governor (Ueda) is appearing today for hearings in the Upper House.

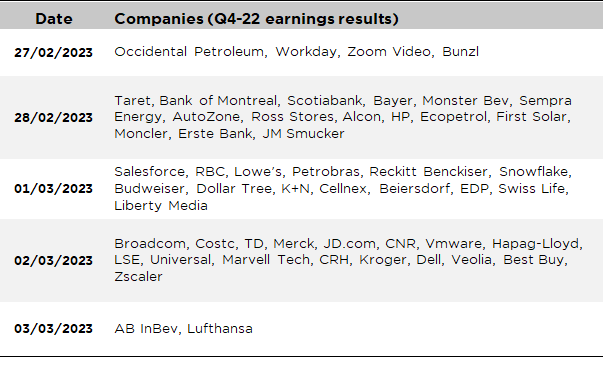

As far as the winding-down earnings season is concerned, US retailers (Target, Lowe’s and Costco) will likely be the major results releases this week among the fewer than 40 S&P500 companies left to report. Other notable earnings releases this week include Broadcom, Occidental Petroleum and Salesforce in the US and Bayer, Merck and AB InBev in Europe (see our non-exhaustive list at the very end of this letter).

Non-exhaustive list of major Q4-22 earnings releases over the week

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.